US Stock Market – In Need of a Correction

The US stock market (SPX) is overbought and vulnerable in the near-term

Excerpted from this week’s edition of Notes From the Rabbit Hole, NFTRH 797:

The US stock market is in need of a correction. Now, will it get one?

On the CPI down day I looked at the market and decided to leave well enough alone because of course they were going to gun it to punish anyone shorting that down day on supposedly bad news (pumping up the hawkish Fed). But I looked at the gap near the all-time highs on the daily chart of SPX and thought ‘hmm, if they close that gap maybe give it a shot…’. They closed the gap and I gave it a shot.

Now let’s again consider all those downside gaps. Sooner or later they are likely to fill. Could well be later, but there are other things going on here that could precede a correction. They are listed after the chart.

- Dumb Money sentiment continues to be excessively bullish, NAAIM are at an excessive 95% bullish, Newsletters are excessive at a 3.28 Bull/Bear ratio and AAII are also excessive at a 1.57 B/B ratio. Sentimentrader shows high risk longer-term and moderate risk short-term.

- SPX became fairly overbought by its distance from the 50 day moving average and that overbought situation came with a negative divergence by RSI. MACD is well aloft but on a down trigger.

- If – and of course with this market it’s always an ‘if’, it seems – the market corrects, the first objective would be the short-term support cluster around 4800 and the uptrending SMA 50. After that there is a clear support at 4600, right on the nose. The SMA 200 is climbing toward that area. A test of the SMA 200 could fill the first of the lower gaps. But oh how those lower gaps yawn patiently.

- But first things first. Can we simply get a healthy correction? One would think that this pig is not going to just climb unrelentingly into the November election. One would think.

A couple other considerations are the ongoing VIX divergence, which has tended to precede corrections…

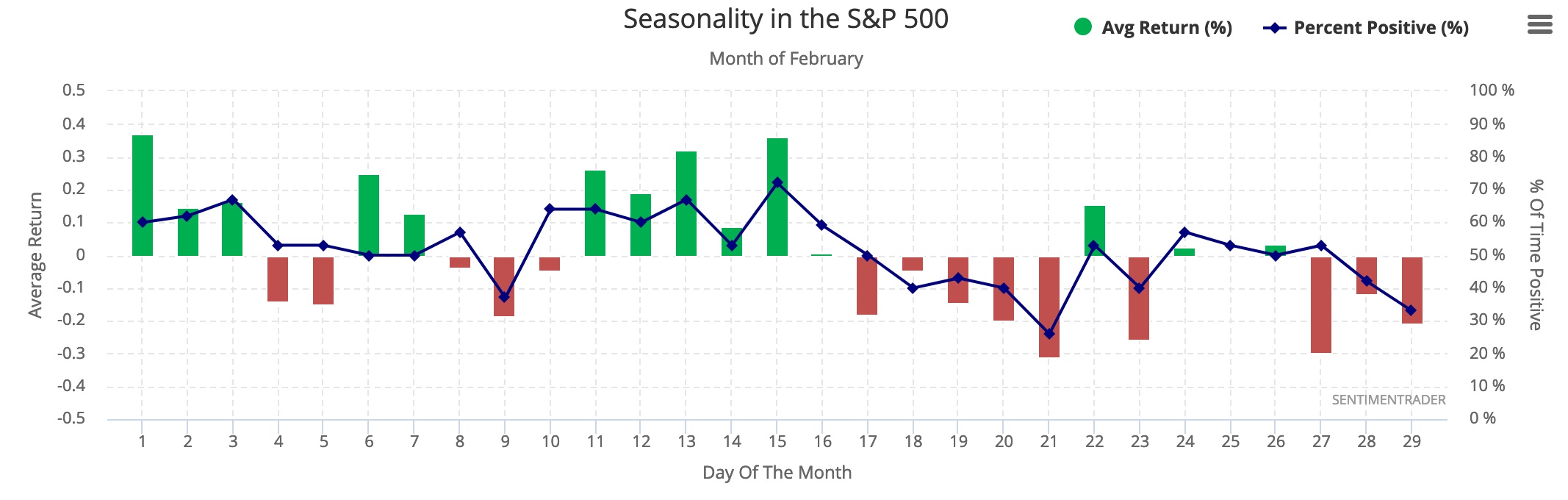

…and oh by the way, while not the most reliable of indicators in any given year, the seasonal for SPX turns down… now, at least temporarily.

While market breadth has resumed fading after the much ballyhooed breadth thrusts of Q4, 2023. Everybody is buying Nvidia, Microsoft, Amazon and Meta, like good little robots. As if that is defensive behavior.

So if ‘they’ (tin foil hat defines “they” as the administration and the Fed working the levers together) are making joint monetary and fiscal efforts to hold things together this election year, might not a correction in the interim perhaps refresh this mess for some fireworks later in the year and into the election?

We have noted that the Fed is signaling out of both sides of its disgusting, foul mouth and that government may be carrying the Semiconductor CHIPS act and whatever Green/EV initiatives they may reengage in its hip pocket. What better time to deploy? A healthy correction and then ram it right up the shorts’ orifice, not to mention the Republicans’?

It’s one plan or potential among others. But it’s good to have plans and the willingness to fine tune or alter those plans moving forward. The stock market is purely trending up after all, and the leaders are still leading, after all.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. Subscribe by Credit Card or PayPal using a link on the right sidebar (if using a mobile device you may need to scroll down) or see all options and more info. Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter@NFTRHgt.

*********