Gold Forecasting Via The Magic Of The Golden Cross (Part 1)

Internationally known technical analyst Adam Hamilton expressed it well: “The gold-mining sector is on the verge of flashing the fabled Golden Cross Buy Signal. This is one of the most powerful and revered indicators in all of technical analysis. When it arrives after the right conditions, it flags the critical transition from bear to bull markets. And today’s gold-stock environment is perfect to spawn such a pivotal Golden Cross. Seeing this milestone will accelerate capital flows back into gold stocks.”

The focus of the following analysis is to prove the predictable accuracy and timing of the The Golden Cross. Simply stated The Golden Cross is defined as:

When prices begin a move up, the shorter term 50 day moving average (50 dma) will begin below the longer term 200 day moving average (200 dma). As the price continues rising, the 50 dma will cross above the 200 dma and continue above it until there is a material change in the price trend. Therefore, the point at which the 50 dma moves above the longer term 200 dma is known as The Golden Cross…and is considered by competent chart analysts as a reliable A BUY SIGNAL.

Below is shown the 2001-2014 history of the Golden Crosses of eight precious metals related securities – and the profitable results they subsequently produced. The symbols of the eight precious metals related securities are: GOLD, GDX, GDXJ, GDM, HUI, XAU, GLD and SILVER. In order to highlight the Golden Cross, the top chart will only show the 50 dma and 200 dma (omitting the actual price of the security for clarity). However, the actual price trend of the underlying security will be seen below moving average chart.

GOLD (Bullion) - The Golden Cross is imminent

GDX (Market Vectors Gold Miners – NYSE) The Golden Cross is completed

GDXJ (Market Vectors Junior Gold Miners – NYSE) The Golden Cross is completed

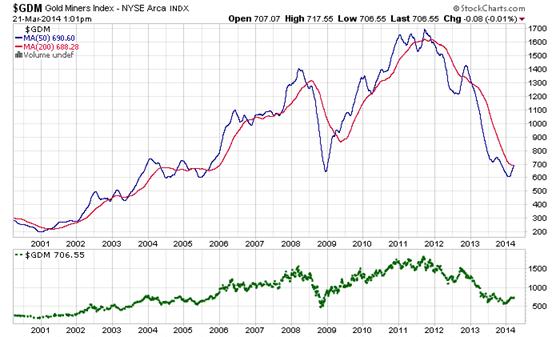

GDM (Gold Miners Index - NYSE) The Golden Cross is completed

HUI Index (Goldbugs Index) The Golden Cross is completed

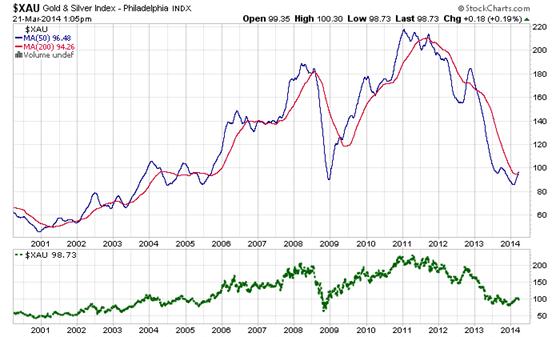

XAU Index (Gold & Silver Index) The Golden Cross is completed

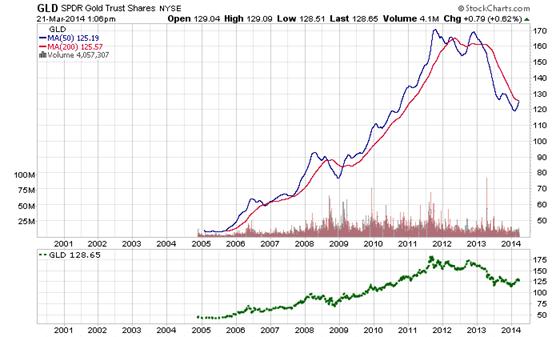

GLD (SPDR Gold Trust shares – NYSE) The Golden Cross is completed

SILVER (Bullion) The Golden Cross is almost completed

Market History since 2001 demonstrates the profitability subsequent to flashing of the magical Golden Cross Buy Signal.

Forecast Price Basis

The following forecasts are based on the assumption that the predicted future price and date might be equal to the average appreciation of each of The Golden Crosses Buy Signals since 2001.

GOLD (Bullion) - The Golden Cross is imminent

Since 2001 GOLD has had four Golden Crosses with an average gain of 67% over a 22-month period. Based on this it is predicted GOLD might reach $2,170 by January 2016.

GDX (Market Vectors Gold Miners – NYSE) The Golden Cross is completed

Since 2001 GDX has had one Golden Crosses with an average gain of 85% over a 27-month period. Based on this it is predicted GDX might reach $46 by June 2016.

GDXJ (Market Vectors Junior Gold Miners – NYSE) The Golden Cross is completed

It is not possible to make a reasonable forecast for GDXJ as it has not had a long enough record. However, as it is more volatile than GDX, one might estimate GDXJ might rise 100% to $80 in the same time period that GDX is predicted to increase 85% by June 2016.

GDM Index (Gold Miners Index - NYSE) - The Golden Cross is completed

Since 2001 GOLD has had five Golden Crosses with an average gain of 93% over a 17-month period. Based on this it is predicted GDM might reach 1360 by August 2015.

HUI Index (Goldbugs Index) The Golden Cross is completed

Since 2001 HUI has had five Golden Crosses with an average gain of 96% over a 16-month period. Based on this it is predicted HUI might reach 461 by July 2015.

XAU Index (Gold & Silver Index) The Golden Cross is completed

Since 2001 XAU has had five Golden Crosses with an average gain of 54% over a 15-month period. Based on this it is predicted XAU might reach 152 by June 2015.

GLD (SPDR Gold Trust shares – NYSE) The Golden Cross is completed

Since 2001 GLD has had two Golden Crosses with an average gain of 81% over a 22-month period. Based on this it is predicted GLD might reach $232 by January 2016.

SILVER (Bullion) The Golden Cross is almost completed

Since 2001 SILVER has had three Golden Crosses with an average gain of 157% over a 30-month period. Based on this it is predicted SILVER might reach $52 by September 2016.

Statistics of the 25 Golden Crosses Since 2001

The statistics of the Golden Crosses since 2001 are indeed very revealing. Among the eight precious metal assets examined above, there were 25 Golden Crosses consummated. The overwhelming favorite month for Golden Cross creation was March, accounting for 48% of the total Golden Crosses generated since 2001. Moreover, 76% of all the 25 Golden Crosses began in the 1st Qtr of the year. For whatever fundamental reason, March is the Golden Cross’s favorite Month of the year to occur. To be sure all eight of the charts show Golden Crosses fait accompli or imminent completion…thus heralding an immediate new Bull Market in all forms of precious metal assets. Frankly, the charts and Golden Cross statistics clearly suggest there is 76% to 100% probability a new precious Bull Market has indeed been born.

Golden Cross Forecast Summary

No one can say with 100% certainty that all the above probable BULL MARKETS will commence on this week. However history is testament that there exists monumental probability 2014-2016 will witness impressive gains for Gold, Silver and Precious Metal Equities…across the board. Moreover, there is ample evidence that the forth-coming secular bull markets in all forms of precious metals may well far surpass the forecasts herein stated. FURTHERMORE, there are two factors which may well be the spark and fuel to catapult precious metal values further into orbit than the above stated forecasts:

- An impending BEAR MARKET in US stocks, and

- The China Factor and all that it portends for higher gold and silver prices

DISCLOSURE: The analyst of the above editorial is already 100% invested in precious metal equities.

For all serious students of the market, here is a recent Golden Cross study by analyst pundit Adam Hamilton that is well worth your attention:

“Gold-Stock Golden Cross” -- Please see: https://www.gold-eagle.com/article/gold-stock-golden-cross