Effects Of Global War On Gold

Sadly the swords of war are again rattling worldwide. And if history is testament, present military hostilities will indubitably have their impact on the price of the universal money called gold.

Sadly the swords of war are again rattling worldwide. And if history is testament, present military hostilities will indubitably have their impact on the price of the universal money called gold.

During periods of armed conflict, GOLD was a preferred form of money due to its rarity, durability, divisibility, fungibility and ease of identification, often in conjunction with silver. Silver was typically the main circulating medium, with gold as the monetary reserve. Commodity money was anonymous, as identifying marks can be removed. Commodity money retains its value despite what may happen to the monetary authority. After the fall of South Vietnam, many refugees carried their wealth to the West in gold after the national currency became worthless. During World War II many European displaced persons escaped Nazi domination and persecution by “buying their way to freedom” with gold.

During periods of armed conflict, GOLD was a preferred form of money due to its rarity, durability, divisibility, fungibility and ease of identification, often in conjunction with silver. Silver was typically the main circulating medium, with gold as the monetary reserve. Commodity money was anonymous, as identifying marks can be removed. Commodity money retains its value despite what may happen to the monetary authority. After the fall of South Vietnam, many refugees carried their wealth to the West in gold after the national currency became worthless. During World War II many European displaced persons escaped Nazi domination and persecution by “buying their way to freedom” with gold.

-----------------------

Historically, paying for wars is a central problem for all countries engaged in armed conflict. This was especially true in early modern Europe (fifteenth to eighteenth centuries), when war relied heavily on mercenary forces. The king of Spain was advised that waging war required three things - money, Money and MORE MONEY. In the 15th Century Spain and Portugal imported (robbed) silver and gold from the Americas to pay for their armies, but in such large quantities that the value of these precious metals eventually eroded.

Pending Iran Military Action And The Historical Effect Of Wars On The U.S. Dollar

“The history of the U.S. dollar is closely linked to U.S. involvement in a series of wars. The Bretton Woods Accord and the resulting world reserve currency status of the U.S. dollar were both byproducts of World War II (1939-1945). The Korean War (1950-1953) was followed six years later by the Vietnam War (1959-1975), which led to the end of the Bretton Woods system. Unfettered by the constraint of gold backing after 1971, the U.S. dollar became a weapon in the Cold War (1945-1991) between the U.S. and the former Union of Soviet Socialist Republics (U.S.S.R.). Each war corresponded with an increase in the U.S. money supply. The Gulf War (1990-1991) was followed by wars in Afghanistan, beginning in 2001, and in Iraq, beginning in 2003, and, simultaneously, by the U.S.-led War on Terror that began in 2001. Like the wars that came before them, the recent staccato of U.S. wars is correlated with increases in the U.S. money supply. The Iraq war, for example, is estimated to have cost as much as $4 trillion.

The loss of value in the U.S. dollar caused by excessive expansion of the money supply, together with rising demand for raw materials from emerging economies, has led to permanently higher global commodity prices. Higher crude oil prices, in particular, have put pressure on the U.S. economy, which is allegedly in a gradual recovery from the recession that began in 2007. At the same time, international trade has begun to move away from the U.S. dollar, threatening its world reserve currency status. Given the history of the U.S. dollar, it seems likely that an eventual end of the U.S. dollar's reign as the world reserve currency will be marked by war.”

(Source: Ron Hera)

********

Areas of Current Armed Conflict –

Ukraine and Russia

- Russia’s President Putin aim to annex the Ukraine into a new U.S.S.R. has been politically and militarily pursuing this objective since the beginning of this year.

- Rockets from the Ukraine Destroy Malaysian Airliner killing all 300 passengers aboard. Kiev says rebels claim responsibility…and that the rockets were probably fired from Russia.

Middle-East

- Hamas (an Islamic Group linked to the Muslim Brotherhood) and other Palestinian factions have been exchanging rocket fire with Israel. In retaliation the Jewish nation has recently been aggressively attacking Gaza with naval and missile weapons.

- Syria’s allies are stretched by a widening war involving Lebanon’s Hezbollah and other Shiite fighters…which are drawn away by the Sunni rebellion in Iraq.

- Al-Qaida and Taliban Terrorists are reining havoc throughout the Middle-East…and reportedly even have plans of a final jihad for India.

- Iran Nuclear talks continue with the USA.

Asia

Asian nations fear war with China. Large majorities in many Asian countries fear that China's territorial ambitions could lead to war, according to the Pew Research Center (PEW), in a finding with implications for U.S. foreign policy in a region that increasingly looks to America for protection.

A widespread worry that military conflict over territorial disputes may disrupt the region is among the findings of a public-opinion survey of 44 countries by the Washington-based PEW.

Source: WSJ

Central-America and the USA Illegal Immigration Problem

The seriousness and magnitude of this exploding problem boggles the mind. It encompasses the countries of El Salvador, Honduras, Mexico…and the final destination target the USA. Whereas hereto date peaceful attempts to resolve the perplexing humanitarian conundrum have NOT been successful, it indeed has the potential for decisive military action not too far down the line.

---------------------------

Related War/Gold Editorials:

Syria 2013: Possibly…Déjà vu Desert Storm War

Let “Dollar” Collapse Or Choose War. Elites Will Opt For War.

Pitched Currency War & US Dollar Rejection

“Do not be surprised to see the Chinese Yuan later as interchangeable with the Gold Trade Note. But first the Yuan must be convertible into the many major currencies actively traded in the world. Numerous reports have come in recent weeks that the Yuan currency will soon have a gold backing, yet unconfirmed. My expectation is for the Chinese Yuan eventually to be interchangeable with the Trade Note. That will signal its implicit gold backing. While many events and steps are not known, and many surprises will be thrust on stage, the guiding pathways are slowly coming to light.” – Dr Jim Willie

Gold Will Win "Euro Vs Dollar" War

Gold glitters and shines in a violently bellicose and combative climate…as the meter on money. Gold almost always prevails and prospers in such an environment of pervasive violence.

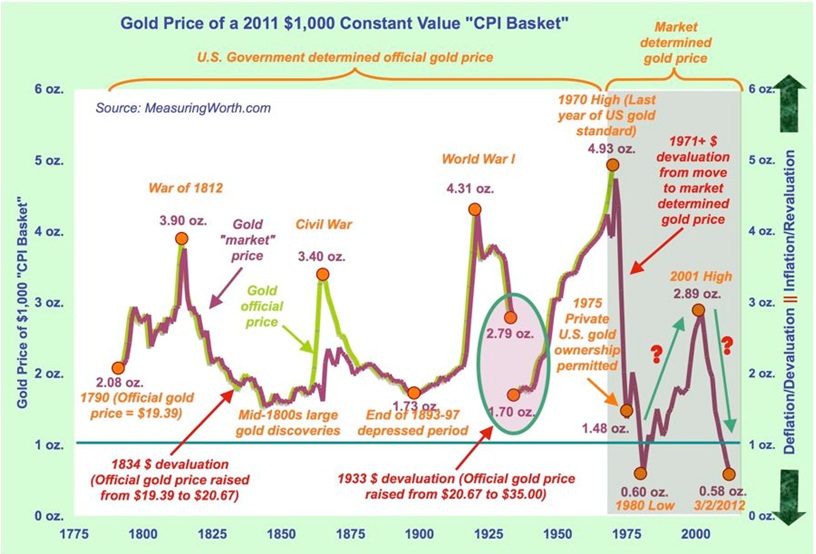

Gold vis-a-vis War Charts:

A Real Potential For A Major WAR…Obama vs Putin:

Gold Price Summary And Prediction

For several months the accelerating plethora of military hostilities worldwide strongly suggests the gold community will benefit from the upcoming, ongoing, broadening, and deepening armed aggression, violence and geo-political conflicts in the four corners of this planet.

And in this event the price of gold will NOT rise in an orderly fashion, but will soar parabolically as frenzied investors engage in panicked buying of the shiny yellow.

And rest assured the price of silver will soar in concert with gold going into orbit.

********