FOMC Day: The Low For Gold

A major inflation cycle has well-defined stages. To prosper, investors need to allocate capital to the dominant theme of each stage.

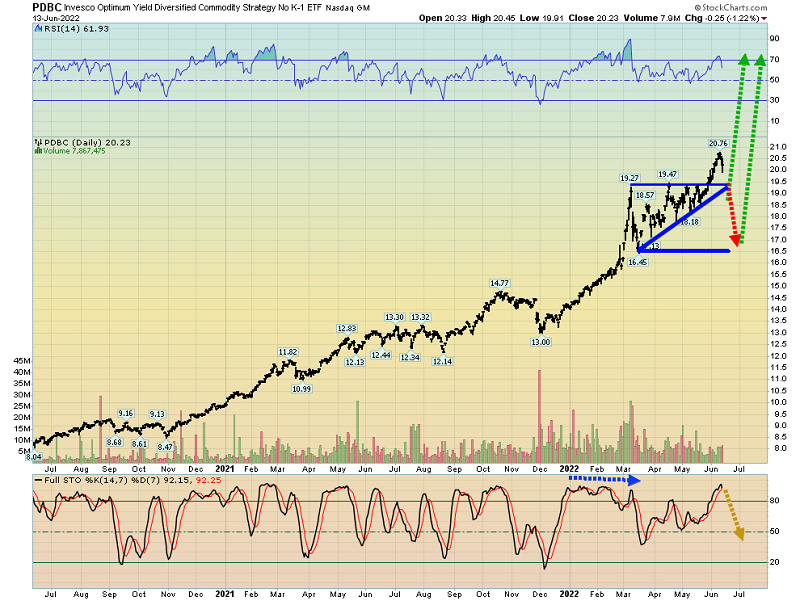

The PBDC general commodities ETF chart. In the first inning of the inflation cycle “game”, commodities fare well. Gold and silver tend to trade sloppily against fiat.

The PDBC ETF features no K-1 reporting for US investors.

The TBF bear bonds chart. The second inning of the game sees central banks and governments begin to admit there’s a problem.

Commodities can still rise in this stage, but investors fare best by betting directly on rising rates. I’ve been adamant that TBF (and investments like it) should be a core investor holding and a 50basis point hike looks like a “done deal” for the FOMC decision tomorrow.

The only question now is whether it will be 50basis points or 75. A full point hike is possible in July if there’s another red-hot CPI report.

Gold market volatility rises as the Fed comes into the picture, and more if governments launch price controls.

The key US stock market chart. The Dow has arrived at the outskirts of the 30,000 round number zone and there’s significant support here.

If Jay Powell announces a 75basis point hike tomorrow, a substantial “all the bad news is in” rally is likely. That would see failed safe-haven bitcoin stage the biggest rally of the “risk-on” markets, with tech stocks also surging.

Jay is likely to hint strongly at more rate hikes ahead, and so any bond market rally is likely to be muted.

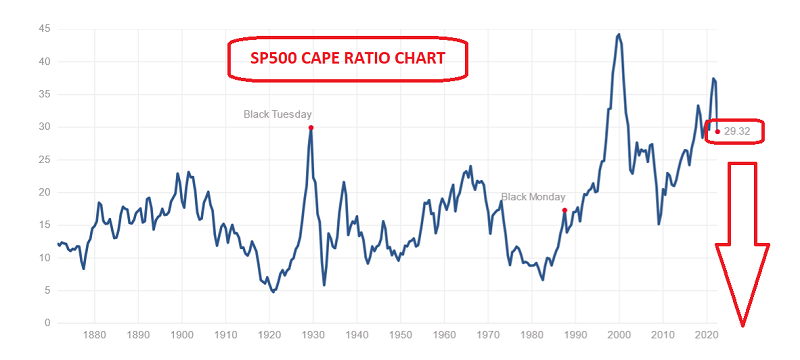

The US stock market is still massively overvalued and will remain so until the CAPE ratio drops under 10.

The China (FXI) versus America (DIA) stock market chart. Unlike the overvalued markets of America, the Chinese markets offer relative value to investors.

Disturbingly, and childishly, Western analysts view rising US stock markets, GDP, and general good times as a sell signal for gold. In contrast, Chinese citizens view both good and bad economic news as a reason to buy gold. The Western view is clearly barbaric and as China becomes the dominant empire, this barbarism will fade.

The GDXJ chart. Unlike the faltering stock market, most gold stocks did not make a new low yesterday… and there’s a possible bullish RSI non-confirmation with the price that is developing.

Many junior miners seem immune to the 2021-2025 war cycle carnage, and I cover some of the hottest ones in my Galactic Juniors newsletter. The regular price is low at $199/yr, and this week I’m offering a “Post Fed Rally” special pricing of just $169 for 14 months! Send me an Email or click this link to get the offer. Thanks!

What about the senior miners? Unlike the Dow, S&P500, and Nasdaq. GDX has held above its May lows.

Some gold bugs are worried about “2008 again”. Are these concerns valid? I think it’s a bit of an apples and oranges comparison.

The Main Street inflation of 2007 was minimal, demand-oriented, and paled compared to financial markets inflation.

The current inflation is related to supply problems and a huge war cycle that’s in its infancy.

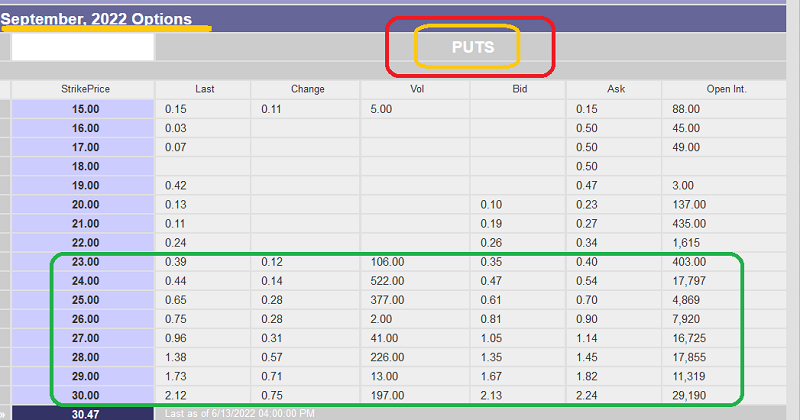

Regardless, gold stocks do get buffeted by stock market and rate hiking winds… in the early innings of a major inflation cycle. In addition to owning general “commods” and bear bond funds, stoplosses or put option insurance may be ideal for nervous investors.

GDX put options soared in value yesterday. The gold stocks house is not on fire, but for investors who failed to buy my key price sale zones of gold $1778, $1671, $1577, $1450, $1228, $1033, $728, $580, $300, and chased price instead, put options are a solid “saving grace” strategy.

Investors can view gold market put options as fire insurance, and unlike regular house or car insurance, these options can be bought not only pre-emptively, but also during a fire!

The stunning long-term chart for Barrick. A huge “pitchfork” pattern is in play. It suggests that in the coming decades Barrick (and most senior miners) could rise to hundreds of dollars or even thousands of dollars per share.

For many years, I’ve been adamant that the “big show” for gold stocks begins only after not just one aggressive series of Fed hikes, but numerous bouts of them, and only when it becomes obvious that the hikes are failing to tame inflation. A mini version of the “big show” lies directly ahead, and while the target is not the moon, a very nice rally… is coming soon!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “GDXJ Superstars” report. I highlight the hottest component stocks of this key ETF, with solid tactics for eager investors!

Thanks!

Cheers

St

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: