Why China Will Bring Down The World Markets!

This coming New Year of 2016 is the year of the Monkey, according to the Chinese calendar. Will this cause wild gyrations in the Chinese and World stock markets, which are symbolized by the volatile nature of the Monkey? Many do not believe that China can derail the world economy, however, but here I explain why they are missing the point. Directly or indirectly, China’s slowdown will definitely lead to a global meltdown.

This coming New Year of 2016 is the year of the Monkey, according to the Chinese calendar. Will this cause wild gyrations in the Chinese and World stock markets, which are symbolized by the volatile nature of the Monkey? Many do not believe that China can derail the world economy, however, but here I explain why they are missing the point. Directly or indirectly, China’s slowdown will definitely lead to a global meltdown.

The Chinese GDP growth rate; “The New Normal”

The ten-year growth chart shows a dip in Chinese growth since 2012. Even during the ‘The Great Recession”, China’s growth rate never dropped below 8%, within four connective quarters. However, since 2012, growth has not increased over the 8% mark for two consecutive quarters and is currently at less than 7%. I suspect that the numbers are “bogus”, and that China’s economy is not expecting more than 3%-4%. A few analysts argue that it is a country specific situation, which cannot derail the world economy. Meanwhile, the world rode piggybacked on China and its growth, during the last several years. You would be surprised to know the contribution that China has made to the world economy.

Chinese actions have not been able to stimulate growth

In May 2015 the Chinese government announced the growth of 7% as the “New Normal” for China. This underlines acceptance that the Chinese economic growth has peaked. The Chinese Central Bank has cut interest rates six times in 2015, reduced the reserve requirements for banks, devalued the Yuan and pledged to do more, if necessary, however, growth is still struggling to reach the 7% target.

Their domestic growth is not picking up. The investment led boom has raised the debts to 292% of the GDP. Meanwhile, factories are cutting jobs, manufacturers have reduced their prices, due to competition, etc. Deflationary pressures within the Chinese economy are increasing and it appears it my last for an extended period of time.

There are a couple positive things out of all this looking forward a couple years. The first is that deflation will reduce product costs for products all around the world and with the Yuan devaluation and lower priced products foreign importers will once again start wanting to import and sell Chinese products. Back when Chinese products were affordable in comparison to the quality I had my own importing business selling Chinese products all around the world for big profits. About 6 years ago I saw the trend of importing uptick and everyone starting selling Chinese products and global competition was on the rise and high-profit margins were about to vanish. Once I saw that everyone could import via Alibaba.com with a few clicks of a mouse that was my signal to jump ship and 14 months later I had sold my importing business at the high of the importing business market high.

I love the idea of a global financial market and product pricing reset. While it will not be great for most individuals these major shifts provide incredible opportunities for those who understand what is taking place and have the knowledge, skills and connections to take advantage of them. I don’t see the China product pricing reset being favorable for another 12-18 months at minimum, but I'm already starting to plan a trip to China with a business partner late next year to take a sneak peek at some products that can be branded and sold along with their factories to be sure they are up to my standards in terms of product quality and management.

Another positive outcome of all these problems is that China has scrapped their 35-year-old controversial one-child policy. This will take another 10 months or so before we see some decent growth in China for the baby products industry but its coming. The one-child policy was said to have prevented 400,000,000 babies. That is equivalent to a new United States being born!

How much does China contribute to Global GDP growth?

Thechart above signifies the effect that China has on the global economy. Although, it is the second largest economy in the world, after the US, it is a major contributor and the engine of world GDP growth. These top two nations contribute to more than 82% of the global GDP growth. Any slowdown in China will affect the global GDP growth since no other country is capable of offsetting the “Chinese Effect”.

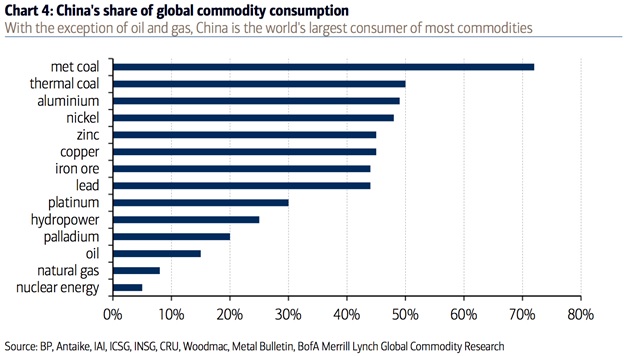

The reason for the drop in commodity prices – China

The above chart speaks for itself. Many nations like Brazil and Australia are dependent on the commodity exports to China; countries like Canada, are indirectly affected, as they are mainly dependent on the crude oil prices. A few producers have announced large production cuts in order to prepare for the low demand from China.

The Direct effect of China’s slowdown within the US economy and the S&P companies

The shale oil industry in the US expanded rapidly to fulfill the rising energy demands of the world. As the crude oil prices were high, many investors participated in the junk bond issues of the shale oil companies, although they were not investment grade. The big drop in crude oil prices is financial hurting these companies and, in turn, their ability to pay their bond holders. If prices don’t recover immediately, we are likely to see many energy companies declaring bankruptcies, which are a risk to the banks and junk bond funds which loaned them monies. This fear has led to recent junk bond collapses.

Apple sells more iPhones in China, compared to US sales. Although, iPhone sales have continued to grow, chances are that a sustained slowdown in China will adversely affect Apple. Similarly, several luxury brands, hoping to capitalize on the Chinese growth, will find it difficult to sell their products, within a slowing economy.

China’s Stock Market performance in the last 20 years

Although, most of the world markets have reached new highs, the Chinese market is now collapsing!

Trading, Investing and Economic Conclusion

In short, no one knows how the global markets will react to the collapsing economy in China. This is a major risk factor as there are no concrete actions that can be implemented to avoid this deteriorating situation. The Chinese growth is not responding to any growth stimulus at all. Currently, the world is at a critical junction, with all of the major economies; the US, Japan, Europe, and China, all facing deflationary pressures. There is nothing left to propel the global economy, with stock markets all over the world at risk of a MAJOR DROP occurring in 2016.

The world is going through some major changes and I do not believe it is something to panic about, though. Why? Because its happening and there is nothing you can do to stop them. Instead of panicking and thinking you are doomed you should pivot and shift your view on the situation. Look at it from a different angle and ask yourself how can I insulate myself from these changes and better yet what are ways to profit from these changes over the next few years.

Keep in mind we have all survived many of these financial and product pricing resets many times in the past. The 2000-2001 reset, the 2008 reset and it looks as though the next one is the 2016 reset. These reset always happened for a different reason but it's virtually the same outcome. Businesses struggle, financial markets correct, and products, properties, commodities, and currencies reset their values. It's not rocket science and its not a life or death situation. It just a massive shift in valuations and people's net worth’s.

This pending reset will be the third reset I will have experienced in my trading career. Consequently, I am very excited about it taking place. Why? Because I understand what is happening and I'm positioning myself to prosper along with subscribers of my trading/investing newsletter. Join our insiders group and make 2016 an exciting and profitable year!

********

END OF YEAR SPECIAL

GET 12 MONTH OF TRADE ALERTS FOR THE PRICE OF ONLY 6!

Chris Vermeulen