A 700 Horsepower Gold Stocks Car

With DOGE now destroyed, financially impaled US citizens wait for tariff taxes (and Godot?) to bail them out.

Sadly, Treasury boss Scotty Bessent sounds like an Orwell book character as he eagerly tells his marks that government taxes are not taxes.

Got gold?

Citizens with no gold need to get some, and those who have this supreme form of money should want to get more.

For further insight into the matter:

If sellers are giving up, buyers are too.

Eastern governments are generally at least as indebted as those in the West, and more so in many cases. The difference between the two zones is that the citizens of the East view gold as their saving grace, while in the West the citizens still have a ridiculous obsession with government fiat.

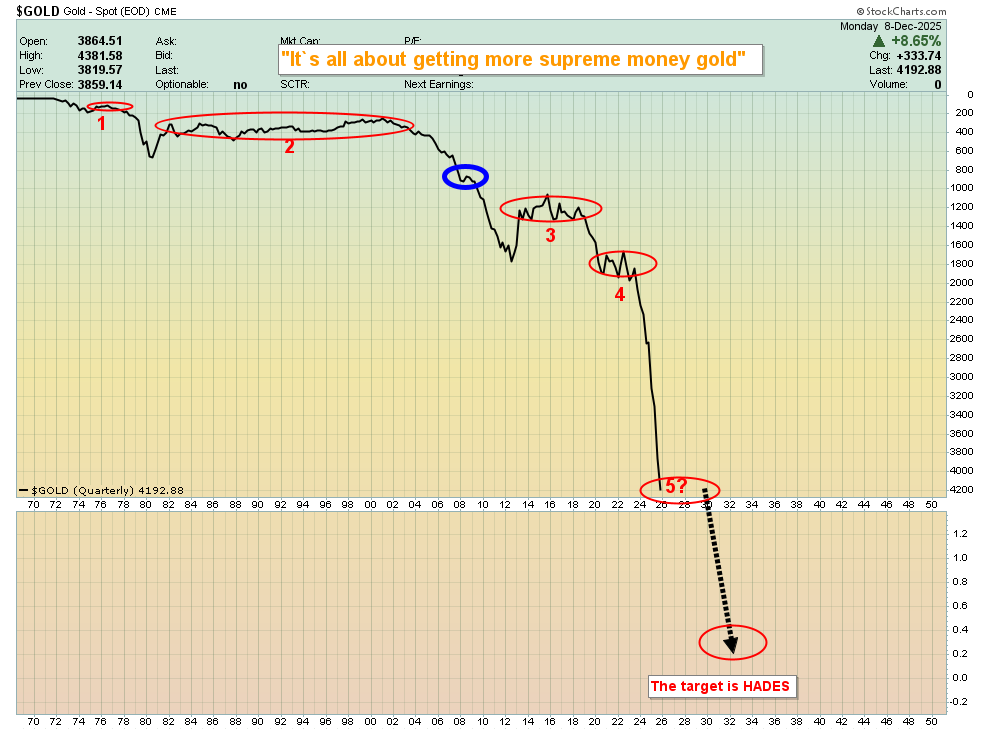

This is the long-term gold versus fiat chart. Tariff taxes can’t save fiat from being obliterated by gold and nor, quite frankly, can gold revaluation.

Gold analysts should be pushing the US Treasury to buy gold daily or even hourly rather than fantasizing that a modest 8000ton stockpile (which is tiny relative to the economy) can be revalued successfully… while the government spends even more wastefully and goes deeper into debt.

Soon it will be 100 years since the US government bought even a gram of gold. That’s the mark of an entity that is pathetic.

My suggestion is not to view the citizens of China and America as being in a race… because from the perspective of most citizens, there is no race.

Governments think life is a competition. The issue is compounded by mainstream media that focuses more on governments than citizens. The bottom line for chips: Selling them to China is going to increase growth there. In Asia, more growth means more citizen income and that of course means… more demand for gold.

In America, the desperate government pounds citizens and companies with tariff taxes to get revenues for itself. In China, the desperate government now pounds the citizens with taxes on jewellery made with gold… so the citizens turn to ETFs.

That’s more good news for gold because analysts in the West don’t focus on jewellery demand as much as on investment demand. They don’t realize that Eastern jewellery demand is investment demand. The move to ETFs will garner more attention from analysts in the West.

Gold has moved up nicely from the oversold zone for Stochastics (14,7,7 series) and now it’s overbought.

I don’t recommend selling physical gold for anything but land or emergency medical needs but selling around 30% of gold and silver ETF holdings into the $4200-$4400 zone for gold seems like a decent play for investors, and it’s one I’ve followed myself.

In a nutshell: gold can go higher, but it’s moved up tremendously in a relatively short (and joyous!) time. If it goes higher, the investor is very happy. If it dips significantly, more can be bought.

Miners?

The CDNX ran into a small brick wall at the key round number zone of 1000 and MACD (20,40,9 series) is now in conflict with Stochastics (14,7,7 series).

What can be said is that some profits can be booked, but the CDNX “raw juniors” market is quite different from the senior mine stock market, because when the CDNX falls, a myriad of individual junior miners often surge on their own mighty merits!

Junior mine stock investing isn’t for everyone, especially with size, but as this gargantuan gold bull era rollout continues, these miners look set to outperform everything! At $199/year, my junior resource stocks newsletter is an investor favourite, and I’m doing a special pricing this week of $169 for 14mths! Send me an email or click this link if you want the special offer and I’ll get you onboard. Thanks!

What about the seniors? Well, let me start by saying that no investor likes to sell their holdings when the market is up, but it has to be done.

My suggestion is to view the situation like a race car; if you have a 1000 horsepower car and reduce it to 700 horsepower, it’s still a phenomenal car to drive. Further, most investors aren’t on a track. They’re on the street. Selling 30% of senior miners after this kind of mindboggling move up is a very sane approach to handling the gains.

I realize that most gold market analysts are focused on gold going to $5000 and of course it eventually goes there, simply because of the nature of fiat… but that doesn’t mean it goes there before there’s a dip that involves some emotional pain.

GDX is up about 20% from the last time Stochastics was overbought… in about a month! Annualized, that’s a massive rate of ascent.

This key oscillator is now overbought. It can stay overbought, as it did recently, but that doesn’t happen very often. If GDX shoots to $100 from here (possible, but unlikely), an investor holding 70% of what they had going into the current highs should still feel fantastic. If it tumbles to my buy zone of $68-$55, they are ready to buy!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: