The Fire Fueling Gold

Gold took quite a beating in September, bucking its seasonal average monthly return of 2.3 percent. The political battle between President Barack Obama and Congress, China’s Golden Week, and India’s gold import restrictions likely weighed on the metal.

September’s correction only adds to the negative sentiment toward the precious metal. The assumption from many market pundits is that gold is no longer attractive as an investment. With rising rates and continuing low inflation, U.S. investors believe they have a solid case for selling their holdings.

However, this could be a premature assessment, causing these bears to potentially lose out on a lucrative position.

Allow me to use an ice cube to explain.

One of the strongest drivers of the Fear Trade is real interest rates. Whenever a country has negative-to-low real rates of return, which means the inflationary rate (CPI) is greater than the current interest rate, gold tends to rise in that country’s currency.

Our model tells us that the tipping point for gold is when real interest rates go above the 2-percent mark.

Consider the ice cube, which shows how new equilibriums can have significant effects. At 31 degrees, H2O is a solid chunk, but when the temperature increases, the mass slowly begins to turn into a liquid. Above 32 degrees, ice changes form from solid to liquid, but it’s still made of hydrogen and oxygen.

Because money is like water, when many other economic dynamics, such as population growth, urbanization rates and changes in government policies, reach their tipping point, the velocity of money tends to be altered.

As global investors, we watch for changes in these trends to know how to invest in commodities and markets, find new opportunities and adjust for risk.

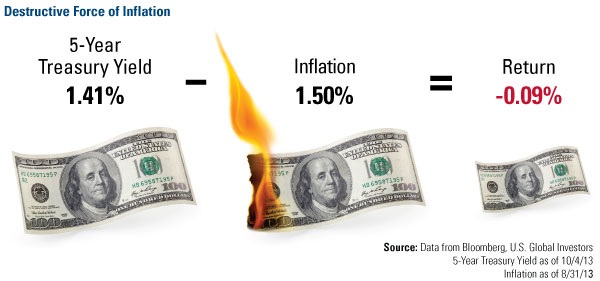

So, how close to gold’s tipping point are we? In other words, what is the real interest rate today? As you can see below, Treasury investors continue to lose money, as the 5-year bill yields 1.41 percent and inflation sits at 1.5 percent. This is nowhere near the 2 percent mark.

I would be worried about gold if real interest rates solidly crossed the 2 percent threshold for an extended amount of time, because it would have a dramatic effect on gold as an asset class. In a high interest rate environment, gold and silver lose their attraction as a store of value.

In order for that tipping point to happen, rates would need to continue rising above inflation, and inflation would need to remain low. These are the forecasts made by many gold sellers today; however I wouldn’t get too trigger happy just yet, as recent data challenges these assumptions.

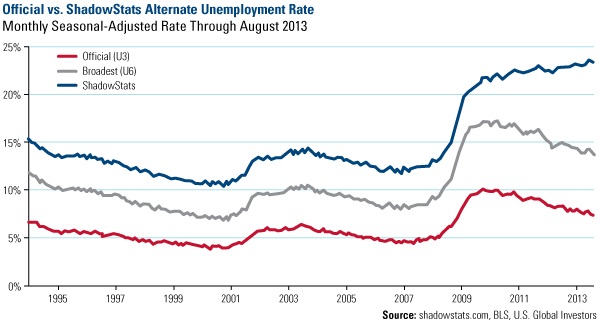

Take the monthly unemployment figure, which is one of the primary indicators the Federal Reserve studies when evaluating the economy. But depending on the definition of an unemployed person, the numbers reveal different results.

The official U3 unemployment rate, the exact figure Ben Bernanke uses, tracks the total unemployed as a percent of the civilian labor force.

The broadest gauge calculated by the Bureau of Labor Statistics (BLS) is the U6 unemployment rate. For this number, the BLS adds in those all people who are marginally attached to the labor force, plus people working part-time but want to work full-time.

What does “marginally attached to the labor force” mean? These people are neither working nor looking for work but indicate they want a job, are available to work and have worked during some period in the last 12 months. These marginally attached people also include discouraged workers who are not looking for work because of some job-market related reason.

Then there’s a measure of the labor market the BLS tracked prior to 1994. This is the seasonally-adjusted alternate unemployment rate that statistician John Williams continued to calculate. It’s basically the U6 plus long-term discouraged workers.

While the figures closely followed one another from 1994 through 2009, there’s recently been a shift. U3 and U6 have been trending downward over the past few years, whereas Williams’ ShadowStats unemployment rate shows a noticeably upward trajectory. Perhaps the official unemployment figure overstates the health of the economy?

Based on the jobs market, a limited housing recovery and regulations that have been slowing down the flow of money, the Fed may have no choice but to raise rates very gradually to keep stimulating the economy.

Then there’s the suggestion of inflation manipulation. Even though the U.S. has been reporting a low inflation number, things feel more expensive to many Americans. Disposable income has been growing less than inflation in recent years; perhaps that’s why many people feel “squeezed.”

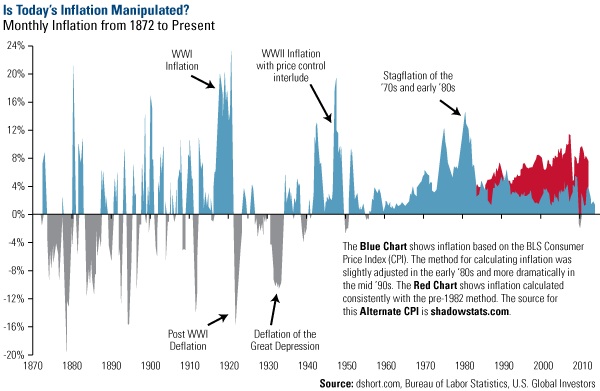

Also consider Williams’ chart below. It shows monthly inflation data going back for more than a century. The blue and grey shaded areas represent BLS’ historical Consumer Price Index (CPI). You can clearly see the wild swings of inflation and deflation, especially during World War I, the Great Depression, and World War II, as well as the stagflation of the 1970s and early 1980s.

However, shortly after disco, bell bottoms, and episodes of “All in the Family” faded from memory, the U.S. adjusted CPI, not once but twice, first in the early 1980s and again in the mid-1990s. If you use the pre-1982 calculation, you end up with a much different inflation picture. This is the area shaded in red.

Figures don’t lie, but liars figure

Way back in 1889, statistician Carroll D. Wright, in addressing the Convention of Commissioners of Bureaus of Statistics of Labor, talked about the impartial and fearless presentation of its data, using the above play on words. He said,

“The old saying is that ‘figures will not lie,’ but a new saying is ‘liars will figure.’ It is our duty, as practical statisticians, to prevent the liar from figuring; in other words, to prevent him from perverting the truth, in the interest of some theory he wishes to establish.”

Wright’s speech seems particularly relevant today.

For patient, long-term investors looking for a great portfolio diversifier, a moderate weighting in gold and gold stocks may be just the answer. And, today, when looking across the gold mining industry, you’ll find plenty of companies that have paid attractive dividends, many higher than the 5-year government yield.

Index Summary

- Major market indices finished mixed this week. The Dow Jones Industrial Average fell 1.22 percent. The S&P 500 Stock Index lost 0.07 percent, while the Nasdaq Composite appreciated 0.69 percent. The Russell 2000 small capitalization index rose 0.38 percent this week.

- The Hang Seng Composite rose 0.25 percent; Taiwan gained 1.63 percent while the KOSPI fell 0.74 percent.

- The 10-year Treasury bond yield rose 1 basis point this week to 2.64 percent.

Domestic Equity Market

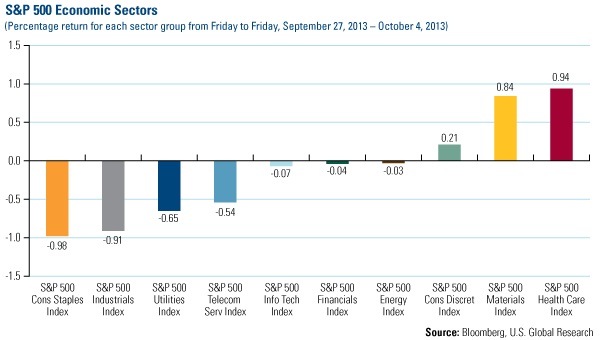

The S&P 500 was virtually flat for the week even as the market bounced around day-to-day. The federal government shutdown was the biggest news of the week, although the market decided this decision didn’t matter that much after all.

Strengths

- The healthcare sector was the best performer this week with Tenet Healthcare leading the way as the company closed its pending acquisition of Vanguard Health Systems. The stock rose 14.3 percent. St. Jude Medical and Edwards Lifesciences were also strong performers on talk of eliminating the medical device tax.

- The materials sector also rallied this week as fertilizer companies, such as Mosaic and CF Industries, rebounded. Chemicals were strong as well, as PPG Industries, Eastman Chemical and Lyondellbasell were all sector leaders.

Weaknesses

- The consumer staples sector was the worst performing group again this week, falling by roughly 1 percent. Weakness was seen in the beverage sector as Dr. Pepper, Snapple, Coca-Cola and Monster Beverage were among the worst performers.

- Industrials also lagged for the week as defense-related issues suffered on the government shutdown. Raytheon, Lockheed Martin, United Technologies and Northrop Grumman all fell by at least 3 percent.

- J.C. Penney was the worst performer in the S&P 500 for the second week in a row, falling 13.15 percent. Last week the company announced it was raising equity which dilutes existing shareholders by about 30 percent. The company was unable to shake liquidity or credit concerns this week.

Opportunity

- The current macro environment remains positive as economic data has been robust enough to give investors’ confidence in an economic recovery, but not too strong as to force the Federal Reserve to change course in the near term.

- Money flows are likely to find their way into domestic U.S. equities and out of bonds and emerging markets.

- The improving macro backdrop out of Europe and China could be the next catalyst for the market to move higher.

Threat

- A market consolidation could occur in the near term after such a strong year.

- Higher interest rates are a threat for the whole economy. The Fed must walk a fine line and the likelihood for policy error is potentially large.

- The debt-ceiling debate has captured investors’ attention this week and potential missteps in Congress could create uncertainty and offer short-term oriented investors a reason to sell.

The Economy and Bond Market

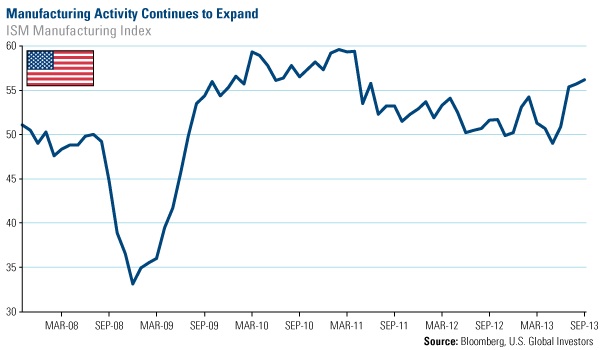

Treasury yields rose modestly this week as attention was squarely focused on the government shutdown. Due to the shutdown, the highly anticipated September unemployment report was delayed, forcing the market to focus on other things. The ISM manufacturing index rose to a two-year high which bodes well for continued economic expansion, assuming the government shutdown is brief.

Strengths

- The ISM manufacturing index showed surprising strength and has typically been a good leading indicator for the overall economy.

- The Eurozone Composite purchasing managers’ index (PMI) rose to 52.2 as new orders and business confidence improved.

- In Japan, the Markit’s manufacturing gauge rose to 52.5 in September, which is the highest in more than two years.

Weaknesses

- Auto sales fell 4.2 percent in September, which was the first decline in more than two years.

- Mortgage applications fell again this week, hitting the lowest level since June.

- While the unemployment data was delayed due to the government shutdown, ADP reported that private nonfarm payrolls grew less than expected to 166,000.

Opportunity

- Despite recent conflicting commentary, the Federal Reserve continues to remain committed to an overall accommodative policy and is unlikely to raise interest rates in 2013 or 2014.

- Key global central bankers remain in easing mode such as the European Central Bank, Bank of England and the Bank of Japan.

- If the shutdown continues for much longer, the Fed may be less likely to reduce the quantitative easing (QE) program.

Threat

- Inflation in some corners of the globe is getting the attention of policy makers and may be an early indicator for the rest of the world.

- Trade and/or currency “wars” cannot be ruled out which may cause unintended consequences and volatility in the financial markets.

- The recent bond market selloff may be a “shot across the bow” as the markets reassess the changing macro dynamics.

Gold Market

For the week, spot gold closed at $1,310.39, down $26.26 per ounce, or 1.96 percent. Gold stocks, as measured by the NYSE Arca Gold Miners Index, lost 3.62 percent. The U.S. Trade-Weighted Dollar Index lost 0.20 percent for the week.

Strengths

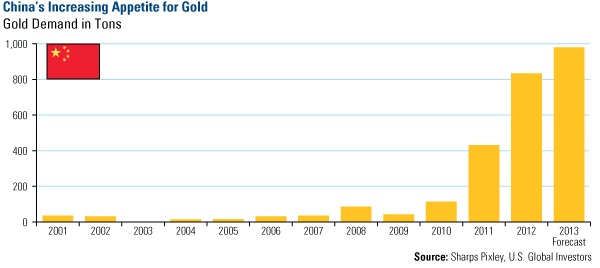

- China’s physical gold buyers have largely replaced western ETF investors as the primary underpinning of demand. In a recent publication titled “Gold: The Silk Road Redux,” Kitco CEO Ross Norman addresses the implications of gold migration to the East. His main argument is that gold migration from western to eastern hands may ordinarily be thought of as price neutral, but in fact it isn’t so. The main reason is that Asian buyers tend to purchase physical gold as a form of long-term savings, and as such, they “do not sell when the price goes up, nor do they sell in a panic when the price drops.” To put it plainly, according to Ross, the “Chinese market is a lobster pot for gold—easy in, difficult out—as the country has a strictly enforced non-export policy for gold.” Which begs the question: have you ever seen a Chinese gold bar in the West?

- Gold Standard Ventures reported assay results from its first confirmation drill hole on the Bald Mountain property in Nevada. The drilling reports high-grade oxide gold with sulphide copper-gold mineralization over 56.1 meters at 1.47 grams per ton. In addition, Platinum Group Metals (PLG) has been granted prospective licenses over a 530 square kilometer land package to the north of the Waterberg joint venture. Obtaining this license allows PLG to test the strike extension on ground where its effective ownership is 87 percent versus the 49.9 percent in the existing Waterberg joint venture. Finally, Pilot Gold reported the latest drilling out of KDC has delivered some impressive step-out holes that showcase yet again the extent of the potential at its TV Tower project in Turkey. Step-out drilling at KDC hit 112.5 gram per ton silver over 70.5 meter, which included a 143.8 gram per ton silver intercept over 25.5 meters.

- Coventry Resources has announced a merger with Chalice Gold Mines in a stock transaction that will have Coventry shareholders holding 17 percent of the merged company. The merger will combine Coventry's Cameron Gold Deposit in northwestern Ontario with Chalice's AUD $55 million cash balance. The deposit has a 43-101 compliant resource comprising 567,000 ounces of gold at 2.45 gram per ton gold in the indicated category and 830,000 ounces gold at 2.11 gram per ton gold in the inferred category. According to Haywood analysts, the announcement represents another example of consolidation between junior exploration companies within a challenged economic environment and bodes well for further merger and acquisition activity.

Weaknesses

- A weakness in the stock selection process of the Market Vectors Junior Gold Miners ETF (GDXJ) was exposed today, as Lion Gold, which is the largest holding in the GDXJ, plunged 42 percent and was suspended from trading by the Singapore Stock Exchange on news of the company’s potential acquisition in an undisclosed company. Last April, Red 5, an Australian listed gold company which was also a significant holding of the GDXJ ETF, ceased trading and could not repay its loans after the milling facility failed. We advocate for investors to avoid market cap and liquidity-based ETFs as their vehicle for gold exposure and instead propose investors benefit from an actively managed approach based on model-driven metrics, as we believe this process can help investors avoid such tragedies.

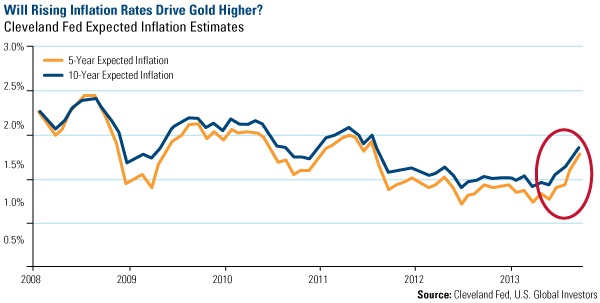

- Credit Suisse’s Tom Kendall was out this week with a research note highlighting that gold should start to see downward pressure resuming soon. The main bearish premise in his argument is that an ongoing gradual normalization of real interest rates resulting from a lack of inflationary pressure in developed markets will lead gold to average $1,150 per ounce in 12 months’ time. While Mr. Kendall’s argument is defensible, we would like to argue his inflation assumption may be flawed. David Rosenberg of Gluskin Sheff was on record this week stating the deflation talk is “overdone,” as he is having a tough time reconciling deflation with the latest data on wages and prices. In his research, labor costs are trending up, and various inflation expectation readings are ticking up. Mr. Rosenberg backs his thesis with a statistical study that shows the five-year inflation expectation measure reported by the Cleveland Fed has a 99 percent correl ation with actual inflation, and this particular reading bottomed out in March and is now at the highest level since July 2011.

- Demand for U.S. gold coins fell 81 percent in September on a year-over-year basis, as political turmoil in Syria failed to rekindle retail buying that has slowed after months of exceptional bargain hunting, data on the U.S. Mint website showed on Monday. Mineweb reports gold coin sales are highly seasonal, with demand typically weakest in summer months before a pick up near year end when jewelers in India buy ahead of the Hindu festival of Diwali, a major gold-buying event. It is worth noting that year-to-date gold coin sales are at unprecedented levels, which have forced the U.S. Mint to limit both gold and silver coin sales at different periods due to a lack of coin blanks used to strike the coins.

Opportunities

- According to a release by the Cleveland Fed, a recent increase in Fed implied inflation, measured by the spread between Treasury Inflation Protected Securities (TIPS) and similar maturity Treasury Notes, is signaling an imminent rise in inflation. Don Coxe, Portfolio Adviser to BMO Asset Management, is of the opinion that gold is unloved right now because there always seems to be bad news in terms of inflation. Gold bears say if inflation hasn't come now with the quadrupling of the Fed's balance sheet, it's never going to come. As previously mentioned, some highly respected economists are having a tough time reconciling inflation readings with most economic wages and prices data. The essence of this subject is that once the economy starts to grow rapidly, gold will become a good news story and will respond to strong economic news at a time of massive liquidity, which translates into inflation.

- Gold futures may rebound to $1,425 an ounce in the fourth quarter after forming a “double bottom,” according to a technical analysis by Logic Advisors. According to the New Jersey-based advisor, a double bottom is a chart pattern showing a drop, a rebound and then another decline approaching the previous low, usually indicating price support. The most recent London Bullion Market Association’s survey shows gold may advance 8.8 percent to $1,405 an ounce in about a year, according to the average response in a survey of attendees at the LBMA’s conference in Rome. Although the monetary and investment argument for gold is negative, the physical side is generally positive, according to James Steel, a HSBC Securities (USA) Inc. commodities analyst. Mr. Steel added that continued high levels of Chinese demand will be supportive.

- Some increasingly strange gold market movements have been reported recently. These adverse price movements in gold appear to have been orchestrated by massive “sales” of paper metal in volumes that have absolutely no relation to the amounts of gold being mined or available to the markets in physical form, according to Mineweb contributor Lawrence Williams. It is far from surprising that central banks and their allies may be manipulating gold; after all, if gold is viewed as money—i.e., a currency in its own right—one already knows that governments have openly manipulated exchange rates (money) ever since countries’ currencies went off a gold standard. The silver lining comes from the growing powers of the East, which do not see gold as an asset that can be readily manipulated; instead, they are hoarders. China’s massive physical buying leads to the belief that it is consolidating into a position where it can use its financial p ower to usurp the United States’ position as the top dog in global trade. This year, China looks likely to import perhaps 1,200 tons of gold through Hong Kong, largely exchanging its U.S. dollar-denominated reserves into gold. With India expected to import close to 1,000 tons of gold this year, these two countries alone could account for perhaps all of 2013’s global new gold production. Gold appears to be in safer hands.

Threats

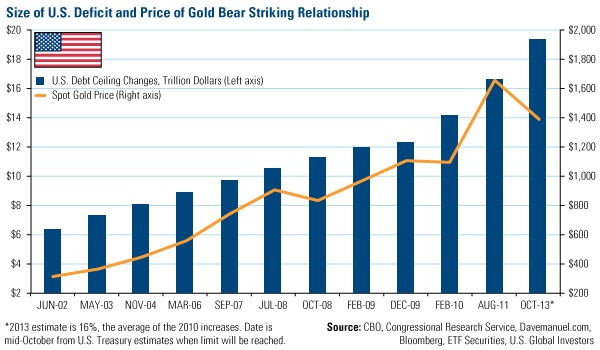

- Now we know why the Federal Open Market Committee voted not to taper at last month’s meeting of the committee, according to Ed Yardeni. In a recent investor’s note, Yardeni comments that Fed-Boston President Eric S. Rosengren said there were three concerns that argued against tapering. On top of “disappointing” economic data, and the worryingly rapid rise in government yields, the third reason was the upcoming fiscal deadlock in Washington. Needless to say, this week’s events in Washington must be convincing the super-doves that they made the right decision to do nothing about the $85 billion per-month pace of QE purchases. Warren Buffet is of the opinion that policymakers will go right up to the point of “extreme idiocy, but we won’t cross it.” We won’t cross it because there is no other alternative other than raising the debt ceiling, and as the chart shows, the gold price has followed the historical pattern of going up right along with the debt ceiling.

- The premium for physical delivery of gold on the Shanghai Futures Exchange dropped to less than $10 an ounce at the end of September from more than $40 an ounce in July. With Chinese markets on holiday for the week ending Tuesday, we will need to wait until then to get a clear signal on the price direction. What has become evident is that Chinese buying is in fact very supportive of gold prices. In an episode this past Tuesday—the first day of the market holiday closure in China—a big seller offered 10,000 futures gold contracts for sale at a time of the day when European and U.S. buyers are not at their desks, leaving only Asia-ex China buyers to cross the sizeable trade. The resulting $41 per ounce price decline had the appearance of market manipulation.

- India’s jewelers are raising concerns over the prohibitive legislation on gold imports that is threatening to drain their respective inventories and making them unable to meet the high jewelry demand period that starts with the Navrati festival this weekend. The peak gold sales season generally starts with Navrati and continues until January. In their desperation, Indian jewelers are attempting to bring idle gold back into circulation by collecting gold from households into trusts, thereby liberating gold for consumption. Despite the fact that we normally oppose such trust programs as they generate tradable “paper gold” that need not be delivered physically, creating a parallel market prone to manipulation, we are of the opinion that this mechanism may work since depositors receive interest payments in terms of gold bullion. The U.S. dollar is considered a currency because it is legal tender to settle debts, and so is gold under this mechanism.

Energy and Natural Resources Market

Strengths

- Crude oil futures (WTI) gained less than a dollar this week despite large builds in crude oil inventories, according to data from the Department of Energy.

- The oil and gas industry in Texas continued to strengthen in August, according to an index of key activity. “The Texas Petro Index continued its march into record territory in August,” said economist Karr Ingham, who developed the index. Strong crude oil prices and improving natural gas prices helped boost the index to 289.8, a record level that beat the old record of 288.2 set in July. The latter number was revised upward from 287.7 because of ongoing revisions for the state’s oil production.

- Australia's thermal coal exports for 2013-2014 are forecasted to increase by 6 percent to 192 million tons. The exports are expected to continue rising at an average rate of 8 percent over the next five years, according to Australian government forecasts. In its latest quarterly update, the Bureau of Resources and Energy Economics (BREE) also forecasted a 17 percent rise in Australian iron exports in the 2013-2014 fiscal year as some of the world's biggest producers including Rio Tinto, BHP Billiton and Fortescue Metals Group beef up operations.

Weaknesses

- The start-up of Nucor’s long-awaited, direct reduction iron (DRI) facility in Louisiana has been delayed until the end of the year following a structural failure in the raw material storage area. Construction and hot commissioning continue at the facility, producing 2 million tons per year, which was due to start in the coming weeks. This is just the first of a number of planned continental U.S. DRI facilities looking to take advantage of lower natural gas prices.

- Natural gas prices fell for the second consecutive week, as weekly inventories continue to rise at a faster-than-expected rate amidst a more balanced market. NYMEX futures fell over 2 percent this week, to around $3.50 per million metric British thermal units (mmbtu).

Opportunities

- South Africa’s Absa Capital has received regulatory approval for its planned palladium ETF, with hopes to launch the product by the end of the year. The fund will be exclusively backed by palladium sourced in South Africa, as is its platinum ETF launched back in April. The platinum ETF has since grown to be the world’s largest, holding 666,000 ounces of metal.

- The $1 billion injection for former Xstrata chief executive Mick Davis' new venture X2 Resources may be the start of a wave of new private equity investments in the mining industry. According to one estimate, cash raised for investment funds dedicated to mining and oil has reached a decade high of $24 billion this year. The 2013 year-to-date record haul brings the total close to $100 billion accumulated for resource investments over the past six years. Philip Heywood, director for transaction services at PwC in Vancouver, says although there haven't been that many big deals announced, interest in mining from private equity players is strong and picking up. "There has always been a niche interest from private equity in mining, but now larger players are entering the market," says Heywood. He commented that private equity players are seeing opportunity in the sector now that valuations have come down, sellers expectations are diminished and competition fo r good assets are much less.

- British Columbia Premier Christy Clark says her province is on the verge of a landmark agreement governing the taxation of liquefied natural gas exported from B.C. This is a deal that would pave the way for billions of dollars in new investment from the sector. Clark said an agreement could come as early as the next month or two and would be enshrined in legislation in the spring. The pact will lay out how much energy companies must pay the government for the right to export the province’s natural gas. “We hope we’ll have it done in the fall,” Clark said during a meeting with The Globe and Mail editorial board in Toronto on Tuesday. “It’s some of the most complex tax legislation that our drafters have ever done, so they say. So it’s going to be very time consuming to write it up. But we want to entrench it in legislation so that there is absolute certainty for the proponents.”

- The U.S. boom in natural gas production is luring investment from foreign manufacturers eager to tap a cheap, abundant supply of fuel and feedstock. Companies from the U.S. and abroad have invested, or are planning to invest, billions of dollars through the rest of the decade in plants that would churn out chemicals, fertilizers, plastics, metals and fuel from gas. Many foreign companies, alone or in joint ventures with U.S. partners, are taking advantage of gas that costs a fraction of what it does in Europe or Asia in order to expand production in the U.S. It is estimated by the Boston Consulting Group that international companies will invest at least $50 billion through the end of the decade on projects that take advantage of low-price natural gas.

Threats

- Until a few months ago, Mexico was one of the rare countries left in the world that didn’t charge taxes on mining production or profits. However, a proposed 7.5 percent tax on resource companies, and as much as 8 percent for gold, silver and platinum miners, is scaring away investors and small players. The country, which ranks fifth globally in terms of mining investment and ranks fourth in exploration spending, currently taxes miners 30 percent of their revenue. And that regime had been working just fine, with mining investment expected to hit a new record of $8 billion by the end of the year. Earlier this year, Mexican President Enrique Peña Nieto introduced a plan to bolster Mexico's feeble tax haul that alarmed miners. The reform focuses on reaping more income tax from higher earners, closing corporate loopholes and widening the tax base. As part of the restructuring, Mexico’s Congress voted in favor of passing a 5 percent tax to redistribut e miners' profits to the states and municipalities where they mine. The bill, originally due for a Senate vote in coming months, was later to fold into the government’s fiscal reform, which increased the proposed fee to 7.5 percent of earnings before interest, taxes, depreciation and amortization (EBITDA).

- “The unanticipated unwinding of U.S. quantitative easing and expectations of improving but unspectacular economic growth leave little room for a rebound in gold prices over the next few years, while a further decline remains a real possibility,” Fitch Ratings said on Tuesday. “We have reviewed our portfolio of gold equities following the recent sharp drop in gold prices, but have not taken any ratings actions because we believe that, under our base case, companies have sufficient flexibility to reduce their operating cost base and capex plans,” said Fitch analysts. “We also expect producers to reassess their dividend policies.”

Emerging Markets

Strengths

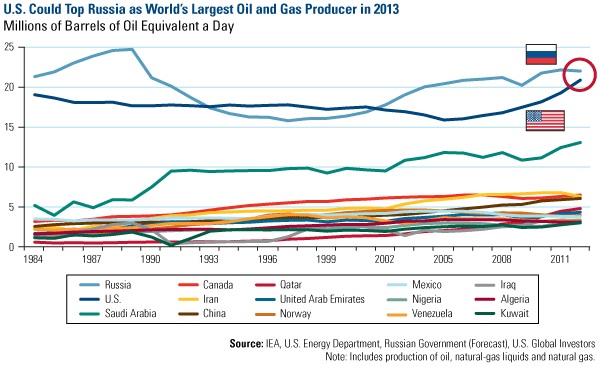

- The chart above shows that the Baltic nations appear to be on a healthy trajectory relative to the emerging market universe. The Baltic nations are expected to grow at a rate higher than 3.5 percent for the next four years, significantly outpacing the eurozone’s average. It is the Baltic nations’ willingness to adopt the euro (Latvia is set to join in 2014, and Lithuania in 2015) and commit to a whole range of measures, addressing economic freedom and the investment environment, which resulted in outstanding economic growth following the crisis along with lower unemployment and sizeable increases in exports. Moreover, these nations boast an innovative, entrepreneurial culture with less bureaucracy and lower unionization than many European Union (EU) and emerging market countries. For the rolling twelve-month period, the Estonian, Lithuanian and Latvian indices outperformed the MSCI Emerging Markets benchmark by 30, 28 and 22 percent, respectively.

- The HSBC Brazil Composite purchasing managers’ index (PMI) rebounded from 49.7 in August to 50.7 in September. The PMI reading was stronger than HSBC forecasted and together with a $2.14 billion trade surplus in September, the reading suggests there is upside risk to the current economic growth forecast for 2013.

- China’s official manufacturing PMI rose to 51.1 in September from 51.0 in August, versus the estimate of 51.6. HSBC’s final Chinese PMI also rose 0.1 percent, disappointing at 100 basis points below the flash number. Nevertheless, both China’s official PMI and HSBC’s final PMI reports confirm that industrial activities are slightly stronger in September than in August.

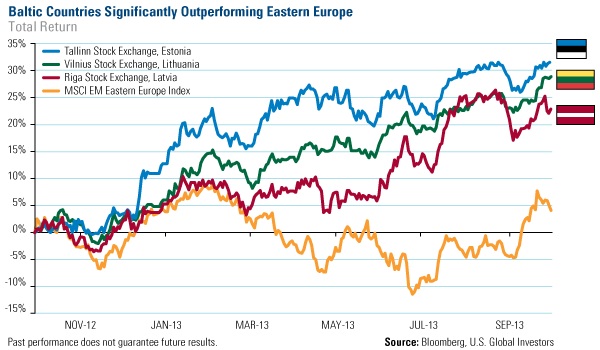

- Macau’s September Gross Gambling Revenue (GGR) was up 21.4 percent to 29.0 billion Macau pataca (MoP29.0 billion), in line with the market estimate of MoP29.1 billion. China’s Golden Week started strong as well, as the number of mainland visitors was up 16 percent, which pushed hotel rates higher this year. Mainland Chinese are spending a great deal more per visitor compared to spending by those from Hong Kong or other regions. Casino stocks have been doing extremely well in the last six years thanks to increasing visitation and capacity expansion.

- Indonesia’s inflation for September surprised to the downside at 8.4 percent versus the consensus outlook of 9.0 percent. The reading was 8.8 percent in August. The lower-than-expected inflation was driven by food prices. Indonesia’s August current account turned into a surplus of $132 million versus a current account deficit of $2.3 billion in July. Although exports and imports both contracted further and missed the market expectation, the bigger pullback in imports actually helped the current account balance. The Indonesian government announced a series of policies for stabilizing the currency and the economy which included an interest increase, tax deduction and a higher tariff for imported luxury goods.

- Sovereign debt in the Philippines was upgraded to investment grade, Baa3, by Moody’s.

Weaknesses

- The Russian ruble should remain volatile this quarter as the central bank cut the second quarter current account surplus to $3 billion. The implications are that the third quarter report, which is due shortly and is known to be the weakest quarter, should see a negative current account balance. This would be the first such deficit since 1999 and could lead to weakness in the ruble, according to Moscow Times contributor Chris Weafer. The risks are still on the downside and may be exacerbated by Vladimir Putin’s pension plan proposal. The proposal follows Poland’s unpopular reform of using pension savings to prop its fiscal budget amid anemic economic growth.

- Moody’s lowered its outlook on Brazil’s sovereign debt rating to stable from positive, citing deteriorating debt and investment ratios. According to the credit rating agency, despite recent signs that the Brazilian economy may be starting to recover, Moody’s believes that the upturn, should it materialize, is unlikely to be strong enough to restore a positive trend in Brazil’s credit metrics.

- August retail sales in Hong Kong grew 8.1 percent, weaker than July’s 9.3 percent and June’s 14.6 percent. The reading is also lower than the estimate of 10.1 percent, which could be blamed for falling sales of durable goods. The collapse of transaction volume in the property market has also slowed purchases of consumer durables.

- The Philippines’ Consumer Price Index (CPI) spiked to 2.7 percent in September from 2.1 percent in August. Although not too concerning due to the base effect, inflation is expected to go up further in 2014, which may require the central bank to raise interest rates in order to counter a higher inflation expectation.

- Thailand’s September CPI was 1.4 percent, versus the market expectation of 1.55 percent. Although the country remains in a deflationary environment, it is expected to be near the final phase.

- Korea’s inflation for September was 0.8 percent, the lowest since 1999 due to slow domestic demand and lower prices for agricultural products. September exports fell 1.5 percent and imports fell 3.6 percent, all weaker than the month prior. An upswing in vessel and semi-conductor exports continued during the month, while auto and auto parts sank.

- Indonesia tightened its property and auto loans by raising down-payments and lowering loan-to-value ratios (LTRs). This was done in order to slow credit growth and strengthen banks’ balance sheets.

Opportunities

- As shown in the chart above, casino companies have been able to raise minimum bets since 2002 when the Macau government issued six gambling licenses. Higher minimum bets and an increasing number of visitors to the gambling enclave have benefited the casino companies in their earnings and cash flow growth. By 2017 and after Cotai new casinos are fully in operation, Macau gambling tables should be doubled along with revenues, as expected by analysts.

- BCA Research says that it’s time to catch Italy’s falling knife. Italian assets have three solid fundamental support factors which include (1) improving eurozone macroeconomic conditions, (2) a market-positive outcome of the German elections, and (3) the European Central Bank’s support, evidenced by Mario Draghi’s mention of long-term refinancing operations (LTROs) in his recent speeches. Hence, the noise and the headline risk of recent days, along with a vote of confidence and talks of expelling Silvio Berlusconi from the Senate (which sent Italian bond spreads upward and the Milan bourse down), could be seen as a buying opportunity.

- Mexican Finance Minister Luis Videgaray has agreed to review some aspects of the fiscal reform bill, which could represent a concern for some productive sectors. According to Videgaray, members of the Business Coordinating Council (CCE) brought forward a series of valid concerns, mainly related to the fiscal reform’s negative impact to job creation and exports. This will be communicated to the legislature as part of the process introducing changes to the bill. Gerardo Gutierrez Candiani, CCE President, declared himself satisfied with the progress made and felt confident that the CCE’s input will be considered for any modifications made to the bill.

Threats

- Slovenian Prime Minister Alenka Bratusek is set to step down if she’s ousted as leader of the Positive Slovenia party. This move could trigger an early vote and could also threaten the country’s fight to avoid becoming the next euro-bailout case. Bratusek has been committed to fixing ailing banks and raising investor confidence since taking over in March, according to Bloomberg. Slovenia is trying to rescue its mostly state-owned banking industry following a six-quarter recession. The country is moving bad loans, worth more than one-fifth of economic output, into a “bad bank” as well as injecting new capital into lenders.

- Many investors are worried that the expectations for favorable policies, coming from China’s third plenary meeting of the 18th Party Congress in November, are too high. This could cause the market to sell off if those expectations are not met.

- Two hurricanes that struck Mexico last month have led traders to increase their bets that the central bank will lower borrowing costs in order to alleviate any damage to economic growth. According to Bloomberg, there is a 76 percent chance that Mexico’s central bank will cut its benchmark rate by 0.25 percentage point in the next three months. However, hurricanes Ingrid and Manuel, leaving 157 people deceased, flooded crops and disrupted logistics as well as transportation. The destruction will likely push up inflation as food prices rise, limiting room for the central bank to maneuver monetary policy in an economy already growing at the slowest pace since 2009.

(c) US Global Investors

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of