Gold Ends 2017 Strong

Strengths

·In the final week of the year, the Bloomberg survey of analysts and traders showed the majority of respondents are bullish on the gold price for a third straight week. The yellow metal will end 2017 on a strong note closing out the year with a 13.09 percent gain for spot prices, while the U.S. dollar will see its worst year in more than a decade. Silver was the best performing metal for the week, up 3.33 percent as it typically is more volatile than gold.

·Gold is living up to its reputation as a stable and liquid asset in contrast to bitcoin, which dropped as much as 30 percent in one day. Bitcoin fell on Thursday to less than $14,000 as South Korea weighs options of shutting down some cryptocurrency exchanges amid a frenzy of speculation.

·U.S. consumer confidence fell off a 17-year high this month to 122.1 from 128.6, further than the expectation of 128.0. Consumers showed greater positivity toward present conditions and were mixed on the state of the labor market. Lower confidence could move some investors back toward gold.

Weaknesses

·The VanEck Vectors Gold Miners ETF, one of the largest such funds, saw two massive outflows of assets. On Tuesday after Christmas, investors withdrew $222.4 million from the fund, then two days later another $203.1 million was withdrawn, reducing the fund’s assets to $7.6 billion. These redemptions are likely the culprit behind the poor performance of the senior gold stocks when gold bullion was moving up strongly throughout the week. Platinum was the lagging precious metals for the week with a gain of just 1.25 percent.

·Taxpayers in high-income tax states, such as New York and New Jersey, are rushing to prepay their 2018 taxes and avoid the newly imposed cap on state and local tax deductions. Meanwhile, banks are facilitating this process by offering loans for taxpayers willing to go into debt to prepay taxes rather than miss out on the deduction.

·Centerra Gold processing operations at its Mount Milligan mine in British Columbia has been temporarily suspended due to a lack of sufficient water resources and will likely be back to full capacity by April 2018, reports Bloomberg. Consequently Royal Gold, which owns a royalty on Centerra Gold, has been downgraded from hold to buy and the target price reduced from $109 to $99.

Opportunities

·Klondex Mines announced the first open pit resource of 2.2 million ounces of Indicated and Inferred at a 1.04 gram per tonne gold equivalent grade at their Fire Creek Mine in Nevada. Klondex is following up on a series of repeating geophysical anomalies and this resource is just the first one that enough drilling data has been collected to calculate a resource. To the north of the Fire Creek land package, Newmont Mining has successfully mined similar open pit structures on its land package. While Klondex stressed it is going to remain focused on its high-grade underground operations, it would consider bringing in a partner to advance what could be a series of bulk tonnage open pits. This is extremely exciting for Klondex as gold production from the open pits would significantly extend the observable mine life of the Fire Creek Mine land package. In contrast, underground operations cannot economically drill out enough resources from underground to show a long mine life, even though historically underground mines continue mining for decades into the future with mine lives of even just three years of ore in the reserve category.

·With demand for electric cars on the rise, Argentina is looking for workers to extract lithium from its large reserves. Although Argentina currently supplies 16 percent of the lithium market, it lacks enough skilled workers to export more and supply a desired 45 percent of the market. Thus lithium markets may remain tight as China extended its tax rebate on the purchases of hybrid and electric cars into 2020 after it was supposed to expire at the end of 2017. Demand for lithium should remain strong in the near-term.

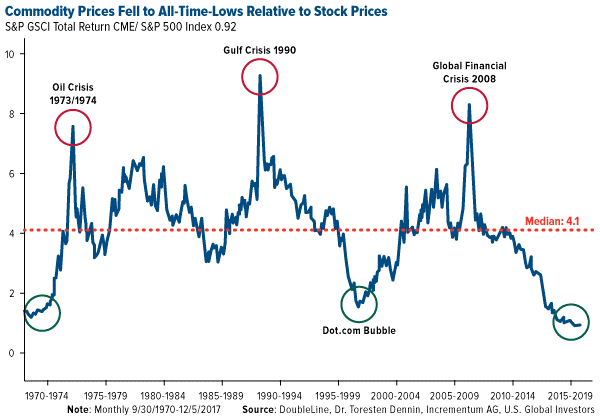

·Many believe a commodity comeback is in the works as the S&P GSCI Total Return Index is at a record-low valuation relative to the benchmark S&P 500 Index for stocks. Shawn Hackett of Hackett Financial Advisors notes that in 2008 stocks were screaming to be bought on this valuation metric, and that was proven correct. The opposite condition is now in place and commodities are the asset class screaming to be bought at the expense of stocks.

Threats

·Effective at the start of 2018, the United Arab Emirates (UAE) will impose a 5 percent value-added tax (VAT) on gold jewelry imports, potentially hurting the Indian export market. This past week Dubai as seen somewhat of a “gold rush” of buying up jewelry before the tax is imposed. There will be no import tax on 24 carat gold bars, leaving room for possibility of the UAE manufacturing its own gold jewelry.

·Personal spending was up 0.4 percent with income only up 0.3 percent as the personal savings rate fell to 2.9 percent, the lowest since 2007. This data suggests that U.S. growth is either at the expense of increased debt or reduced savings, and thereby at the expense of the balance sheet, writes Macro Strategy Partnership, hence economic conditions may not be a rosy as the consensus is trying to sell.

·Quantitative easing (QE) by the Federal Reserve is over. Now we are executing the quantitative tightening (QT) phase of reversing this policy which will accelerate in 2018, effectively reducing M2 money supply by 1.73 percent or the equivalent of a 30 basis point rate hike. Macro Strategy Partnership notes that by the second quarter of 2018, QT will be equivalent to 2.6 percent of U.S. M2 and by the third quarter 3.5 percent. With tax cuts starting to kick next year and Fed borrowing expected to climb, uncertainty over the direction of interest rates will be significant.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of