Chinese And Russian Banks Increase Gold Purchases

Strengths

- The best performing precious metal for the week was platinum, up 6.11 percent and finishing the month up 11 percent. Palladium, however, was even stronger, surging 17 percent for the month. Both metals have benefited from better auto sales in China and concerns over potential labor strikes in South Africa.

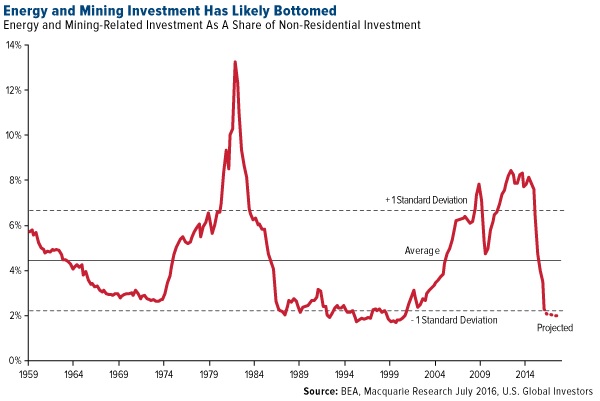

- Energy and mining investment has collapsed to its lowest level in nearly 15 years, according to Macquarie Research, and appears to have hit bottom. This could be a sign that it is due for a rotation upwards with the recent strength in precious metal prices.

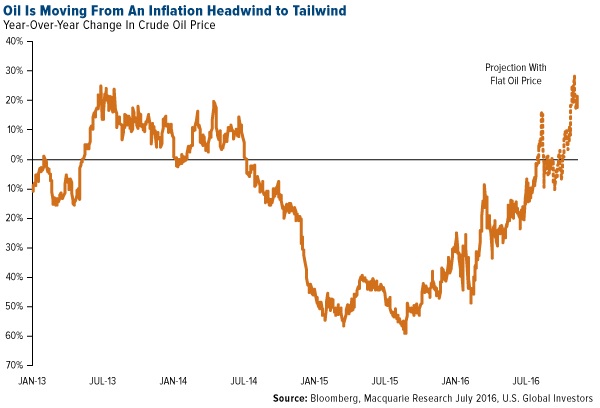

- In addition, healthy inflation has returned, according to the core PCE price index, which increased at a pace of 1.9 percent annualized in the first half of the year. Private sector wages and salaries also increased 2.6 percent over the last year.

- Platts reported that both Chinese and Russian banks increased their gold purchases during the month of June, after they had both slowed their gold purchases in May. Russia added around 18 metric tons, and China added around 15 metric tons. China is now the sixth-largest holder of gold reserves, and Russia is the seventh-largest. The two countries have accounted for over 95 percent of total central bank purchases of gold in the last two years, in their efforts to diversify away from foreign currency.

Weaknesses

- The worst performing precious metal for the week was gold, although still positive, up 2.16 percent. Most of the gains came after the Federal Open Market Committee (FOMC) meeting, as the U.S. durable goods orders dropped 4 percent in June, more than expected and the most since August 2014. Gross domestic product rose at an annualized rate of just 1.2 percent last quarter, while forecasts had called for a 2.5 percent increase.

- Gold showed some weakness in trading sessions earlier in the week, related to rising speculation that the Fed will raise rates sometime this year. In addition, the Bloomberg Dollar Spot Index gained for three weeks in a row, and purchases in gold-backed exchange-traded funds have backed off from their three-year high earlier in the month.

- Anti-corruption measures in China have taken a toll on gold jewelry consumption, with demand falling 17.4 percent compared to last year. Meanwhile, the investment-related demand for gold has picked up, with gold bar and coin purchases up 25.3 percent and 17.3 percent, respectively. China’s Ministry of Industry and Information Technology estimates that the country’s gold consumption will increase to 1,200 tonnes by 2020 from 986 tonnes in 2015.

Opportunities

- The chief investment officer of TD Asset Management, Bruce Cooper, has shifted to a “maximum overweight” allocation to gold for its portfolios. The firm oversees more than $230 billion. Cooper is watching for Germany to shift away from its austerity approach and notes that if Hillary Clinton and the Democrats win the election and unveil fiscal stimulus, inflation could pick up in the global economy.

- Amid the gold rally this year, Barrick Gold Corp. plans to continue its plans to sell off peripheral assets, starting with its share in the Australian Kalgoorlie Super Pit. Barrick reported that it made $968 million in debt repayments this year, nearly half of the target amount. Gold producers have had a mixed quarter for earnings as Newmont Mining and Agnico Eagle Mines beat estimates while Goldcorp and Kinross Gold missed. In fact, Agnico Eagle’s CEO, Sean Boyd, is optimistic for the future, stating that it’s not too late for investors to participate in this rally. Boyd cited the “tremendous amount of debt in the system,” along with strong demand from China and India.

- Klondex Mines’ planned acquisition of the Hollister asset looks like a positive move for the mining company. The Hollister location has historically produced high grades of around 30 grams per metric ton of gold, and since the location is in direct proximity with the Midas Mill, there are several Klondex team members who have direct experience there. Klondex’s announced $100 million financing to fund the acquisition was met with three times the demand for the shares. Klondex released its second-quarter production results for the Fire Creek and Midas mines, exceeding analyst expectation. In addition, the Hollister and True North acquisition, completed earlier this year, significantly raises its production growth.

Threats

- SkyBridge Capital, a firm which profited from gold during the surge in 2010 and 2011, now puts forth a cautious outlook for gold. A senior portfolio manager at the investment firm states that bullion’s rally could be hindered if the Fed decides to raise rates more quickly than expected, even though the fundamentals for gold are supportive. SkyBridge managed $12.6 billion as of May 31 and does not have any exposure to gold and precious metals currently.

- Macquarie Research published a report this week with the outlook that fiscal policy will result in “financial repression for decades.” The firm calls the low rate policies an “implicit tax on savings” leading to weak consumption, and in turn, lack of investment by companies and stagnant wage growth. In addition there is a lot of pressure on entitlement programs such as pension funding.

- BofAML notes that funding ratios for the top 100 corporate defined benefit pension plans are at all-time lows, due to the flattening of the yield curve, amidst the 70 percent rally in the S&P500 Index and $400 billion in contributions. Pensions may switch to more funding through debt instruments (liability driven investing). A higher allocation to fixed income will likely lead to lower returns for pension plans, more equity outflows and more slow growth.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of