US Currency in Circulation & Barron's Gold Mining Index

Part 3 of 3

Exactly what is money? Looking at Wikipedia's definition of what money is, it's obvious that money is more a dynamic economic catalyst than just an asset to be spent.

- Medium of exchange (frees society from barter exchanges)

- Unit of account (standardizes the terms of commerce)

- Store of value (allows for secure saving over time)

- Standard of deferred payment (allows the creation of a bond market for long-term capital formation)

And economic catalyst is the precise concept to understand how money functions in an economy. Like all catalysts, money facilitates a process without being consumed.

In our ancient pre-history, peaceful trading had to be done without the benefit of money. Archeological finds of copper knives from Spain and France, at England's Stone Hedge provide an intriguing hint of commercial activity in the British Isles, trading across the English Channel over 5000 years ago. The American Indians never developed an iron and steel industry. Yet, trade with Europeans on the east coast of North America routed steel blades all the way to the Pacific Ocean, by way of trade between the tribes. But these are examples of trade by barter, not exchanges of goods and services facilitated with money.

Gold and silver have always been highly valued, as they were by the Incas and Aztecs, but coins for monetary purposes possibly go back as far as Mohenho-daro, in Pakistan (2600-1750 BC). King Sennacherib of Assyria (705-681 BC) minted shekel coins, but he saw war as a better means to gain wealth than commerce. Coins for commerce didn't really take off until King Croesus, of Lydia (560-546 BC) minted coins of gold and silver, whose weight and purity was guaranteed by the state.

Why did King Croesus begin minting coins? No one exactly knows. Maybe he began minting gold and silver coins because he found them beautiful. It's doubtful he fully understood the economic dynamics his coins were to unleash. No matter, the citizens of Lydia who formerly had to barter sheep for pottery (a difficult transaction if no artisan of clay had need for sheep on market day), could now base their trading on a common term of value: King Croesus's gold and silver coins. Now, bringing sheep to market guaranteed its owner that they would walk away with coins, and bringing coins to market allowed their owners to buy anything offered for sale.

Lydia became fabulously rich, thanks to gold and silver coins circulating in the markets, functioning as an economic catalyst. Sheep got eaten, pots of clay got broken, but the coins of gold and silver used in trade were unaltered in the transaction. With no interference from a political class, Lydian coins continued circulating from hand to hand in an endless stream of economic activity. So, coins became a powerful stimulant for economic activity, and political power. The world was never the same again.

Credit is not money, but the belief that lent funds will be repaid. Credit can also function as money. In fact, credit is the major component in most monetary metrics, such as the monetary aggregates M1 & M2. Viewers of CNBC are frequently informed that corporate America is "flush with cash", suggesting some figure greater than a trillion dollars. The same is true for cash held by mutual funds. From the good folks at ICI, who compile weekly data on money market funds, we see that money market funds currently hold a total of $2.73 trillion dollars in "cash." But with CinC (actual paper dollars and base metal coins in circulation) currently just over $1 trillion dollars, we know that most "cash" today is not cash at all, but credit - debt awaiting repayment.

Credit can be used for many purposes, some vital, some not. Wimpy's "I will gladly pay you Tuesday for a hamburger today" is the economic basis for most consumer credit and government debt. After Wimpy, the City of Detroit or the State of California spends their lent funds, there is seldom any collateral a creditor can foreclose on, in the unexpected situation that come Tuesday, Wimpy, or Sacramento, California is a bit short of cash. Are some of Wimpy's IOUs, credit created for past hamburger consumption, now sitting in your pension fund, or life insurance company reserves? Don't doubt that for a second!

With Doctor Bernanke's "policy" since December 2008 of low interest rates and regular, massive injections of funds into the banking system, allowing deeply indebted consumers to continue running up credit card debt, and allowing all levels of government to continue runaway spending, we can be sure that Wimpy got his fill of hamburgers.

Here's a YouTube video explaining the technical aspects of consumer credit. Okay, it's a Popeye cartoon, but it better illustrates how consumer credit works than anything you'll see on CNBC. At 4 minutes and 36 seconds, stop the video and note how much Popeye was charging for a bowl of soup or a hotdog in 1957, one year before the run on the US Treasury gold reserves began: fifteen cents.

Don't get me wrong, credit creation artfully done is a wonderful thing! During the gold standard, credit creation funded the industrial revolution, and credit once provided a more equitable distribution of wealth than state socialism ever achieved in its sorry 100 year history of inflationary monetary policies. Wimpy, and the Keynesian academics would surely disagree with this, as the gold standard forces economic participants to bring something of value to the market, if they are to share in the wealth others create.

At the root of this disagreement lies the question of exactly who is entitled to the money and credit circulating in the economy. Proponents of the gold standard believe that money and credit belong exclusively to those who create wealth, by offering labor, goods or services that other producing members of society are willing to exchange their money for. The gold standard also directs credit into productive uses that provide a return of lent money, plus interest. The gold standard punishes those who use debt to fund current consumption, both governments and individuals. But ultimately, so does paper money.

This wise policy can prevent today's youth from becoming tomorrow's aging poor, and inhibits governments from becoming a hobgoblin, consuming their citizen's wealth as it corrupts everything it touches with legislation & regulations. So, in a world where the economy is financed by sound money, banks provide a safe place for people to deposit their excess savings. Loans, by necessity, are for funding commercially viable activities. With no Central Bank injecting phantom-funds into the banking system, at rates artificially determined by ivory tower academics, banks, long ago, had to pay meaningful rates to attract deposits from the public, to fund commercial activity.

With the gold standard's insistence that money can only come to those who bring something of value to the market, Wimpy, Keynesian economists & social utopians have never approved of gold as money. Their preference will always be for a form of money that can be lent-into-existence. "Liquidity injected" into the banking system becomes money lent-into-existence when banks make personal loans for consumption (credit cards, auto loans, and no money down, 30 year mortgages). To the extent that Washington spends more than it taxes, it spends money into existence.

The long term consequences of this policy (creating credit from nothing for the purpose of funding current consumption), are best illustrated by a chart of the US National Debt. The US Treasury is forced to continually roll over past debts, as the proceeds from past debts were used by the US Government in ways that provided no economic return. When one rolls over their debts, it's because the funds spent haven't earned enough to pay off their past debt, and nothing Washington, or government in general spends our money on is profitable.

The big push for "Urban Renewal" by academic "Social Engineers" of the 1940-60s has long since been forgotten by most, but was well covered by Barron's at the time. The return on these "investments" in America's inner-cities, as predicted by Barron's, has been dismal. And the debts created to fund these socialist-urban catastrophes are STILL rolling over in the US National Debt after six decades. Incredibly, US Treasury bonds were much sought after in every global financial scare during the Greenspan era as "safe haven" assets. When purchasing US Treasury debt, do people really know what they are buying? I don't think so!

So as we see above, Washington's past debts, which funded one Soviet style economic disaster after another, are not only being rolled over, but new debts are increasing the US national debt exponentially. The expansion of debt to the scale seen above is only possible because gold was replaced with debt backed money, which could be "injected" without limit into the economy like gasoline is to an engine. With such confused notions about the proper function of money in a healthy economy, the US Congress proceeded to legislate greater and greater quantities of debt backed money into existence, increasing the rate of growth of the national debt. And as the dollar is backed by US Treasury Debt, so has the supply of dollars.

Generations from now, economic researchers will wonder how such a harebrained scheme could have been allowed to go on for decades, a scheme that obviously lined the pockets of politicians and bankers, at great expense to private citizens and global commerce. The answer to that question is that the politicians and bankers found willing accomplices in academia, economists who were more than willing to compromise their professional integrity to support the debt-as-money scam in return for a generous piece of the action. Via the student loan program, educational grants, and government sponsored research that funds junk science, colleges and universities have grown fat on the debt based dollar, and "higher education" has shared its enthusiasm for debt, and antipathy for sound money with generations of their students.

Five years later, "mainstream" economists like Dr. Laffer, et al, have lost all credibility. Keynesian and Monetarist theory has now been thoroughly discredited by their complete inability to forecast the gaping chasm lying less than a year away in 2007, unlike Peter Schiff and the Austrian School Economists, who saw it coming. True, the panic of October 2008 was still 2 years away, but default rates on subprime mortgages were already increasing by late 2006/early 2007, and Bear Stearns announced liquidity problems on their portfolio of mortgage backed securities in the summer of 2007. Still the mainstream economists refused to face reality.

I don't mind tooting my own horn every now and then, but I predicted the coming debacle in the mortgage market when I penned a piece for Bill Murphy's Le Metropole Café:Mortgages - What the Bank Won't Tell You in February 2004, where I concluded:

"FDR's "policy" for American mortgages blew up some 40 years after it was implemented. The mortgage "policy" of Carter, Reagan and Bush the first, won't last that long. --- long term American mortgages will perform in the future for the current holders as they had in the past for the Savings and Loans."

Doctor Laffer may be clueless on the economy, but I'm sure his income is still generous. Who would pay for such horrible advice? Washington, via government-grant money to academia, and Wall Street with their consultation fees. And where do they get their money from to pay for Doctor Laffer's work? This is straight from the horse's mouth:

"We make money the old fashioned way. We print it." - Art Rolnick, Chief Economist for the Minneapolis Federal Reserve Bank

And what is Art's favorite hobby when he's not "printing money?" Economic Education; who could have guessed!

Like most money spent on such research, Washington and Wall Street really don't care if someone like Doctor Laffer is right or wrong, as long as his research supports the current debt-based money system, and continues to carry considerable influence with the college "educated" public.

It's time to move on to the Barron's Gold Mining Index (BGMI). My data goes back to 1920, however Barron's only began publishing the BGMI in 1938. But as the BGMI was comprised of only two companies in 1938:

I was able to backdate the data when a friend of mine, Goeff, obtained price data for Homestake Mining from 1920 to 1938 from the New York Times. Thanks Goeff!

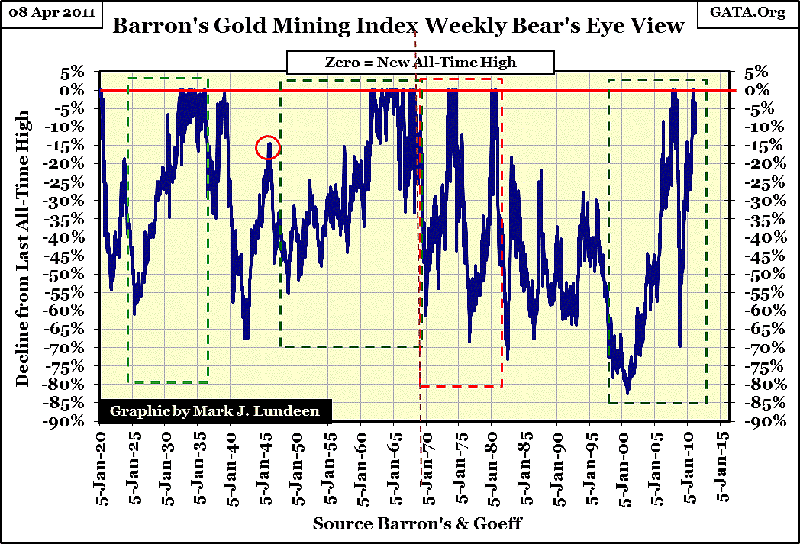

Looking at the Barron's Gold Mining Index with the Bear's Eye View (BEV), we see that there have been four bull markets in the BGMI since 1920, which I've placed in boxes:

- May 1925 - March 1936 -------------: (Gain of 1254%)

- November 1948 - March 1968 ----: (Gain of 911%)

- December 1969 - October 1980 --: (Gain of 1331%)

- October 2000 - To Present ---------: (Gain of 598%)

As the Bear's Eye View is a technique of examining bear markets, and corrections within a bull market, it cannot display gains above a previous bull market's high. Also, for the BGMI bull market of the 1950s & 60s, I chose the 1948 bottom as a start date, not 1942's. Nothing wrong with 1942, but the 1948 bottom was after Bretton Woods was ratified. By the way, the 1925-36 bull market saw its TZ in 1936, not 1939, although it may appear so in the chart below. In March 1939, the BGMI came within 0.91% of making a new Terminal Zero. Close, but no cigar.

An interesting historical fact, documented in Allan H. Meltzer's, "A History of the Federal Reserve Vol. 1", & Ron Chernow's, "The House of Morgan," is that after WW1, The United Kingdom wanted to return to the gold standard, as it should have. However, during the war, the Bank of England printed more paper pounds than they had gold to back them. Not wanting to devalue the postwar pound, the British "policy makers" foolishly priced the pound to prewar levels, eventually leading to a run on British gold.

An interesting date in this charade was 28 April 1925, when the Chancellor of the Exchequer, Winston Churchill announced to the House of Commons that the UK was returning to the Gold Standard; however this was after the House of Morgan, and the US Federal Reserve, provided funds and credits to the Bank of England (BoE). I won't go into further detail, other than to say that the BoE continued receiving support from the US "monetary policy makers," in the form of artificially low US interest rates to help prevent the run on British gold. This resulted in a bubble in the US real estate and stock markets, which ultimately deflated causing the crash of 1929, followed by the Great Depression in the 1930s. Meltzer tells us that this affair led the "policy makers" to conclude they needed to take a more "activist" approach in the future. As I recall, Doctor Bernanke said something similar to Congress in October 2008.

Anyone who has studied the Great Depression's bear market knows that Homestake Mining, and Alaska Juneau Gold had a fabulous bull market, while the rest of the economy was in ruin. My source is Wigmore's "The Crash and its Aftermath." But what's made clear in the BEV chart above, is that the 1930s bull market in Homestake Mining actually started in 1925; just 5 weeks after Winston Churchill's April announcement of the UK's return to the gold standard! It's amazing how markets respond to political influences.

Next is the WW2 era, which in the BGMI's BEV Plot we could say started at its March 1936's Terminal Zero.

From a BGMI perspective, the depression ended and the World War 2 era began with its 1936 BEV's Terminal Zero (its last all-time high of the 1925-36 bull market). This TZ marks a logical point in time where the world turned its attentions from domestic, to international concerns. If war and global chaos were actual reasons for gold mining stocks to rise, we should have seen a historic bull market in the BGMI during World War 2.

What actually happened was the BGMI (now using the published data from Barron's) crashed 67%, and bottomed just a few months before the Battle of Midway.

I took 1948 for the start of my BGMI bull market, but if you chose 1942 you would not be wrong. The war years were abnormal, so I decided not to use the 1942 date in my analysis. Look at the red circle I placed over the November 1945 peak in the BGMI: The guns of WW2 were silent, Bretton Woods, with its $35 to one ounce of US Gold link was in place * and * holding (as we saw in Part 2 of this series on Currency in Circulation), and the BGMI began a 3 year decline on this happy news for the US dollar.

But this happy situation was changed in 1948, when the US monetary printing presses started a 20 year bull market in the BGMI, whose Terminal Zero ultimately occurred just days before Buckingham Palace announced to the world that the London Gold Pool was being shut down, and a two tiered gold market was created. One market for central banks, who promised to continue trading their monetary gold at the set official price of $35 an ounce, and a new public market for gold, where buyers and sellers would set the price.

Buckingham Palace's 1968 public announcement, and the creation of a two tiered gold market, had a radical effect on the gold mining shares. Before the closing of the London Gold Pool, bull markets in the BGMI were normal affairs, whose chart patterns looked very similar to bull markets for the Dow Jones. But afterward, BGMI bulls became wild beasts. Look at the BGMI before and after the dashed line marking the Buckingham Palace announcement. We entered a new world, where "monetary policy" was capable of anything but prudence.

Look at the extremes in volatility the BGMI displayed from 1969-80. Washington took the world off the gold standard, and the mining shares went wild, with bull market corrections of over 65% becoming common! Three decades ago, in June of 1982, with the BGMI down 73%, did anyone even realize that the bull market was over? As documented in Barron's: many didn't! This was the craziest bull market ever! Lots of the old-timers talk about all the money they made in gold, silver and mining shares during this time. Really? Ask them how much money they actually took, and kept home; after 1980.

I purchased a few 1 oz silver medallions from the Franklin Mint before I enlisted in the Navy. I left San Diego for Hawaii on the USS Mobile. We were going on a six month deployment to Asia. When we arrived in Hawaii, I went to the library to check out Barron's January 1980 issues. When I saw silver at $50, I went back to the ship to write my sister to sell my medallions. I still chuckle about that, writing a letter to a family member to sell silver in January 1980.

The 1980-2000, 82% bear market was the longest & deepest bear market for gold mining shares in the past 90 years. The 2000 bottom was a HARD BOTTOM; a bottom so extreme that speaking kindly of gold, silver or mining shares actually invited ridicule and hostility! But, it's from such bottoms that historic bull markets are born. In 2000, when shares in gold, and silver mining companies were dirt cheap, no one wanted any, now people don't want them because they cost too much. But mark my words: before the current bull market in the BGMI is over, investors will be willing to pay any price to jump onboard!

Don't think so? Look at what happened after the December 2008's, 70% correction - just two years later the BGMI was making new BEV Zeros (new all-time highs). What other sector see * frequent * bull market corrections of over 60%, and then powers back to new highs in less than two years? Since the closing of the London Gold Pool in 1968, such corrections and powered rebounds are standard occurrences with the shares of precious metals miners during bull markets.

In the next few years, the gold & silver mining shares are going to give us all the ride of a lifetime, if the past is any guide to the future, (and it usually is). This is straight from the "1MC": "all hands standby for heavy rolls to port and starboard" when the Barron's Gold Mining Index starts moving up again in earnest! A tsunami of deflating credit instruments is coming our way.

We'll finish up part 3 next week with charts showing the Dow Jones, the BGMI and CinC. It'll be worth the wait.

[email protected]