Big Beautiful Gold

Supreme Money Gold. The money of kings. It’s coveted by the citizens of China and India, and excitingly… it’s a key focus of savvy citizens in the West!

The US government is as addicted to debt as heroin addicts are to heroin, and the coming “cold turkey” withdrawal will involve significant pain.

Trump’s big and horrible debt bill is likely the catalyst for the next surge in rates…

And for gold.

For a long-term look at US rates:

Rates appear to be headed towards 20% in the coming years. A major inflation (and higher rates) cycle is underway. It should last about 40 years.

When Ronnie Reagan got elected, US debt to GDP was only about 40%. Now it’s 100%+. Ron cut taxes but he also had a massive declining rates wind at his back. The economy grew strongly as he added a lot of debt.

Now, creditors are beginning to question the government’s ability to handle additional debt. Will the passing of Trump’s ludicrous “Big, Horrible Debt” bill mark the day gold blasts to a new high?

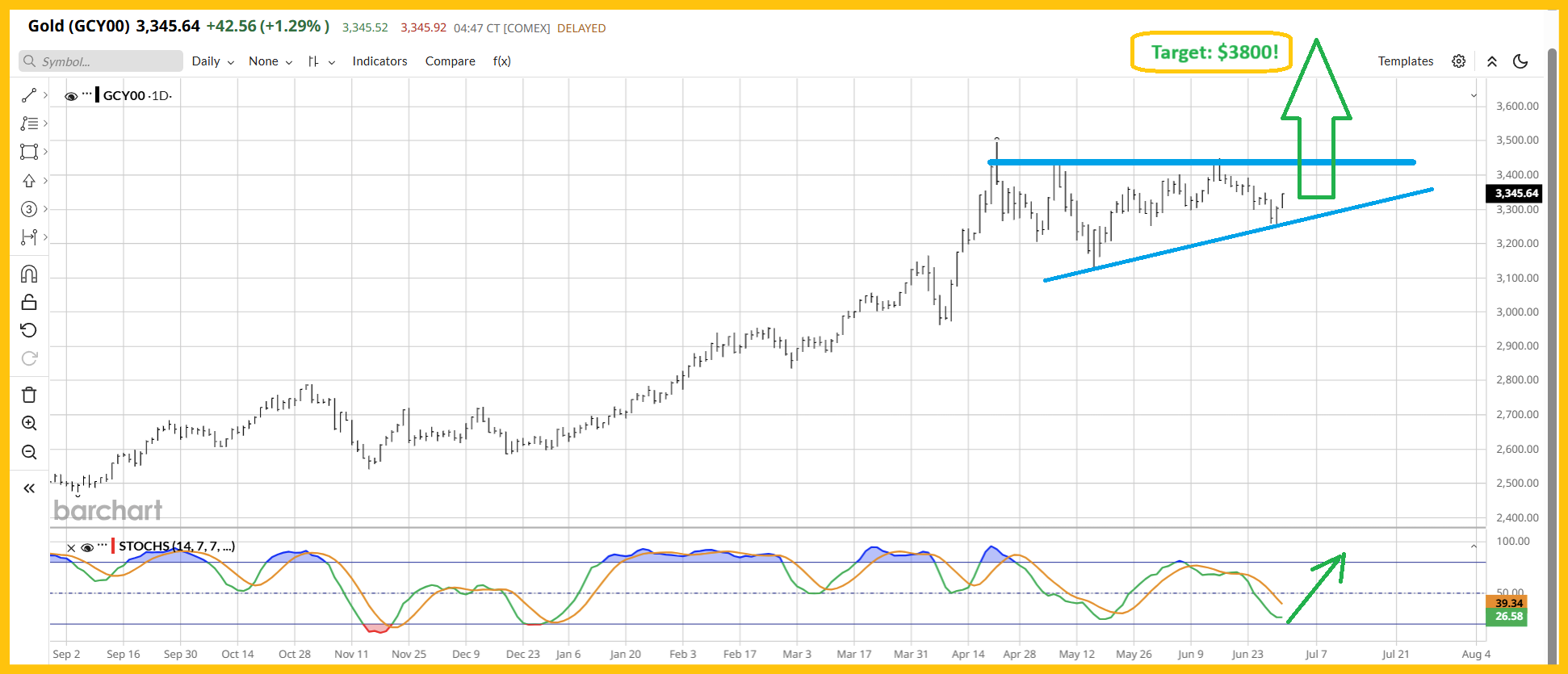

This is the “Big, Beautiful” gold chart. A spectacular ascending triangle pattern is in play and the upside target is $3800.

Stochastics (14,7,7 series) also looks fantastic. It’s poised to flash a thunderous buy signal… only the second one this year.

My suggestion to the top callers and bears: Take the year off. Come back in the spring of 2026 when gold is likely to stage a more significant pullback in the price.

Right now, the bulls are in control… and they look set to stay in control for quite some time.

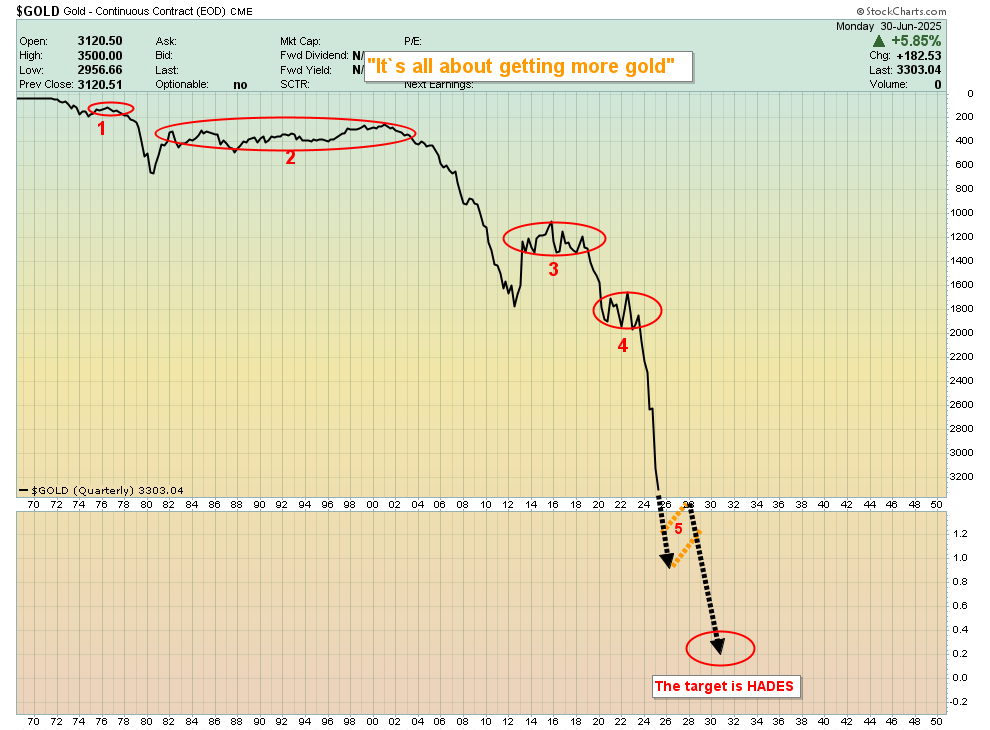

To sum up the big picture for fiat:

The performance of government money against supreme money gold is pathetic… and it’s set to become much worse over the next 10-20 years.

What will replace the dollar when it loses so much purchasing power that nobody wants it? Well, for some insight into this key matter:

I’ve outlined a 200year “gold bull era”, launched by the citizens of China and to be taken to its full potential by the “titans of ton” citizens of India.

India will become an energy exporter and that will end the government’s obsession with import duties on gold… because it will end the current account deficit.

From there, India is likely to launch electronic gold currency, ushering in the final building block of the glorious gold bull era.

Western gold bugs will celebrate, and many of their mining stock prices should rise to the price of gold.

This is the stunning CDNX chart. My long-term target is 10,000 and that’s going to be easily attainable as the citizens of China and India begin to add mining stocks to their portfolios.

Everyday, 10 to 20 different CDNX stocks look like golden cannon balls, blasting to new 12month highs. Soon it will be 40-50 a day that are hitting new highs, and then 100-200. Junior stock investing isn’t for everyone, especially with size, but as the gargantuan gold bull era rollout continues, these miners look set to outperform everything! At $199/year, my junior resource stocks newsletter is an investor favourite, and I’m doing a special pricing this week of $169 for 14mths! Send me an email or click this link if you want the special offer and I’ll get you onboard. Thanks!

For a look at the senior miners:

This is a fantastic GDX chart. My latest buy alert looks good… and GDX is trading at almost $53 pre-mkt this morning!

A blast through the $55 highs looks imminent, and it probably occurs as debt-hungry senators pass Trump’s big debt bill.

It’s not too late to buy. New players can buy senior miners with an optional stop for some/all of the position basis $50 GDX.

For a look at the “wow factor” weekly chart:

The technical target of the spectacular C&H pattern is about $60, but large patterns with fabulous aesthetics tend to see the price rally well beyond the target range.

I’ve talked about a somewhat rare “Seasonal Inversion” event for gold, silver, and the miners for 2025. Instead of a swoon from April to October, there should be a brief consolidation, and then a massive rally from July to October. The good news:

July is here!

Should investors throw caution to the wind and buy as many gold and silver stocks as they can today? Well, the debt-worshipping government clearly has a monopoly on throwing caution to the wind, but investors with significant cash flow who feel a bit light on the miners should consider doing some buys. Further, I’ll dare to suggest that it’s not so much about throwing caution to the wind as it is about putting bull era party hats on!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: