Bullion Coin Sales Data Indicate Impressive Figures

Strengths

- Palladium was the best performing precious metal, gaining 5.26 percent for the week, with continued follow-through from the Volkswagen scandal. The gains are largely speculative as it is not likely that Europe or Volkswagen will abandon diesel vehicles as their main staple.

- September’s nonfarm payrolls disappointed, rising 142,000, which was nowhere near the consensus estimate of 201,000. There was also a decline in workweek data from 34.6 hours in August to 34.5 in September, which equates to an added 348,000 in job losses. Additionally, ratios from the Household report showed that the job participation rate fell to its lowest level since October 1977 (from 62.4 percent to 62.7 percent). Consequently, gold prices jumped $25 in the first 15 minutes after the jobs report was released on Friday.

- In response to their country’s stock market selloff, Chinese investors may be returning to precious metals as a safe haven. Retail sales of gold and silver in China during August rose 17.4 percent year-over-year, representing about $3.9 billion in sales.

Weaknesses

- Platinum was the worst performing precious metal this week as traders shorted platinum to go long palladium, where there might be a shift in demand.

- Gold just had its worst quarterly loss in a year at the close of the third quarter, and close to its worst weekly loss since March. However, the shortfall in the jobs numbers on Friday was a sentiment changer on the likelihood of a Federal Reserve interest rate hike in October or December. Earlier in the week Janet Yellen gave a speech reiterating the Fed’s intention to raise interest rates this year.

- In response to the Fed’s decision to not raise rates in September, and considering Yellen’s comments, Citigroup was espousing that the woes for gold were only delayed rather than avoided. Some analysts have now pushed estimates for a rate hike out into 2016 with the disappointing jobs data.

Opportunities

- Bullion coin sales data indicate impressive figures. American Eagle gold coin sales totaled nearly 400,000 ounces in the third quarter of 2015, compared to 127,000 ounces sold in the prior quarter. Additionally, government mints are witnessing unprecedented demands for silver coins as a result of its price drop to a six-year low, and are even taking steps to ration the sales of silver bullion coins. It appears that someone, other than the Wall Street pundits, thinks investors should add precious metals to their portfolio when prices are cheap.

- Chinese gold imports show continued strength, as Shanghai Gold Exchange reports indicate over 800 tonnes for the third quarter alone. The Chinese government was also active during August with the purchase of about 16 tonnes of gold, likely financed with the proceeds from a record sale of $83 billion in U.S. Treasuries.

- Contrary to the majority, UBS and HSBC see gold as an excellent investment at current prices. UBS noted its belief that gold’s upside potential currently outweighs its downside risk.

Threats

- Morgan Stanley warns that commodities are set for their worst quarter since 2008 and that more losses may still be ahead. The bank cut long-term forecasts for metals by as much as 12 percent.

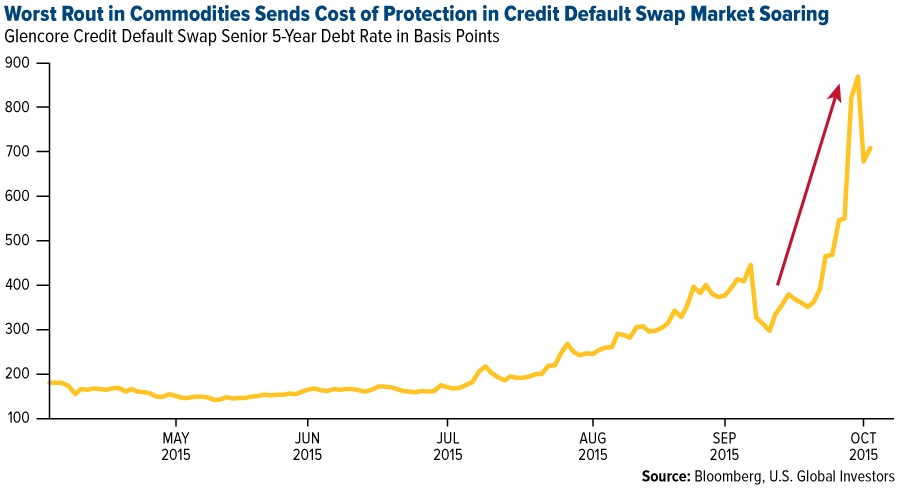

- Glencore may seek more than $1 billion in streaming deals in an effort to recover from plummeting share prices. These deals would most likely be focused on future production of gold and silver from some of its South African mines. Glencore’s share price plunged at the start of the week as analysts speculated the company could lose its credit rating.

- Swiss regulators identified seven banks that are being investigated to determine if they were involved in an effort to manipulate the prices of gold, silver and other precious metals. Although the investigation could last until 2017, it is unlikely that these banks would be prosecuted. Many of these banks have been investigated dozens of times in the past for metal price manipulation; however, none of these investigations have ever resulted in criminal prosecution or significant fines against them.

Courtesy of http://usfunds.com/

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of