Foreign Exchange Figures Suggest China Added 16 Tons of Gold Last Month

Strengths

- Palladium was the best performing precious metal for the week, up 4.08 percent. According to Goldman Sachs, 70 percent of global palladium demand originates from catalytic convertors found in gasoline dependent motor vehicles. Auto demand has been more than robust, averaging growth of over 5 percent year-over-year y in the last 12 months. Further, 79 percent of global palladium mine supply comes from Russia and South Africa. The strength of the U.S. dollar versus both the Russian ruble and the South African rand over the past 12 months has acted as an effective tailwind for producers in both countries as operating costs have shifted down. Silver outperformed gold for the week. Sales of silver coins at the U.K. Royal Mint have tripled from April to August, compared with a year ago.

- Foreign exchange figures released Monday suggest China added around 16 tons of gold in August, according to UBS. Gold watchers will be paying attention to see if China continues its recent trend of publishing its gold accumulation on a monthly basis.

- The demand for imported gold in China seems to be improving, based on higher premiums paid for the metal.

Weaknesses

- Platinum was the weakest precious metal for the week, down 2.12 percent. Platinum group metals (PGM) production data released by South Africa, showed a 72 percent output rise year-over-year, perhaps explaining why the PGMs have underperformed gold over the past year.

- Consumer sentiment declined in September to the lowest level in a year as Americans anticipated a weaker economy in the face of a global slowdown and turbulent financial markets. HSBC expects the FOMC to forego a rate hike next week. If that is the case, gold will remain subdued, in expectation of the eventual hike.

- Two straight years of drought in India have hit gold demand and could cut imports by up to 10 percent in 2015, according to the head of the All India Gems and Jewellery Trade Federation. Further, Indian gold premiums are negative which shows little demand for imported gold.

Opportunities

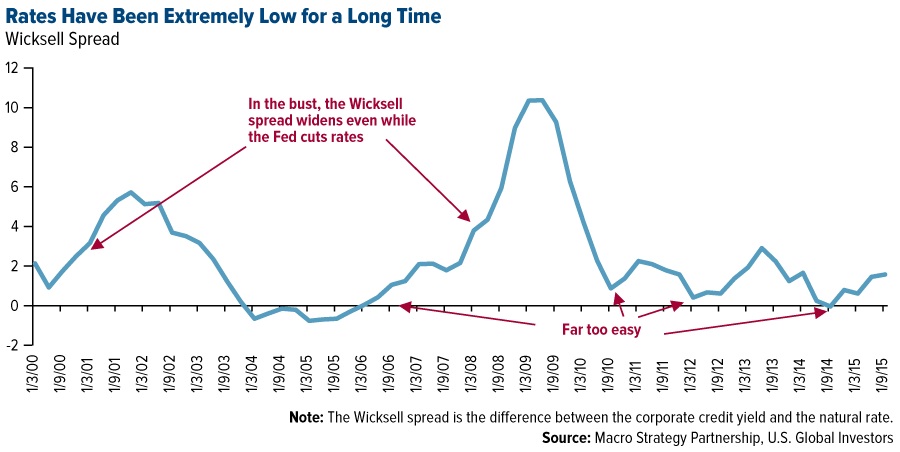

- The Wicksell spread, which shows the difference between the corporate credit yield and the “natural interest rate,” shows that rates have been too low for a very long time. It focuses on the key drivers of the business cycle; what is happening to the cost of capital versus what is happening to the return on capital. As such, if returns fall below the market rate for credit, boom turns to bust. That is exactly where we seem to find ourselves currently according to research by Julien Garran of Macro Strategy Partnership. Furthermore, billionaire investor David Tepper said this week that he sees problems with earnings growth, valuations, and people having too high expectations for earnings in 2016. Thus, he said he would be a buyer of equities if the market fell 20 percent. Mr. Garran suggests today investors should be long gold and short U.S. stocks.

- Copper had its longest rally since June on speculation that output cuts by miners will tighten supplies just as demand rebounds. Technically, the move in copper has broken through its overhead resistance and copper producers have started to rally.

- Macquarie initiated coverage of St. Barbara Limited with an outperform rating and a target price of $1.00/share. According to them, the company has found a new direction after a change of senior management and strong performance from its key asset at Gwalia. This has been complemented by a strong turnaround at Simberi and the divestment of Gold Ridge is putting the company in a position where it can deleverage and re-examine expansion options.

Threats

- According to Nomura, India’s sovereign gold bond scheme is more likely to succeed. Their annual investment demand for gold is estimated at 300 MT per annum, which is around 35 percent of India’s gold import bill. Furthermore, the government is likely to offer 2-3 percent interest rates for the two gold schemes it announced on Wednesday according to a senior government official.

- According to past government gold monetization schemes in India, there are reasons to believe the current one will fail. As part of the 1993 scheme, the government managed to mobilize a little over 41 tons because the scheme offered immunity to investors from being asked questions as to how this gold was acquired and the source of funds. The current plan contains no such protections and thus, the potential oversight and investigations could cause investors to be much more wary in taking part.

- ABN Amro, the biggest Dutch bank, cut its forecast for gold prices and now expects them to fall to $1,000 by the end of the year and to $800 by 2016 on expectations the Fed will cut interest rates. Keep in mind this is the same ABN Amro that defaulted on physical delivery of gold to their customers in 2013 because they did not have any physical gold to deliver.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of