Bull Market Leaders Are Now Leading the Way Lower

Stocks kick started the second quarter with a bang but were the first few days the start of another rally or just an oversold bounce?

For most of March the stock market corrected in a somewhat control manner. The last couple days in March the broad market was oversold and ready for the bounce so it was no big surprise. But now we must review the technical to see if the market goes higher or lower from here.

First, I want to get you up to speed on the current technical state of the broad market from my point of view.

Cycle Analysis: As of today 3 out of 4 indexes are still showing bullish cycles. The DJIA, SP500 and Russell 2K are still trending higher. The Nasdaq on the other hand is showing a bearish cycle and that sellers will likely continue to weigh on these stocks.

With the Russell 2K only a couple days away from is cycle possibly turning down you must trade with extreme caution and protect any long positions within your portfolio. Know that ¾ stocks move with the market trend, the odd will be against you when a down trend starts.

Moving Averages: Aside from cycles, price and volume, the moving averages are one of the most important indicators for my trading strategy. Currently the IWM and QQQ are trading below the 20 moving average and are underperforming the broad market, and this is worry some.

Divergent Stock Market Sectors

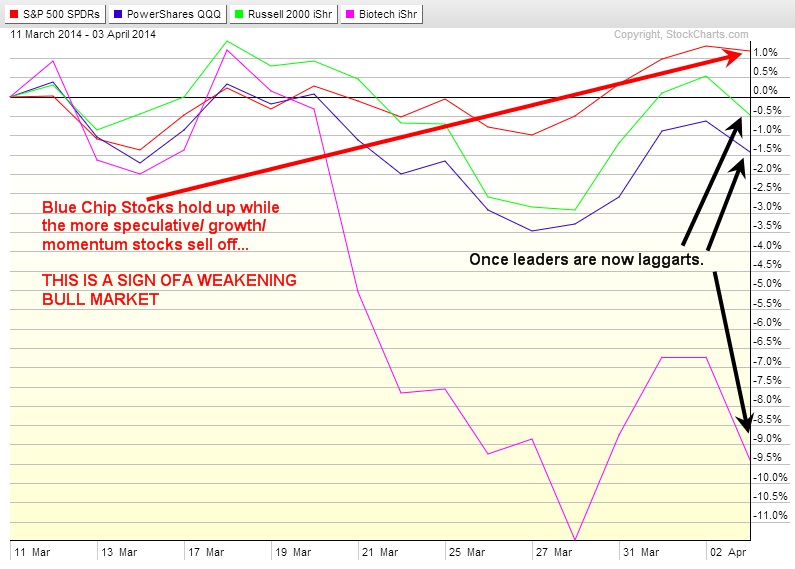

The past few weeks’ divergence among the bull market leading stocks and that of the broad market (blue chip stocks) has taken place. The Nasdaq, Russell 2K, and Biotech stocks have been leading the market higher, but these growth and momentum stocks seemed to hit a wall a few weeks back and are now underperforming the SP500.

This is a sign that the active investors/traders and hedge funds are rotating their money out of these higher beta stocks to lock in gains and are moving their money into the more stable blue chips in anticipation of a market correction.

Similar to how money moves in and out of gold mining stocks before the price of physical bullion price moves (in most cases), we see big money rotating out of these leading stocks first, and you should be aware that the broad market health is slowly deteriorating.

Leading Stocks are Now Lagging

Gold Stocks & Bonds Show Early Signs of a Bottom

The chart below shows possible early stages of gold stocks and bonds forming a bottom. Gold, silver and gold stocks have a lot of work to breakout and kick in to high gear. Bonds on the other hands are showing more strength.

With most traders and investors getting their head handed to them the past couple years if they had held their precious metals positions, it most likely has investors ignoring this sector this time around with a focus on more conservative plays like bonds.

Conclusion: Out of Favor Investments Will Be in Favor Soon Enough

In short, the broad stock market remains in an uptrend and getting short now is a little premature. There are some really exciting short plays setting up, but until the broad market is technically in a down trend shorting is not the direction to be trading.

When gold, silver and mining stocks build more of a base and firm up, I will be posting and trading metals, miners and bonds aggressively. Keep up to speed with my free weekly newsletter at: www.GoldAndOilGuy.com

Chris Vermeulen