Gold Market Update

In classic fashion gold's brutal plunge ended in a zone of strong support just above its 200-day moving average. Normally, a drop of this severity would lead to more downside action, but there is now strong evidence that gold hit bottom last Monday, and that it is now basing prior to turning higher again.

We can see the latest action on our 1-year chart for gold, which shows that once gold broke down below the support (now resistance) at the lower boundary of its intermediate top area, it went into an accelerating decline that culminated in a vertical plunge back to a point just above the 200-day moving average, where a large "bull hammer" formed that we will look at in more detail on the 3-month chart. It is no coincidence that the decline halted both at the 200-day moving average, as just mentioned, and in the zone of strong support shown where premature sellers in the April - July trading range are now buying and underpinning the price. Gold is now massively oversold at this juncture - it is the most oversold it has ever been since the bullmarket began over 10 years ago, and considerably more oversold than it was during the 2008 market meltdown, as we can see by reference to the MACD indicator at the top of the chart, which has never registered such a low reading, and it has in addition dropped way below its 50-day moving average. While we might normally infer from the severity of this drop that there is more downside to come, there are other factors, principally the COTs for gold, silver and the US dollar, which strongly suggest that gold is going to turn higher again before much longer.

Below is the chart for gold from the article "GOLD - A TOP SO BEAUTIFUL, IT MAKES YOU WANT TO CRY", which appeared on the site on 14th September.

The 3-month chart for gold is very interesting as it allows us to examine recent action in considerably more detail. On this chart we can see how gold plunged upon breaching the support at the bottom of its intermediate top area, and how the decline suddenly, but predictably, halted when it got to its 200-day moving average, where a large pronounced bull hammer candlestick appeared, which was a very positive development. While the shock administered to sentiment by the steep drop means that gold may need to base around these levels for a while before a recovery can gain traction, other factors, principally the COTs suggest that it is likely to recover sooner than we might otherwise think. For this reason it is thought to be prudent for those wishing to go long here or add to holdings to do so immediately as we are now in the accumulation zone, and whilst recognzing that the price could very well drop back towards the hammer lows, it could instead advance almost immediately, so that there a danger of missing it. However, if it does drop back towards the hammer lows it should be bought aggressively, and this would be an excellent point to lock in leverage by buying Calls, either in gold, in gold bull ETFs or in the better gold stocks.

The latest COT charts for gold are VERY bullish, with Commercial short and Large Spec long positions having dropped to their lowest levels for a very long time, as we can see on the COT chart below...

The dollar COTs are becoming very bearish, with the Commercials now having accumulated a heavy short position. This means that the dollar rally may soon be history, which suggests that some kind of breakthrough may be imminent regarding the crisis in Europe. This would logically involve more integration and the commitment to a massive blast of QE, Fed style, in order to mitigate the liquidity problems arising from the insolvency of member states. Needless to say, if Europe graduates to the elite super QE club, it will be great news for gold and silver, and for commodities generally. We can see the inverse of the big Commercial short position in the dollar on the COT chart for the euro fx, which shows that the Commercials have accumulated a massive long position in the euro.

On the 6-month dollar index chart we can see the first signs of a potential reversal, following its blistering rally, which we predicted before it began. The dollar appears to be rounding over beneath a developing resistance level at the top of a potential Dome Top.

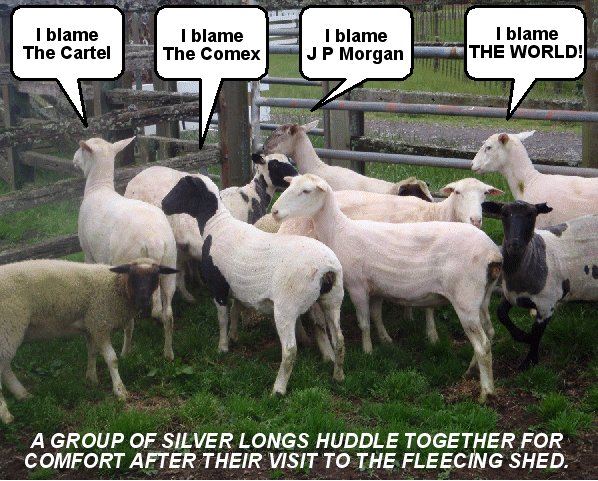

I have received the usual crop of Emails by traders caught out by the savage plunge in gold and silver over the past couple of weeks. They are bleating about "The Cartel" staging such an audacious raid or "drive by shooting", but what do they expect? - these people aren't operating as a charity - if the little guy buys a lot on margin, he can expect them to do this periodically to force him to cough up his holdings at knockdown prices. Technically, all that has happened is a healthy and predictable correction back to support near the 200-day moving average that serves to flush out weak longs and set the stage for renewed advance.

A small leveraged gold investor was caught on camera last week right after being fleeced...

Following our highly successful foray into the future to see what would happen to the silver price, many readers have been urging me to clamber back into my time machine and go Back to the Future to see what is going is to happen in the next few weeks. However, on this occasion I have decided not to. It was not concern about disrupting the space-time continuum, or even a sudden attack of moral rectitude concerning looking at charts 3 weeks before other people get a chance to see them, but the simple fact that it isn't necessary. You see, we have all the evidence that we require in the here and now that silver has probably bottomed, or is very close to doing so, and that it is set to enter another advancing phase shortly. Let's now look at this evidence.

On silver's year-to-date chart we can see how the brutal plunge that wiped out many leveraged small silver speculators, and which enabled us to make a fortune in a matter of days, abruptly terminated at the zone of support shown in Far East markets on Monday, after which silver rallied to close the day almost at its highs, leaving behind a large very bullish "Dragonfly Doji" on its chart which we will look at a little later on the 3-month chart. The ferocity of the decline is thought to be partly or even largely due to a wave of margin calls going out to leveraged small speculators, who had been set up to be fleeced by their cheerleaders egging them on for weeks, having apparently learnt nothing from the May plunge just a few months earlier.

Big Money is right now having a field day mopping up the holdings of massacred small traders whose corpses are being loaded on to waggons like a scene from the aftermath of The Battle of Waterloo, and there are strong indications that after they have finished rifling through their pockets and taking the fillings from their teeth, silver is going to go storming back up. We had already figured out that silver was undergoing a 3-wave A-B-C correction that would end with a violent C-wave flushout weeks ago, and labelled it as such. An A-B-C correction is just that, a correction, which means that it should be followed by a 5-wave advance to new highs, although it may seem hard to believe looking at the charts right now. Sentiment has been shattered by this plunge, the severity of which would normally imply that the price is set to go lower still. However, there are various indications, principally in the latest COT figures for silver and also for gold and the US dollar, which suggest that silver will not now go lower, although the damage to sentiment may of course require a period of base building for days or perhaps weeks before a new uptrend can gain traction, that may involve the price dropping back down again towards the intraday lows of last Monday. A point worth emphasizing here is that silver is now extraordinarily oversold, as shown by the MACD indicator on its charts - it is at its most oversold since the bullmarket began, and this fact alone should limit immediate downside.

On the 3-month chart we can see much more clearly the huge bullish "Dragonfly Doji" candlestick that formed back last Monday and the climactic volume that accompanied it. This was a clear Reversal Day. Since then it has been in a state of temporary balance - unable to drop much further because it is so oversold, and unable to rally because of the severe damage to sentiment, which normally takes some time to heal. When it plunged it broke below the support level shown in the $33 area, and this will be the first hurdle for silver to clear on the way back up.

Now we will look at the truly extraordinary COT situation for silver which suggests that, with weak longs having being nicely shaken out, it won't be long before it resumes the upward path. The latest COTs show a TRULY MASSIVE DECLINE in Commercial short and Large and Small Spec long positions in silver, which comes on top of earlier declines for several weeks. The Commercials have never been long silver and make money by playing the swings and this is as close as they have got to being long. This is THE MOST BULLISH COT CHART FOR SILVER THE WRITER HAS EVER SEEN. It alone suggests a stunning turnaround in the silver price before long. How could this be? If we couple this strongly bullish silver COT chart together with the strongly bullish euro COT chart shown in the Gold Market update (and the dollar COT chart is very bearish), the story it appears to be telling is that the dollar rally may soon be history, which suggests that some kind of breakthrough may be imminent regarding the crisis in Europe. This would logically involve more integration and the commitment to a massive blast of QE, Fed style, in order to mitigate the liquidity problems arising from the insolvency of member states. Needless to say, if Europe graduates to the elite super QE club, it will be great news for gold and silver, and for commodities generally. The last part of this paragraph is repeated in the Gold Market update.

In conclusion it would appear that silver has bottomed and that we are now in a base building process that may be completed a lot sooner than would normally be the case. Silver and silver related investments may be accumulated in the "accumulation zone" shown on the 3-month chart, and should be bought aggressively whenever it dips towards the intraday lows of last Monday towards $26, and this would be an excellent zone to go for the leverage of options.

On clivemaund.com we saw the silver plunge coming as you know and positioned ourselves to take full advantage of it by buying rafts of bear ETFs and Puts which we offloaded for a massive profit last Monday morning, having spotted the potential reversal, closing out extraordinarily successful trades in ProShares Ultrashort Silver Calls just as it peaked. Our next challenge is to see if we can do the same thing in reverse on the long side, and this coming week we will be looking at ways to capitalize on the expected uptrend, including ways to leverage gains in the same way that we just did on the downside.

A flock of small leveraged silver investors were caught on camera last week right after being fleeced...

Clive Maund, Diploma Technical Analysis

[email protected]

www.clivemaund.com

Copiapo, Chile, 2 October 2011