Gold And Silver: Accumulators Buy Now

Gold and silver currently have a bit of a fundamentally and technically oriented “hangover”.

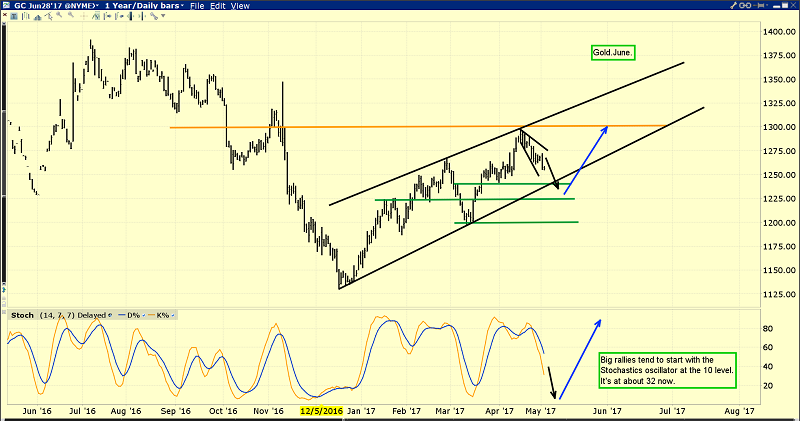

From a technical perspective, gold is recoiling from the weekly chart downtrend line and a daily chart overbought condition.

The Stochastics oscillator I use for the daily gold chart is the 14,7,7 series. It’s now at about 32, and decent rallies tend to begin after it’s declined to about 10.

From a fundamental perspective, gold is in between rate hikes in America. It tends to rally after a rate hike, and be soft before the hike. That’s the case right now.

The next FOMC meeting is on Wednesday. I expect Janet Yellen will hint that the June rate hike is not a sure thing, and that will do nothing to alleviate the current price softness.

Also, the next jobs report is due to be released on Friday. Gold has a rough general tendency to decline ahead of the jobs report, and then rally after it is released.

So far, gold is reacting with “textbook” price softness ahead of this jobs report. All members of the world gold community should cheer that it rallies with textbook strength once this report is released!

The end of Indian dealer stocking for the Akha Teej festival is probably the biggest reason for the current “wet noodle” gold price action.

Dealer stocking in preparation for the festival was incredibly strong and created the gold price rally to the $1300 area.

Unfortunately, while Indian citizens bought decent amounts of gold for the festival, it doesn’t appear to be as much as the dealers bought. That’s created a lull in the market.

That’s a shorter term look at the gold chart.

Note the broadening pattern that has been in play since gold recoiled from the $1300 area high. These types of patterns tend to be resolved in quite a violent fashion.

I carry short positions in gold that will only be covered if gold trades under $1000 an ounce. I hope I never cover these positions, but no analyst “knows” where gold is going for 100% sure, including myself.

The wise investor carries some market positions that are essentially bets against their own outlook, and that’s what my short positions are!

Regardless, the current price weakness is a great buying opportunity for gold stock investors. This is the GDX chart. I’m an accumulator of GDX in the $23 to $18 area, buying every ten cents decline in that price zone.

The big banks buy in the same manner, and that’s because it’s impossible to consistently buy at points where the price is bottoming or breaking out to the upside.

The entire world gold community should be keen gold stock accumulators at the current time. Put options can be used to manage downside risk during the accumulation process.

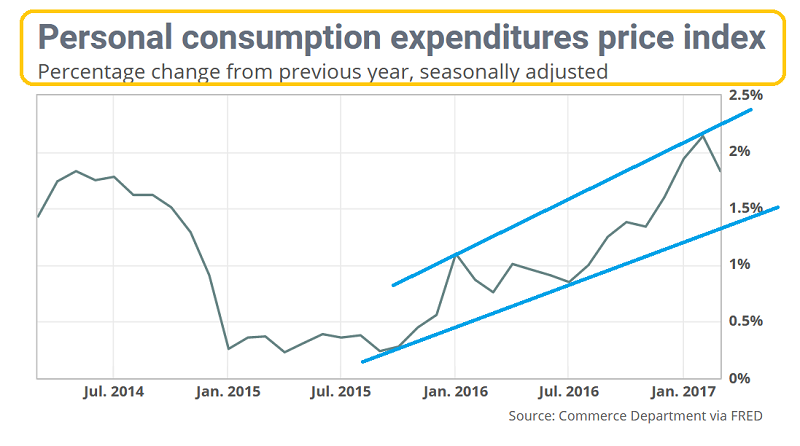

The US central bank uses the PCE index as their main measure of inflation.

It’s been rallying nicely, but has stalled at the same time as gold has stalled. More rate hikes are required to push the PCE index higher. The rally began around the time that Janet did her first rate hike in late 2015.

In my professional opinion, American GDP growth will surprise on the upside in the coming months, and Janet will commit to a June hike. That will provide further incentive to banks to make more loans, and it will increase the profit margin for those loans.

That’s inflationary, and the PCE index should turn higher once the next rate hike has occurred. GDX and most gold stocks should turn higher in advance of the PCE upturn.

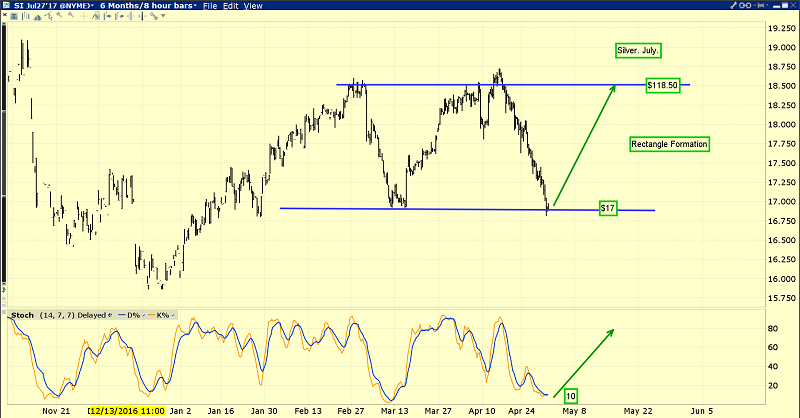

Silver is now trading in a rectangular formation. The bottom of the rectangle is a great buying area for accumulators, and that’s exactly where the price is now.

International FCStone has essentially the same gold market outlook that I have for the month of May, which is that the current price softness is not quite over.

When the softness ends (with an ending point that is likely this Friday) a very violent upside rally will occur, perhaps pushing gold up towards the $1300 area highs! All precious metal investors should be in accumulation mode now, so they can enjoy the imminent upside action!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “The Golden Ten!” report. If a precious metals investor could only hold ten stocks, which ones should they be, and what buy/sell actions should be taken? I answer that key question with this report!

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

https://www.gracelandupdates.com

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: