Is The Gold Bull Market Over (Part 2)

I often get e-mails from beaten and battered gold and silver bulls wondering if the prices will ever go back up. I understand their frustration and decided to write a second editorial answering this question once again. Though this has been an extraordinarily extended and painful correction in gold and silver it's totally normal and will soon be over. (Part 1 can be found HERE).

I often get e-mails from beaten and battered gold and silver bulls wondering if the prices will ever go back up. I understand their frustration and decided to write a second editorial answering this question once again. Though this has been an extraordinarily extended and painful correction in gold and silver it's totally normal and will soon be over. (Part 1 can be found HERE).

Below are a few charts explaining our position.

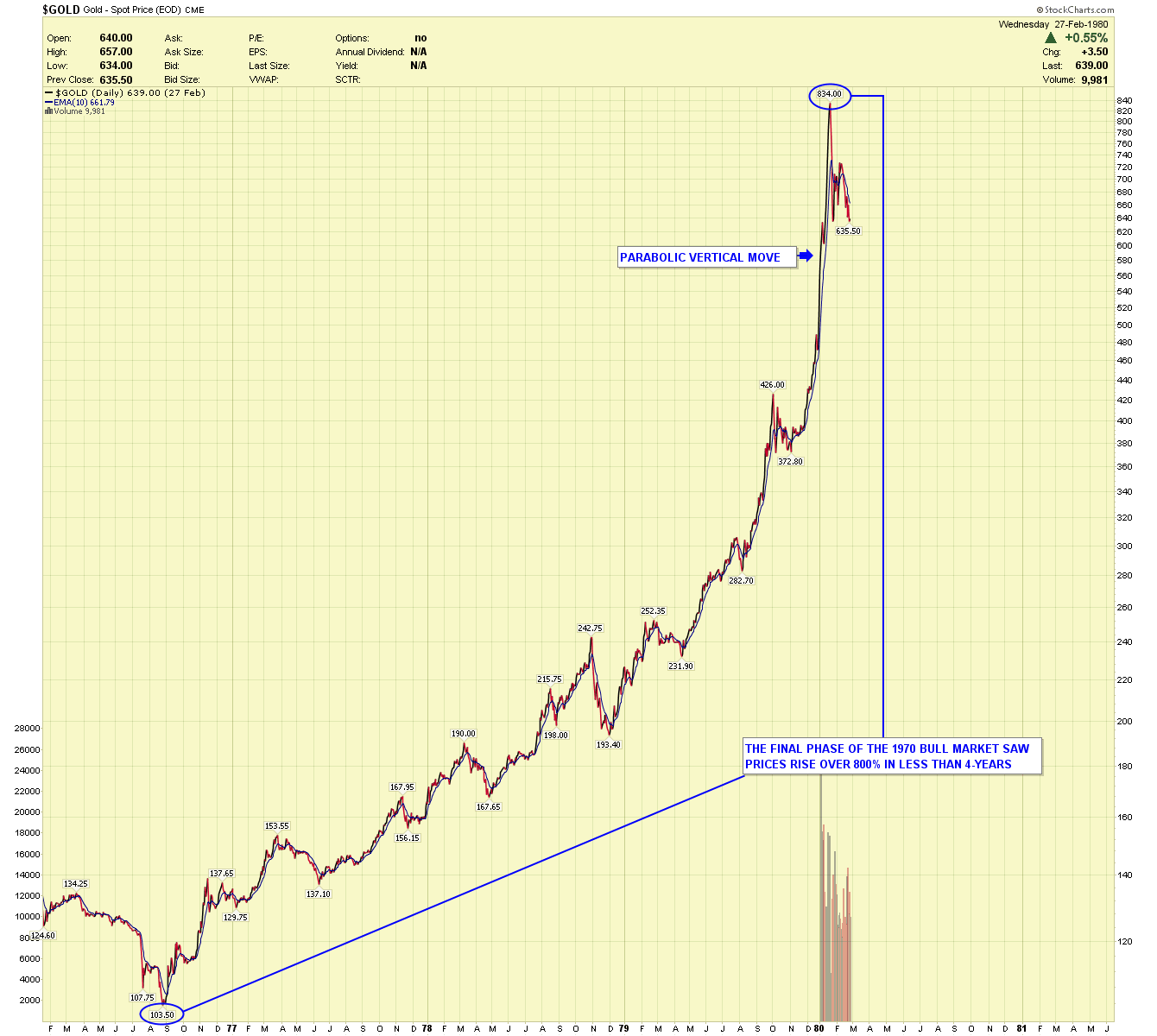

Looking at the chart below I would like you to notice how the gold bull market ended in January of 1980. This is a true parabolic move; prices more than doubled in less than two months, and the angle of ascent is near vertical.

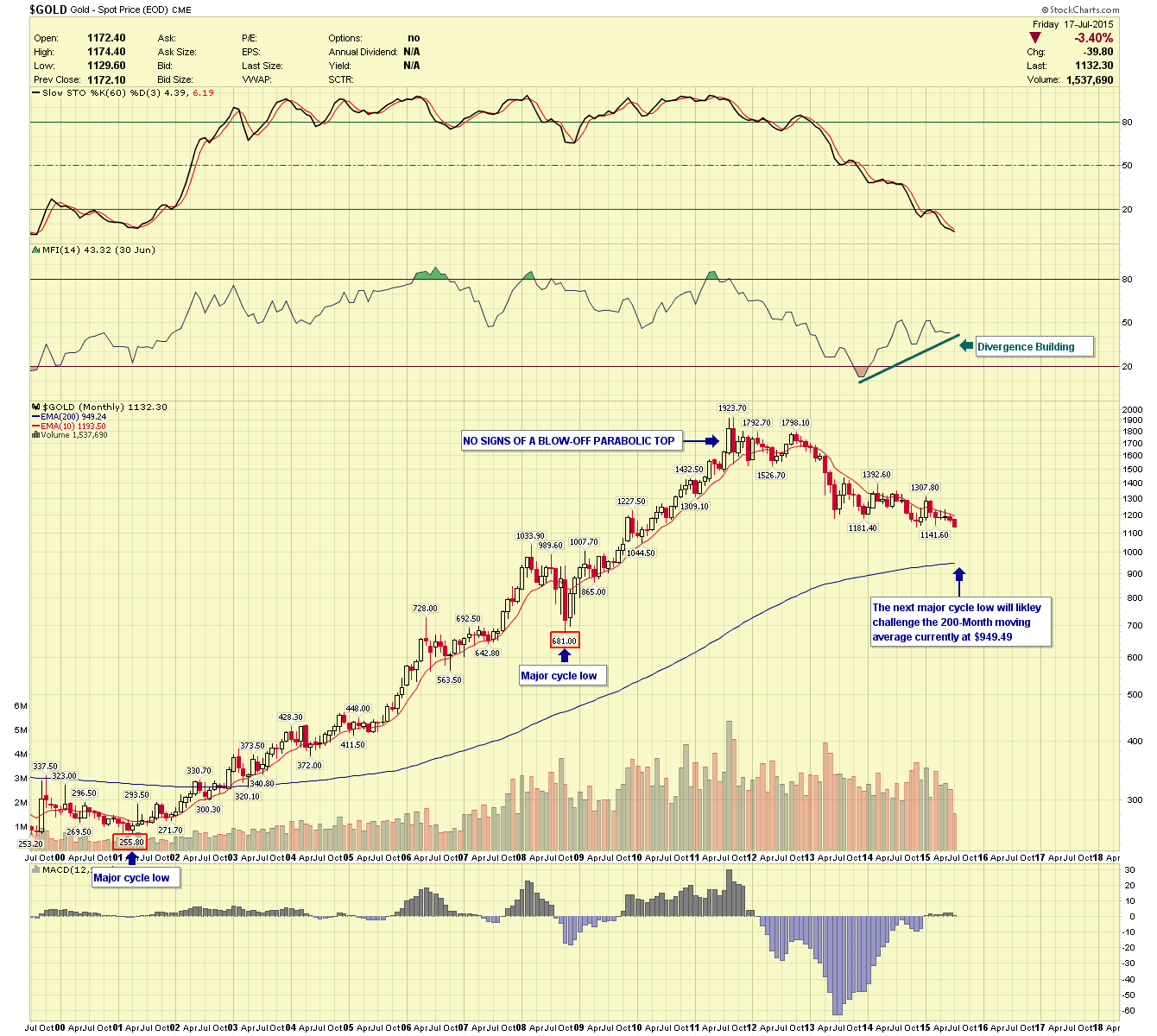

Now look at the current long-term gold price chart, I see a steady and orderly climb higher. Also the correction has been relatively orderly from the 2011 high not an absolute crash like bubbles so often produce.

I don’t believe the secular gold bull market would have ended with such an anticlimactic top like the one we had in 2011. Secular trends conclude in a mania and with parabolic moves fueled by intense public participation. I didn't hear ordinary people discussing gold prices or silver prices in the checkout line at the grocery store in 2011.

Below is a yearly chart, as you can see gold was up every year for twelve years consecutively, that’s an incredible run of year after year growth. With such an incredible move, it’s only natural to take a break before entering the next phase. We are also finally oversold in the slow stochastics, often a sign of a major low nearing.

I’m most excited about the appearance of the next major cycle low. These incredible buying opportunities arrive just once every 7.5 to 8.5 years. In the chart below I labeled the last five major bottoms with the next coming soon, either this year or in 2016. To put it in perspective once this low arrives the next won’t be seen until 2023 or 2024. The blue numbers represent how many quarters between bottoms, the average is 32, and we are currently on 27. My initial bear market targets are around $950 gold and potentially as low as $875-$825, if we are in a panic selloff.

So be encouraged, we only need to endure this a little while longer. The coming major cycle low could represent the best buying opportunity yet for precious metal investors. Once prices bottom, I expect them rally, finally entering the parabolic and mania phases of this extended gold bull market. The finale should be spectacular as social media will fuel speculation feeding the gold and silver frenzy.

********

Chartseek.com offers very affordable subscription services that help precious metal investors time their market entries and exits.