US Government Shuts Down…Will Gold Price Go Up?

US Government Shuts Down, Again

Could you imagine life without a government? Now, you can. The federal government has been shut down since December 22nd, 2018. The government shutdown does not, of course, imply that the whole government is closed. Only non-essential discretionary federal programs and agencies close. They include NASA, IRS, Department of Commerce, Department of Education, Department of Labor, Food and Drug Administration, etc.

The partial shutdown occurred because President Donald Trump and the United States did not agree on the appropriation of funds for the 2019 fiscal year. The bone of contention is Trump’s call for more than $5 billion for a U.S.-Mexico border wall. Democrats, who now control the House of Representatives, have rejected Trump’s demand, claiming that there are more effective ways of enhancing border security than building a wall costing more than $25 billion. They also point out that Trump promised during his campaign that Mexico would pay for the wall (however, its government has refused, what a surprise).

The shutdown of the US government is not something new. For example, it happened in January 2018 for three days, 2013 for 16 days in, or in 1995-1996 for 21 days. The current shutdown is the longest in the US history, lasting 25 days already.

Government Shutdown and US Economy

What the government shutdown imply for the US economy and the gold market? Well, it resulted in a lack of funding for nine executive departments, affecting about one-fourth of government activities with around 800,000 employees. Almost half of them have been furloughed, i.e. sent home without pay, while the rest of them have to work without a paycheck. More importantly, the shutdown also affects the pace of economic growth, as the government spending is a component of GDP. Indeed, the shutdown in 2013 reduced the GDP by 0.4 percent in the fourth quarter of 2013. On that basis, the J.P. Morgan economists have cut their first-quarter growth forecast by a quarter point to 2 percent. Gold should enjoy the economic slowdown.

And, according to the S&P Global Ratings, the shutdown imply a decrease in sales for contractors to the government, delays in federal loans, and reduced consumer spending and lost productivity by furloughed workers. Hence, the company estimate costs of shutdown at $1.2 billion for every week the government is closed. We are a bit skeptical, but if true, the cost of the shutdown will exceed soon the $5 billion Trump has demanded for the wall. Is that not funny?

Implications for Gold

So far, we have not seen any impressive rally in gold amid the US government shutdown. We mean that, of course, gold shined in January, but it still cannot cross the level of $1,300, as the chart below shows.

Chart 1: Gold prices from January 13 to January 15, 2019.

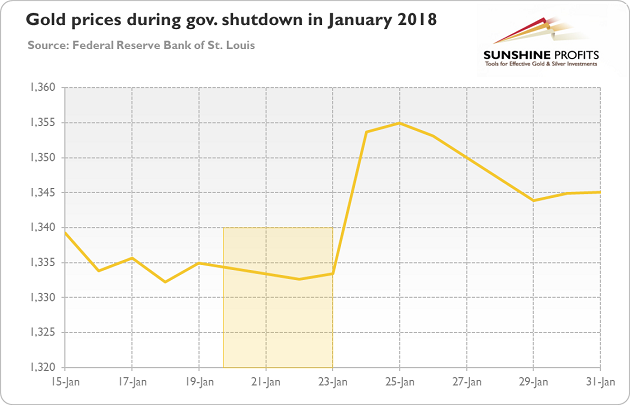

One can convincingly argue that the longer this shutdown lasts, the more collateral damage the economy will suffer, and the brighter gold will shine. However, this is not what history suggests. For example, the government shutdown in 2013 did not provide a boost for gold prices. Similarly, in January 2018, gold prices declined between January 20th and 23rd, and went up only when the shutdown ended, as one can see in the chart below.

Chart 2: Gold prices during government shutdown in January 20-23, 2018

Actually, the lack of meaningless gold’s reaction is quite understandable. The government shutdown is not a big deal, as government still provides essential services. And the shutdown will eventually be resolved. Come on, do you really think that the US economy will collapse because the Smithsonian museums and the National Zoo are closed? Hence, any potential impact on gold should be limited and short-term. Unless, of course, there is a protracted shutdown… Anyway, the nearest days may be quite hot for the gold market, as today there is a vote in British Parliament on May’s deal. Stay tuned!

Arkadiusz Sieron

Sunshine Profits - Free Gold Analysis

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.