Gold: Breakdown Or Simple Overshoot?

As a group, gold stocks are trading like the entire sector is going “off the board”. Is that going to happen?

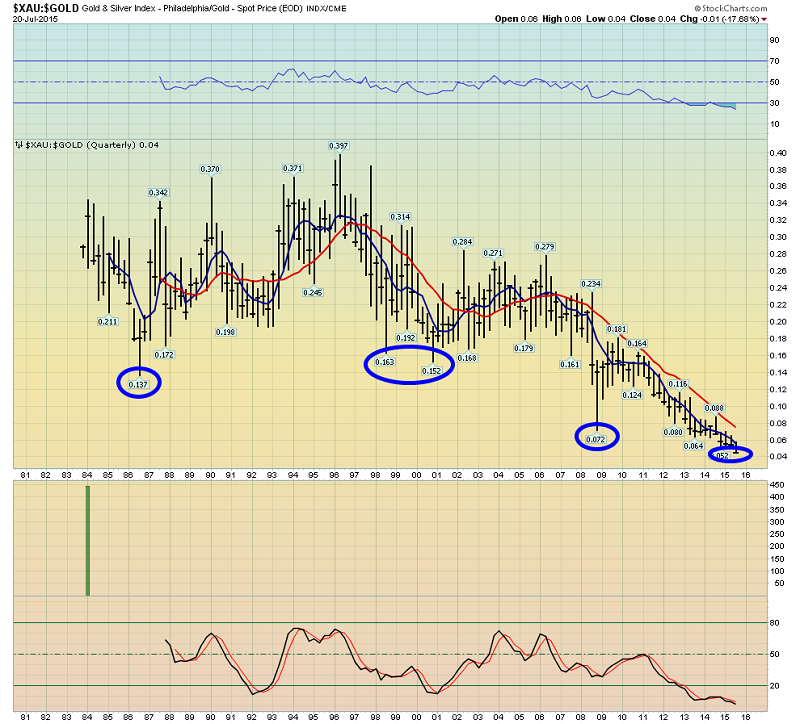

Perhaps, but I’m a solid buyer anyways! That’s the quarterly bars ratio chart of the XAU gold stocks index, versus the price of gold.

It’s clear that gold stocks are trading lower now against gold than when gold was under $300 an ounce! Some analysts argue that gold is going to $5000 or more, yet they suggest investors should not buy any gold, silver, or gold stocks now. They claim that gold might fall another few hundred dollars, so it should be “avoided” until it goes to their personal price targets.

I don’t think those analysts have a proper understanding of risk and reward. If gold has thousands of dollars of upside potential reward, and a few hundred dollars of real risk, any professional investor is likely to be a buyer in this general price area.

Amateur investors spend most of their time trying to forecast the next short term price action. They believe their forecasts will create wealth, and eliminate risk. They are mistaken.

Professional investors simply respond to price action. Strength is sold. Weakness is bought.

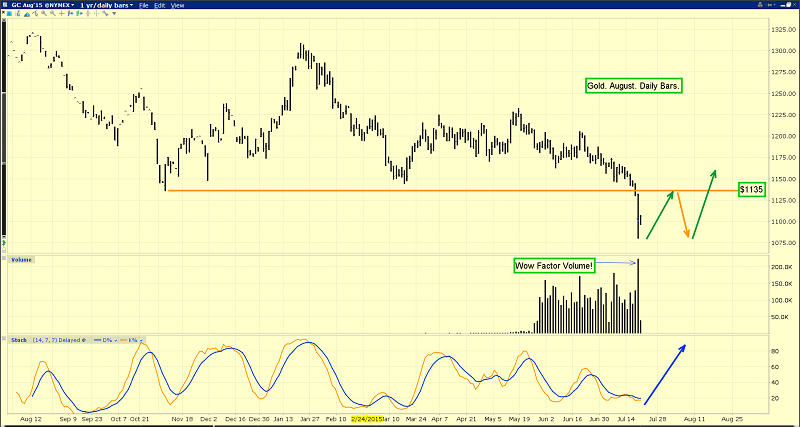

That’s the daily gold chart. Perhaps gold will form a double bottom pattern in the $1080 area, and then move higher.

Note the huge “wow factor” volume in play yesterday. The August gold contract volume exceeded 200,000 contracts, in just one day!

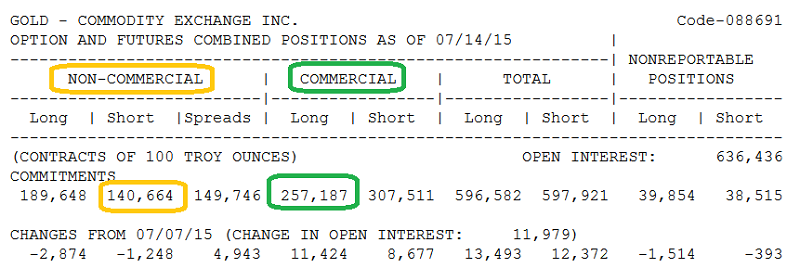

The above chart shows the difference between the actions of a professional gold investor and an emotional amateur one. That’s the most recent COT report for gold. It ends with the close of trading on July 14. The professional investors (mainly banks) are the commercial group. As of July 14, they held about 257,000 gold “longs”.

It’s my professional opinion that the price and volume action on Friday, Sunday, and Monday has produced a historic moment, with the commercial traders now holding a net long position in gold! If they are not net long, they are very close to being so.

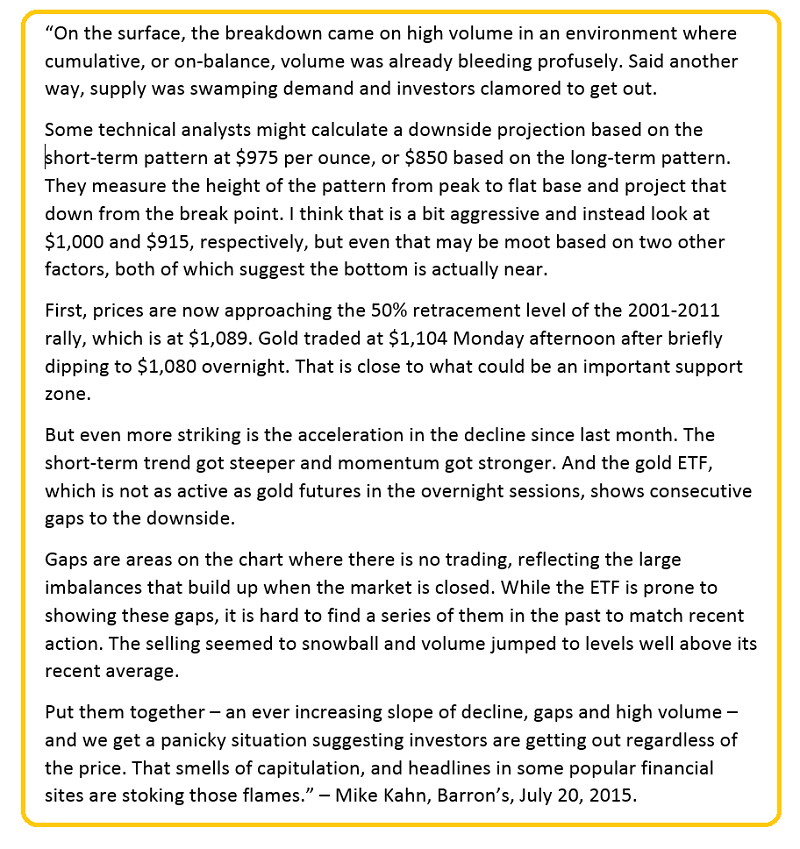

Mike Kahn is arguably the world’s greatest market technician. He is former director of the Market Technicians Association. He’s written three books on technical analysis, and he writes for Barron’s.

That is what Mike had to say about gold yesterday afternoon.

His take on the gold chart. The green circles on his chart are mine.

Mike highlights the “target” price that most amateur technicians focus on, but he is open to the possibility that gold is actually in “overshoot” mode now. I’ve often spoken about the importance of differentiating between chart patterns and meaningless chart shapes.

Amateur technicians tend to think every shape on a chart is an important pattern, and this can get them into serious trouble when dealing with phenomenal assets like gold. No technical pattern on a gold chart is more important than the nature of gold as an asset.

So, I would issue a word of caution to gold investors who are shorting gold now, betting against the banks, and predicting lower prices. With the banks buying gold, and apparently buying with unprecedented aggression, Mike Kahn’s overshoot scenario gains serious credence.

I’m a buyer of this price weakness alongside the banks, simply because it is price weakness that is occurring in the world’s greatest asset. The banks have very deep pockets, so they can buy with stunning size. It’s important for amateur investors to buy the current price weakness, but in size that is “smaller than they know is rational”.

Investors should always buy when they are personally afraid of lower prices, particularly when the banks are buying. Buying the fear of others won’t make an investor richer. To succeed, investors must buy their own fear.

That is the gold versus silver ratio chart, using monthly bars.

Another important look at that same ratio chart. Against silver, gold appeared to stage a technical “support failure” in early 2011. I viewed it more as an “overshoot”.

So, I sold one third of my silver in early 2011, and bought gold “money” with the proceeds. In 2014, I sold that gold, and re-bought silver with the proceeds of the transaction. At the 2011 highs for gold and silver, silver began failing to confirm the new highs for gold.

Now, silver is not decisively confirming the new lows for gold.

Against the background of strong bank buying, and the outrageous fear of lower prices shown by most amateur gold analysts, this budding non-confirmation of silver versus gold gives me confidence that both silver and gold are poised to move higher, with silver leading the way.

I don’t believe most investors in the Western gold community want to look at an endless series of gold and silver charts that have downside price targets painted all over them. I do short GLD-NYSE and GDX-NYSE at my www.guswinger.com trading service site. I try not to overly hype it, even though we’re sitting on pretty fat profits right now from the latest trade on the short side, with a system track record going back to 2011. If you want details of the service, send me an email at [email protected] and I’ll send it to you. Thanks.

Trading should be just one modest component of a total gold asset portfolio. The prudent precious metals investor is a steady accumulator now, alongside the banks. The sun will shine for years to come, for investors who focus not on calling turns, but accumulating the sector, because of the overall quality of the asset!

********

Special Offer For Gold-Eagle Readers: Please send an Email to [email protected] and I’ll send you my free Golden Rebound report! I highlight 3 low cost producers 3 debt-free junior gold stocks that are poised outperform their peers, on the next gold sector rally. I include specific buy and sell tactics for all of them!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: