Gold Lies Low Whilst Silver Steals the Show

We simply must start with the spotlight on Silver: Sweet Sister Silver! As if shot out of a cannon this past Monday, Silver swiftly soared, by Wednesday reaching 36.27 — a level not having traded in better than 13 years (since 29 February 2012) — then onward to as high yesterday (Friday) as 36.51 before settling the week at 36.13 Just like that!

Oh how many times through hundreds of missives have we stressed “Do NOT forget the Silver!” For when Silver goes, she GOES!

A stellar week indeed for Sister Silver. Through now 1,275 trading weeks of the 21st century, this past weekly net gain of +9.4% was Silver’s 21st best, (the largest weekly net gain being +17.4% for that ending 27 March 2020 as COVID closed the globe). And year-to-date, Silver is now +23.4%, within our Metals Triumvirate having passed Copper +20.1%, atop which Gold still leads +26.2%.

But wait, there’s more: for relative to Gold, Silver still remains cheap as we turn to the daily Gold/Silver ratio for these past 25 calendar years.

And as you can therein see, the Gold/Silver ratio (now 92.2x) periodically returns to its evolving average (69.1x), at which today we’d find the white metal +33% higher at 48.22 versus the present price of 36.13. Effectively as a rule of thumb, a ratio above 80x generally leads to higher Silver prices.

“But a decline in gold without silver going up can also bring the ratio down, mmb…”

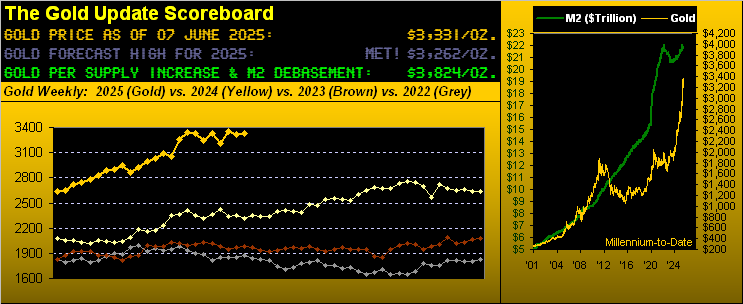

Unlike the balance of the modern-day financial world, Squire does math. And were Gold fundamentally overvalued, we’d be on the lookout for such declining ratio impetus. To be sure, technically Gold remains in a weekly parabolic Short trend. But by the de facto driver that is Dollar debasement, Gold today at 3331 is -13% undervalued per the opening Scoreboard’s implied 3824 level. So let Silver also rise to the occasion.

Still as noted, Gold’s weekly parabolic trend remains Short, price on balance lying low for the week in posting a net gain of just +0.5%, overwhelmed by Silver’s aforementioned +9.4% net gain. In fact as a rare graphical bonus, here are Sister Silver’s weekly bars from a year ago-to-date and — contra to Gold’s parabolic trend being Short — hers is Long per the three rightmost blue dots:

In turning now to Gold’s weekly bars, the Short trend thus far actually “appears” up even as the rightmost red parabolic dots are in decline. Yet price nevertheless has sported three “higher lows” in a row:

Regardless, Gold intra-week had been up as much as +3.5% before basically  “…giving it all away…”

“…giving it all away…” –[Roger Daltery, ’73]. Thus the Short trend continues from which an ascent up through 3487 in the new week would initiate a new Long streak. Such level is +156 points higher from here, which is not that unrealistic as Gold’s expected weekly trading range is presently 151 points. But should the Short trend stubbornly persist, we remain mindful of the underlying 2973-2844 support zone as maintained on the above graphic. Either way, for these past five days, the spotlight has shown upon Sweet Sister Silver per her cumulative percentage track versus that for Gold:

–[Roger Daltery, ’73]. Thus the Short trend continues from which an ascent up through 3487 in the new week would initiate a new Long streak. Such level is +156 points higher from here, which is not that unrealistic as Gold’s expected weekly trading range is presently 151 points. But should the Short trend stubbornly persist, we remain mindful of the underlying 2973-2844 support zone as maintained on the above graphic. Either way, for these past five days, the spotlight has shown upon Sweet Sister Silver per her cumulative percentage track versus that for Gold:

‘Course, doing all it can to avoid the spotlight is the Economic Barometer. This past Wednesday, the Econ Baro reached its lowest level in nearly 16 years — since 14 September 2009 — the StateSide economy then arduously trying to recovery from the depths of the FinCrisis. And today, the Baro’s divergence from the happy-go-lucky-stuck-on-stoopid “Casino 500” stands as stark as perhaps we’ve ever seen (barring our clawing back through 27 years of Baro/S&P data). Have a view, should you’ve the stomach to so do:

But not to worry! Rather, ’tis all OK! Out of the Bond and into the S&P, “Olé!” Hat-tip Bloomy yesterday, post-May Payrolls data: “…Treasuries slumped after stronger-than-expected US job and wage growth, prompting traders to trim bets that the Federal Reserve will cut interest rates this year … Jobs Surprise…” Seriously? “Jobs Surprise”? Let’s see: according to the Bureau of Labor Statistics, “Non-Farm Payrolls” growth slowed from 147k in April — itself revised lower from 177k — to 139k in May. Isn’t that going the wrong way?

“But it beat the 130k consensus, mmb…”

Ah yes, that’s it, Squire: consensii are more important than reality. Further, the pace of Hourly Earnings doubled from +0.2% to +0.4%. So: job growth is slowing and wages are rising. Very much akin to the just revised read for Q1 Productivity: it decreased -1.5% … but Unit Labor Costs increased +6.6%. Remember the “S” word? “Stagflation“? “Got Gold? … Got SILVER?”

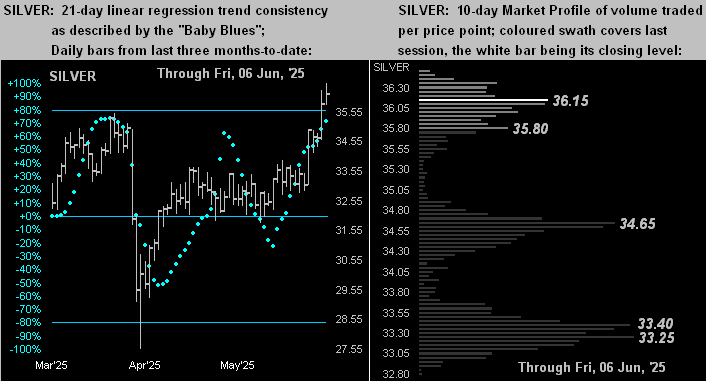

Let’s next look first to Silver as we go to her two-panel display of daily bars from three months ago-to-date on the left and 10-day Market Profile on the right. From 07 April’s low of 27.55 to this past week’s high at 36.51 is a 42-trading-day (two months) gain of +32.5%: impressive! Note the Profile’s dominant volume support areas of 34.65 and 33.40-33.25:

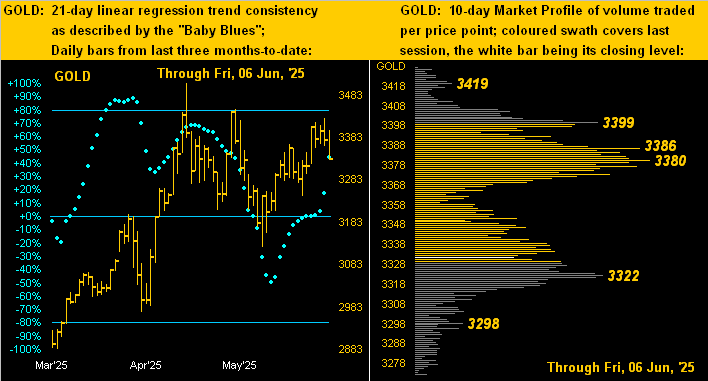

Then second there’s Gold… good ol’ Gold! By the baby blue dots of regression trend consistency (below left), Gold understandably lacks that of Silver; however, price’s gain across the three-month panel, too, is impressive! A bit more daunting though is Gold’s Profile (below right) depicting notable volume resistance from 3380 up to 3399. And we not be reminded that Gold’s weekly parabolic Short trend still is in force:

All-in-all, a stunning and well-overdue super week for Silver. And again, relative to Gold, Silver is still a bargain. But the inexorable passage of time marches ever onward, the ensuing week’s StateSide highlights being both retail and wholesale inflation readings for May. Consensii for the Consumer Price Index sense same or an uptick from April’s pace, whilst the Producer Price Index is expected to have swung from DEflationary back to inflationary. We therefore graphically query:

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro

********