The New Macro; Gold, Stocks & Debt

The new macro features real assets over paper/digital assets

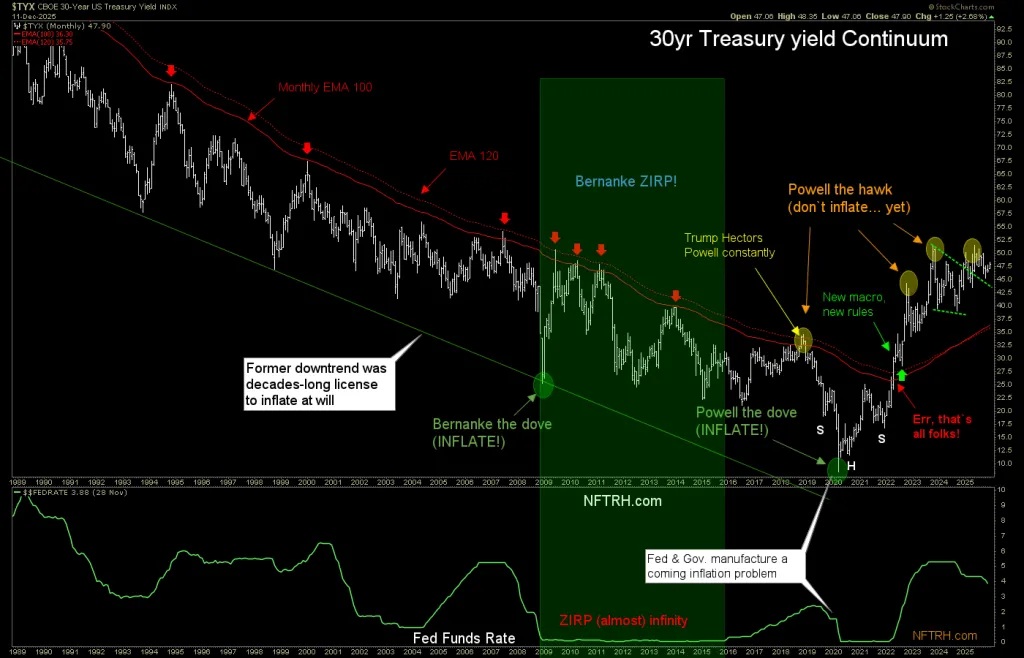

I have harped upon the symbolic picture of the new macro since 2022. That was the year that the trend in long-term Treasury bond yields was broken in a fierce rebellion by a bond market that had enough of the previous decades of monetary and fiscal chicanery.

It’s over folks. What was – a disinflationary continuum in declining yields permitting the Fed and government alike to print/bailout/inflate at will – no longer is. Period.

Since 2022, we have been refining the meanings and implications of the above-noted rupture in the Continuum. The effects will be many, from limiting the “print (Fed) and spend (government)” gambits of the past to a mass exodus out of the paper that held so much of the public’s confidence from 1980 to 2022.

The new macro will actually conform to Alice’s words:

“And contrary-wise, what is it wouldn’t be. And what it wouldn’t be it would, you see?”

Whereas the Continuum chart above represents the trend, now broken, that had kept appearances well and good for decades as paper reigned supreme, that phase, that macro backdrop is now over. Done. I don’t don’t say so. The bond market has been saying so since breaking the long-term trend in yields in 2022.

The old macro was structurally in favor of those who sold, bought, traded and owned claims on… paper.

The new macro is in favor of those who own real things, unleveraged by debt.

This begins with the only real “monetary” thing, gold. You can argue that digital money like Bitcoin is real, and it is. It is a real technological development that is strictly a tool for transaction. For instance, transactions bilking old people out of their life savings at the hands of scammers. Of course, it can also transact legal exchanges as well. But it is not an asset. It is transactional.

Gold is not money. Relatively few people in this world are conducting transactions in gold. They are holding it, trading its futures or wishing they owned it. That is because gold is a counter-measure; a defensive means of dealing with the debt-choked modern world symbolized by the excesses routinely injected into the system over the course of the last several decades (most aggressively, beginning with the Bernanke Fed and its QE, Operation Twist and ZIRP blights).

The New Macro: A Picture

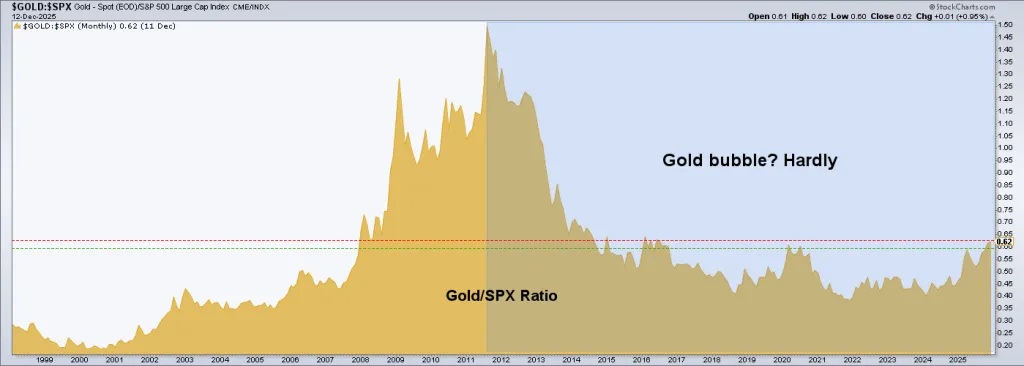

I have shown the picture above many times in an effort to most profoundly depict the end of the “paper” macro. Functionally, this picture of the S&P 500 measured in gold units defines what the new macro will look like if the history of the inflationary 1970s repeats.

In the 1970s, the stock market did not go overtly bearish. It did however, enter a terrible bear market in real terms, as adjusted by monetary stability, gold.

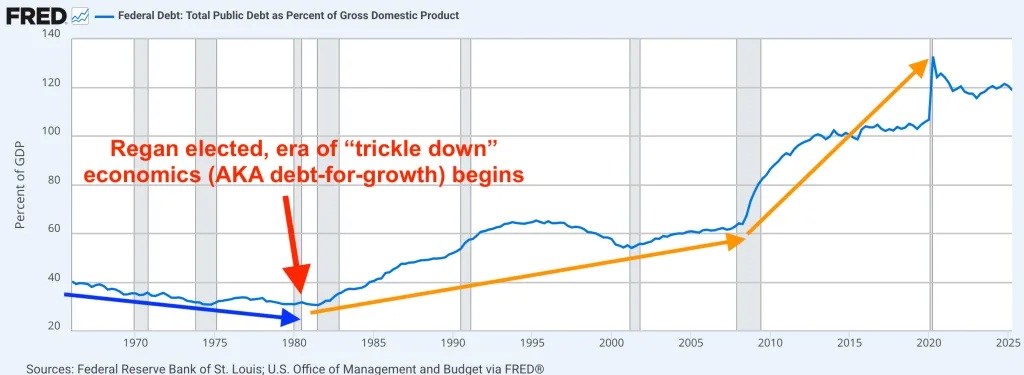

We should present evidence to the assertion that the multi-decade rally in all things paper was fueled by the ability, the confidence, to create and leverage new debt at will. Here is your evidence.

Very simply, a new and widespread bull market in all things paper was manufactured by the ability to continue raising debt levels and leveraging that debt into asset market appreciation. U.S. GDP has risen consistently since 1980… and the associated debt levels have risen much more. It is no coincidence that the 1980s stock market bull and U.S. Debt-to-GDP both began to rise in/around 1980.

That was one hell of a macro phase, and it is over. RIP.

Considering the factors above that the 30yr Treasury yield “Continuum” has been broken (implying less, shall we say, flexibility for monetary and fiscal inflators to do their dirty work), the SPX/Gold ratio is making a very bearish posture, and the whole edifice is and has been not only supported by, but run on the ability to expand the national debt level (now $36T) you can see that the new macro is actually something very simple.

While we remain in an age of speculation, with more and more of the populace treating the stock market like a casino, legally betting sports and making “coin” in crypto, the shear beauty and simplicity of it all is this; gold is an anchor to stability, and the system is likely approaching max-instability.

As we step into the new macro, gold in SPX units is not only not a bubble. It has barely taken out its long-term bottoming base.

Over 4300/oz. nominally, gold has barely gotten started in the new macro, which has not yet fully revealed itself to the masses (still hopped up on sports betting, crypto mania and day trading). A $10,000/oz. nominal gold price in the next few years not only possible, in my opinion, it is now probable as the macro backdrop develops.

Fed of OZ

The monetary anchor will remain stable, but its assigned price is going to get a move on as the debt edifice unwinds, probably slowly and painfully.

The Fed is up to its usual tricks, manipulating Treasury bonds and MBS out its rear orifice in service to yet another QE of some kind to come. But on the big picture, the debt-for-growth regime is falling apart. What was, no longer is.

So at best we will have a 1970s style inflation problem where paper assets stagger forward with relatively poor returns while real assets, including many important commodities, as led by silver (after gold led the whole process beginning in 2021) greatly out-perform.

The age of paper is over. The solution is not digital (crypto, AI, etc.). The solution is simplicity. Debt-free simplicity. It’s going to take many years to get to that simple state as a society. Hard years.

The new macro is engaging now and it should have a long run. The article above is a big picture view of it. NFTRH analysis has guided us well to this point (through the old macro and into the new), advising and defining the “top down” situation in real time. We will continue these themes in order to be ready at all times for the opportunities ahead.

What was, no longer is. Prepare to think differently.

For “best of breed” top-down macro analysis and market strategy covering Precious Metals, Commodities, Stocks and much more, subscribe to NFTRH Premium, which includes a comprehensive weekly market report, detailed NFTRH+ updates and chart/trade setup ideas, and Daily Market Notes. Receive actionable (free) public content at NFTRH.com and subscribe to our free Substack. Follow via X @NFTRHgt and BlueSky @nftrh.bsky.social, and subscribe to our YouTube Channel. Finally, watch for ANS coming soon and check out Hammer’s trade (long and/or short) setups.

*******