Historic Volatility In The Gold Market? Not Yet!

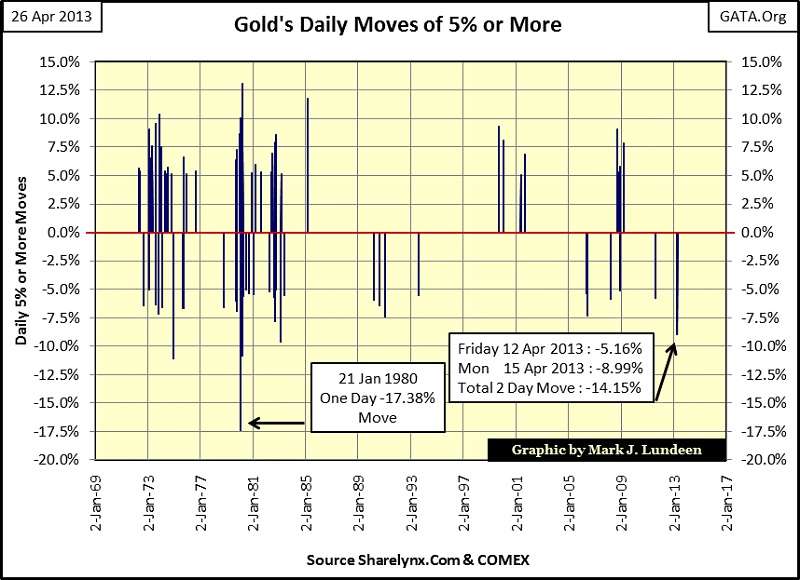

We’ve seen lots of talk of massive and historic volatility in the gold market after its recent take down. This is not true. Here is a chart showing every day since 1969 where gold moved (+/-) 5%. Since the early 1980s, the price of gold hasn’t really seen the volatility it saw soon after the US took the US dollar off the Bretton Woods Monetary Accords in August 1971.

To date the largest down move for gold occurred on 21 Jan 1980, where it saw a ONE DAY DECLINE of 17.38%. As noted in the chart above, this is more than the combined decline for 12 & 15 April 2013.

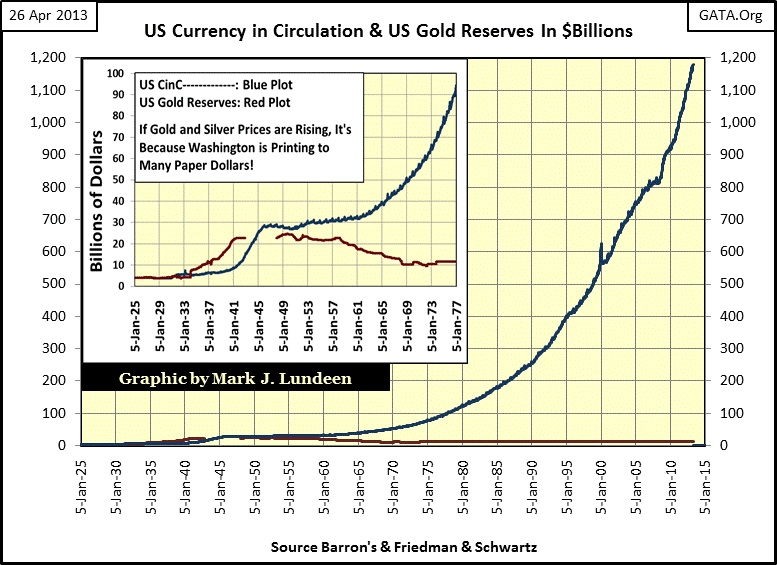

The thing to remember about the 1970s and early 1980s was that the world was having a crisis with the world’s reserved currency. This was long before the “policy makers” were given the “tools” to “stabilize” the markets and economy from the destabilizing debt backed US dollar. The undisputable truth about the post-World War 2 gold standard isn’t that it made the world’s economy unstable, but that American politicians, academics and bankers intentionally did away with gold as money by over issuing paper US dollars (Blue Plot below).

Legally gold was money in the United States since the 18th century; paper money was only a claim to gold, or was until August 1971. Bretton Woods allowed only $35 paper dollars to be issued for each ounce of gold held by the US Treasury. But by 1958 the US government’s excess issuance of its paper currency began a run on gold held by the US Treasury that didn’t end until President Nixon closed the Treasury’s gold window in 1971. If the now discontinued gold standard had a problem, it was due to the people charged with administering it were criminals who refused to follow the laws of the United States.

Here are some old Barron’s articles on the US dollar from the 1960s and 70s. This list is only a small sample of what Barron’s said during this time:

US$ 23-Jul-62 ON THE FALLING DOLLAR

US$ 2-May-66 CURRENCY TROUBLE

US$ 3-Feb-69 Currency crisis

US$ 19-Jul-71 Dollar Problems

US$ 3-Jul-72 PROBLEMS WITH THE DOLLAR

US$ 16-Jul-73 Why the US$ is sick

US$ 6-Oct-75 ARTICLE ON THE DEVALUED DOLLAR

US$ 12-Jul-76 PROPOSED DOLLAR REFORM (BARRON’S NOT HAPPY)

US$ 1-Oct-79 US$ no good overseas! Big Problem for US Citizens in Europe

The price of gold didn’t really trade freely until after the London Gold Pool broke up in early 1968, when governments began a two tier market with gold being traded at two different prices; one gold price was market driven and the other price was used by central banks for their official gold reserves. “Officially”, the US Treasury to this day still carries its gold reserves at something like $42.10 an ounce no matter what the price of gold is in the market. I don’t believe the US Treasury has ever purchased or sold any of its gold at this price – so what kind of price is that? Keep this in mind whenever you see unemployment or inflation statistics coming from Washington.

Going back to my 5% daily moves for gold chart above, it’s clear that daily price volatility from 1969-83 was much higher than it currently is. We can assume this is so because after 1983 Wall Street and Washington have contained the price of gold to protect the US dollar from competition from real money. Gold used as money was always a problem for expanding governments as gold limits the supply of money and the creation of credit. Unlike the current debt-backed “reserve currency”, gold as money is a fixed money supply. Governments must tax its population to receive income, as the gold standard, if actually respected (unlike we see in the chart above) prevents governments from increasing their paper currency in circulation in excess of a country’s gold reserves.

Today, gold has absolutely nothing to do with the money supply or with the financial markets as everything with a cost is priced in US dollars. This is true for even gold and silver. So, if the price of gold and silver should become “destabilizing” what is actually out of whack are the digital-dollars used in purchasing gold and silver, not the former monetary metals themselves who were kicked out of the global monetary system decades ago.

But as the debt-back bucks enter into their twilight years, we can anticipate people like Doctor Bernanke, members of Congress, and Wall Street criminals to attempt to blame all the inflationary ills they inflicted on the economy and business on the rising prices of gold and silver. It won’t be true, but the financial media will most likely go with the storyline. We should expect historic daily volatility for gold and silver in the years ahead of us as the “policy makers” lose control over their price fixing schemes in the precious metals, and other markets.

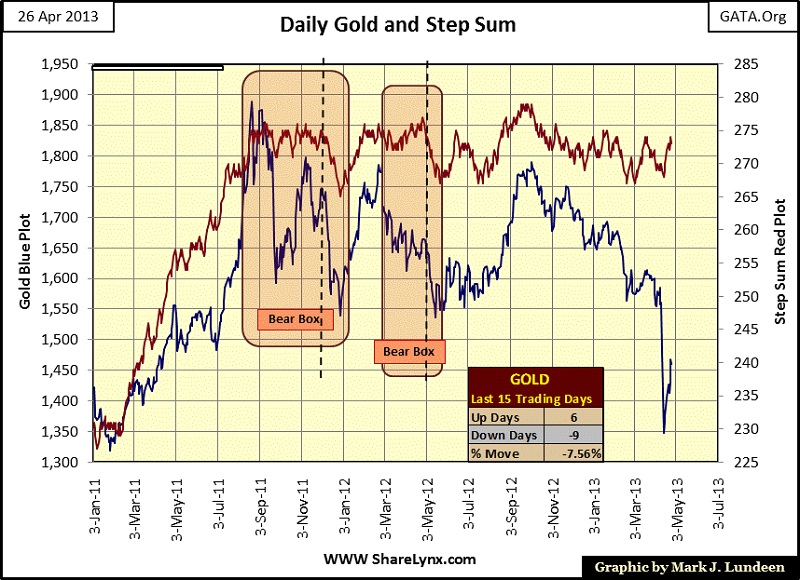

Gold’s step sum chart below show that the price of gold and its step sum have both turned up strongly since the unpleasantness of a few weeks ago. This is a step sum strong buy signal. I last sent out a strong buy signal this March. You can see it on the March 03 line. It wasn’t one of my better calls. But in my defense I remind you that on April 12 & 15 banks were flooding the paper gold markets with hundreds of tons of paper gold they didn’t have to crash the price of gold. Had someone did this same thing with the Dow Jones futures the Justice Department would be investigating this.

No doubt the big banks, with the approval of their governments, were hoping to cause a selling panic in the physical gold and silver markets too. These banks have major problems in the precious metals markets as they have sold every ounce of gold they hold for their clients to many other people, and have charged everyone for storage fees too. Morgan Stanley was taken to court for this, and lost the case because they were guilty. That was only a few years ago. These institutions are all managed by ethically challenged people who don’t care about anyone but themselves. It’s unwise to expect any other bank to have managed their clients gold ethically, as promised in the storage contract. The world is beginning to wise up to this paper scam in the gold market too. Here is Keith Barron whose friend saw actual gold eagles selling for $500 above spot price, which makes the spot price at Kitco suspicious.

“One of my colleagues, who was in Tokyo, just told me there were stunning $500 premiums on one ounce American Gold Eagles -- and there were none to be found anywhere in Tokyo. So the Japanese were taking advantage of the price drop to buy seemingly everything available in terms of physical gold in the entire country.”- Keith Barron

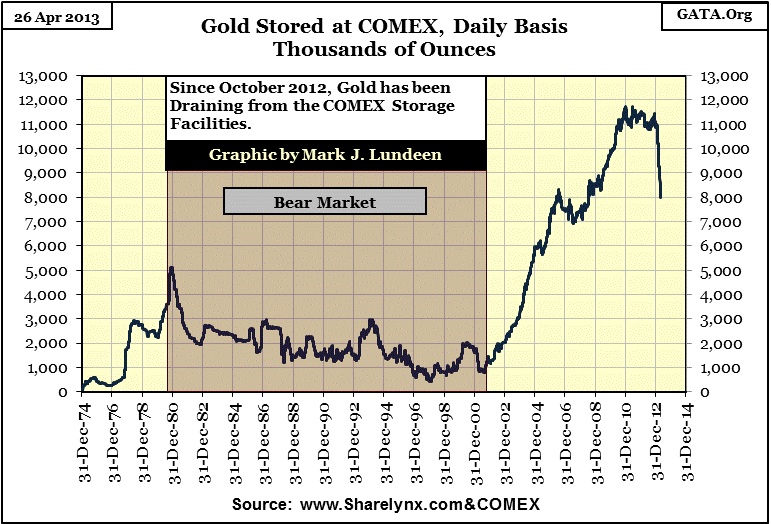

Then there is the run on COMEX gold we see below. I know that no one else is calling the declining gold stocks at the COMEX a “run.” But seeing a four month, 30% reduction in the gold stored at a major regulated market sure looks like a run to me! One thing for sure, if this keeps up there is going to be problems in the world of paper gold. After all, it was the COMEX that allowed its big bank member to sell hundreds of tons of paper gold in a few hours just two weeks ago, huge trades COMEX officials knew these member banks couldn’t deliver on if asked to. If I had a few tons of gold stored for safety at a COMEX approved facility, I’d be a bit worried whether or not I could get it out in the not too distant future. People lost gold and other assets during the MF Global default of Halloween 2011 that had legal reason to believe that government regulators and exchanges like the COMEX would protect their property, but government and exchange officials failed in their duty to the public.

Here is the problem: to keep interest rates low the “policy makers” have tried every dirty trick in their book to keep the price of gold and silver down, but have failed for over a decade. During a time when the US national debt has gotten completely out of control, we should have never seen such low bond yields in the US Treasury bond market (Red Plot below). That they have is only because Doctor Bernanke has been good to his word that he would promote “stability” by monetizing the Federal Government’s debts, and printing money. Is it a surprise that the bull market in gold began accelerating after Doctor Bernanke’s “helicopter speech”? I expect history will one day record that ultimately the only thing Doctor Bernanke stimulated was the inflationary dollar price in the precious metals.

The day is coming when US Treasury bond yields are going to rise far above what “market experts” currently refuse to consider. It could happen this summer if Doctor Bernanke and the Federal Reserve stopped their QE program. When this happens, and it will, a buyers' strike will develop in the US Treasury market and a crash will result in the financial markets (stock market too) as the dollar prices of gold and silver rise to shocking levels. What do you expect? We no longer have free markets with their built-in checks and balances to keep massive misallocations of capital from becoming market killers.

Here is silver’s step sum chart. I don’t yet see a strong buy signal in silver, but silver below $30 looks very attractive to me. Anyway, since April 12 when the big banks whacked the price of gold and silver with a tsunami of bad-faith paper promises to deliver metal in the futures markets, who can purchase actual gold and silver anywhere near the published price of metal? Precious metals dealers around the world have been charging large premiums on sales and still can’t keep up with demand. I can’t see into the future, but 2013 seems to have the makings of becoming a historic year in the old monetary metals market.

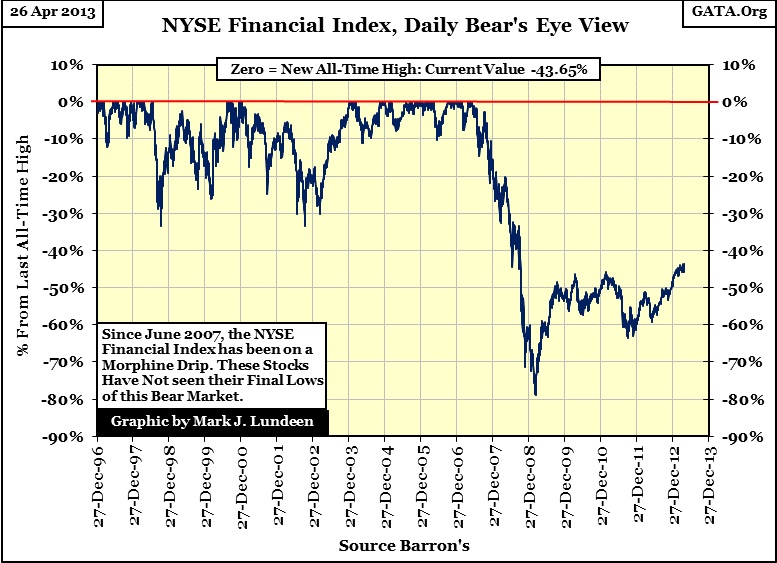

Next is a Bear’s Eye View chart (BEV) for the NYSE Financial Index. They were a hot group during the mortgage bubble, but in 2007 (six years ago) they saw their last all-time high and then crashed 80% two years later in March 2009. If it wasn’t for the US government and the Federal Reserve bailing out these criminals using the public’s credit by monetizing these banks' garbage reserves, this index would have declined far below its BEV -90% line.

As it is, these companies look pathetic. They had a great six months from March to September 2009, but have been dogs since. Still, CNBC has placed financial companies on their must have list, right next to high-tech stocks. But the world has changed since the 1990s, and one day CNBC will notice. Anyway, this index is ground zero for the banks who have been manipulating the price of gold and silver below their free market prices. Well desperate people do desperate things.

The government’s “regulators” and central banks can pretend that all is right in a world where struggling financial institutions are allowed too short a few thousand tons of fictional gold in the futures market, but it’s not true. These companies have huge, hundreds of trillions of dollars of potential liabilities should bond yields and interest rates return to where they were before the credit crisis. Since 2007 when the US mortgage market became illiquid, they’re only breathing because the Fed is “injecting liquidity” daily into them. No one else wants to buy their worthless mortgages. The Fed is buying (monetizing) something like $45 billion dollars of abandoned mortgages a month from these guys.

No wonder the COMEX has lost 30% of its clients’ gold in the past four months; some of these financial companies are the stewards of the COMEX’s gold inventory, and in the past the COMEX has changed the rules to protect these politically connected banks. Wall Street in 2013 is a world where criminals never go to jail for theft, so I expect to see the run on the COMEX gold inventories to continue until something really bad happens. When it does, we’ll see daily volatility that far exceeds the daily moves from the 1969-80 gold bull market.

Mark J. Lundeen