Are Gold Targets Like $20,000 Realistic

The three pillars of governments around the world are debt, fiat, and extortion. National security (debt-funded) and critical minerals are the new buzzwords spouted by the governments and worshipped by the “sheeple”.

Personal prep for a virus crisis is “gone with the corona wind”. Coca leaf tea and CBD oil are deemed far more dangerous than deadly fast food hamburgers and processed cheese drugs, the latter of which have ruined the lives of hundreds of millions of global citizens and are promoted maniacally on TV.

Draft dodger presidents start wars but refuse to fight in them and back up their “tough guy” routines with nothing but more debt, fiat, and extortion. In Iran, fake Ayatollahs pray to their machine guns and internet blackouts instead of to their God.

In Venezuela, an evil election hater, drug dealer, and citizen starvation specialist is suddenly deemed to provide great stability for the millions of citizens she eagerly ruined… as long as she doesn’t send her drugs to America and provides oil (with huge kickbacks for herself?) to her new partners in crime.

In a geopolitical nutshell: global governments are racing to announce everything “big” except… a big focus on savings based on silver and gold.

Billions of Chindians (and a few savvy Westerners) have these savings plans in place, and for them the childish antics of the world’s governments are mostly less worrisome than a fly.

Gold is the money of “citizen kings”, and to best sum it all up:

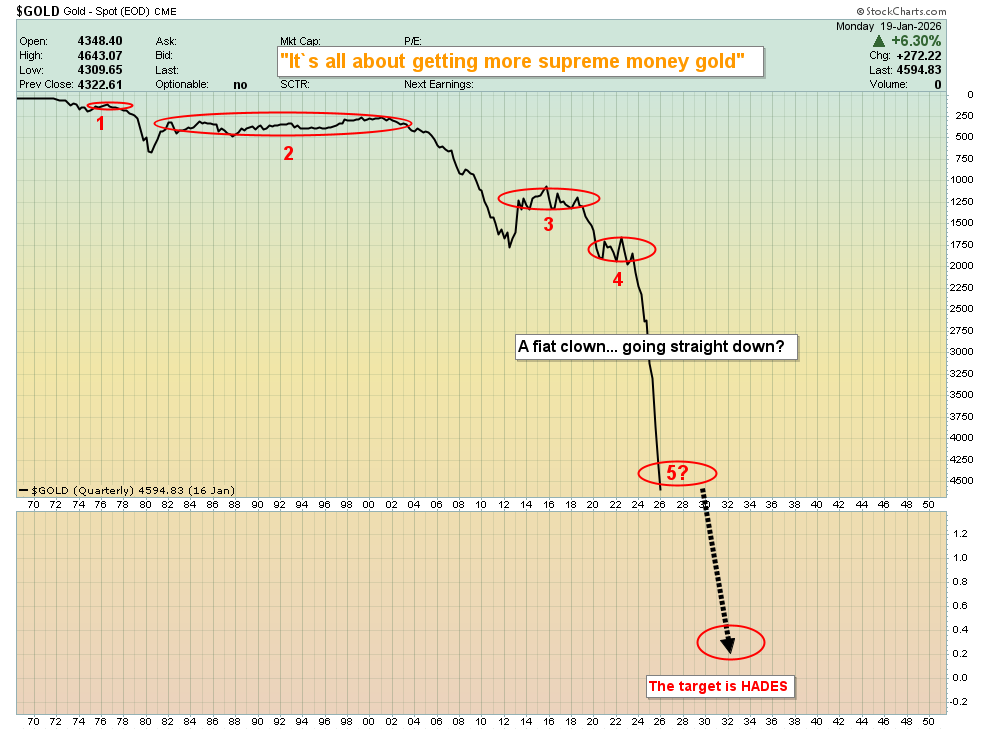

While US fiat is technically due for its fifth pathetic rally against gold in 50 years, that doesn’t mean it has to occur now, and when it does…

Gold-themed savers should be ready to pounce and get more gold (and more silver too)!

This is the weekly chart. Technically, gold is overbought but it’s also beginning to act exactly like the stock market did in 1995:

RSI and Stochastics oscillators are bottoming in the momentum zone of 50 and then rising above 70 and staying there for extended periods of time.

The actions of debt-funded, fiat-obsessed, and war mongering government extortionists border on madness, and it’s why legendary gold money experts like Pierre Lassonde are targeting prices to surge to close to $20,000 in the coming years.

Some profits can be booked (up to 30% in most cases), but not to call fiat price tops. The fiat cash can be put back to work on the next big price sale… a sale that likely ends well above where the price of gold is now.

Mentally, any price sale can be demoralizing and an investor with no dry fiat powder will have a hard time buying more gold, silver, and miners when the time to do so arrives. That’s the sole purpose of booking partial fiat money profits now.

The fundamentals in favour of gold are “through the roof”. US “Gmen” claim that attacking NATO allies in Greenland is an option that is on the table. The blowback from that statement alone, let alone an actual war, could potentially drive gold another $2000/oz higher against fiat. If there’s an actual war, that $2000 surge could occur… in a single day.

This is the horrifying Shiller (CAPE) ratio chart. It’s the inflation-adjusted PE ratio of the SP500.

If US Gmen continue to push their war-humbled Euro allies with these extortionist tariff taxes while giggling that war is an on the table option, the blowback won’t be so humble. A breaking point will be hit, and Euro governments and institutions will probably then race to sell all their US government bonds and stock market holdings.

In return the US government would likely freeze those assets, and if that happens, gold will be set to begin rising thousands of fiat dollars higher each day. The US stock market would collapse so fast from the massive Euro zone selling that it could make the crash of 1929 look like an Apollo rocket heading for the moon.

The bottom line: gold is the money of three billion Asian citizen kings and it’s time for the rest of the world to wake up and join the supreme money party. There’s no escape from what lies ahead for the world’s fiat, debt, and extortion-obsessed governments, and in America, the fall from supposed grace could be the biggest (and most well-deserved?) fall of them all.

This is the ten-year interest rates chart. The upside breakout carries enormous implications for the US government… and for gold. For decades, I’ve warned that QE to infinity is a fantasy. I predicted it will be replaced with higher rates to infinity, and higher US fiat prices to infinity for gold. I’m more adamant about that prediction now than ever. Loss of confidence in governments and their fiat is in play… and it’s here to stay!

The new Fed chair hasn’t been picked, but frontrunner Kevin favours QT (to infinity?) and views the stock markets as outrageously overvalued. He’ll need massive QT to restore any semblance of confidence in the US government, its bonds, and its fiat.

Here is what I continue to view as one of the greatest base patterns in the history of markets, the CDNX inverse H&S pattern. I’ve suggested the breakout could accompanied by a long-term rates breakout and that prediction looks set to materialize in a magnificent way. My long-term target for the CDNX is 10,000 and many key juniors are almost certain to become “thousand baggers” even before that target is reached.

Junior mine stock investing isn’t for everyone, especially with size, but as this gargantuan gold bull era rollout continues, these miners look set to outperform everything! At $199/year, my junior resource stocks newsletter is an investor favourite, and I’m doing a special pricing this week of $169 for 14mths! Send me an email or click this link if you want the special offer and I’ll get you onboard. Thanks!

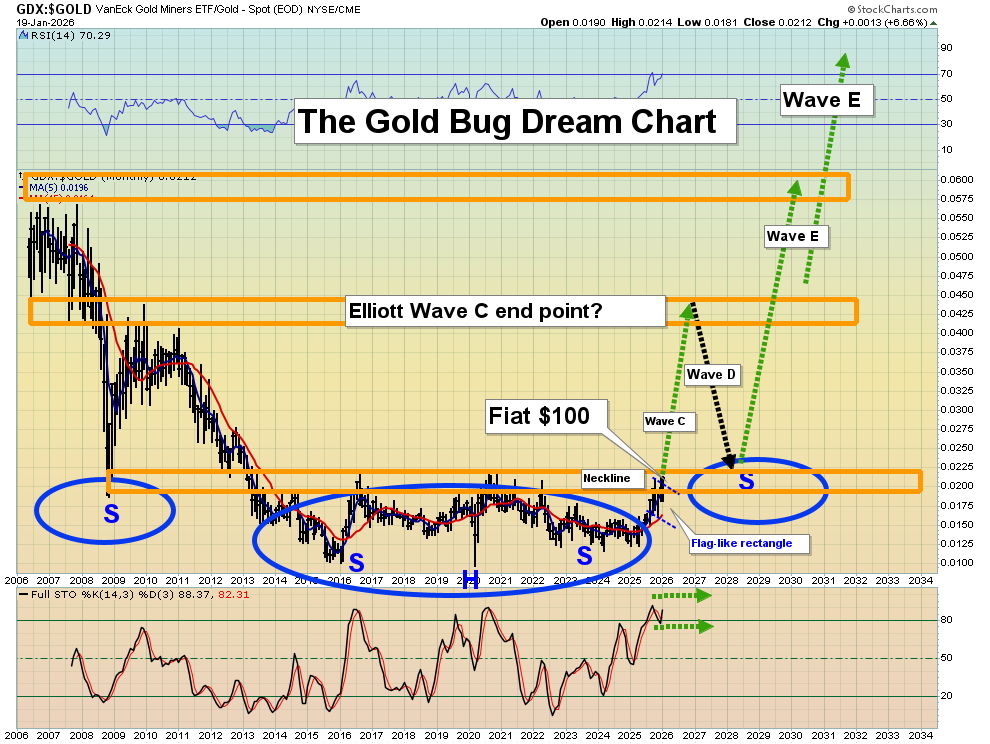

Another key chart that I urge investors to look at every day is this GDX versus gold chart. Note the key 14,3,3 series Stochastics oscillator at the bottom of the chart. As the fantastic upside breakout unfolds and the rally begins, I expect that oscillator could stay overbought for not just years… but for decades. The bottom line is this:

It’s a new era, a gold bull era, and it’s all about the rise of the savviest citizens as kings!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: