Gold Price And Silver Price Updates

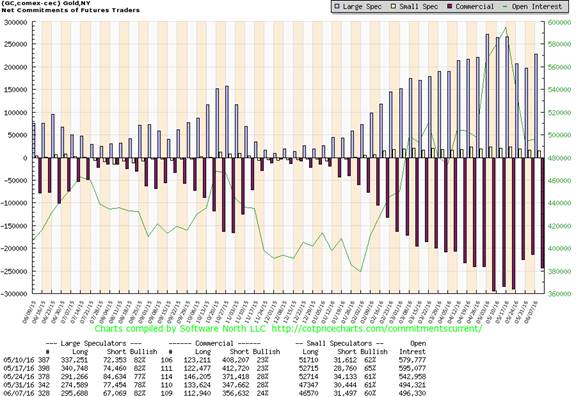

Both COT data and the divergence in our cycle indicator suggest that we are at or near a major top.

Gold sector cycle is up and now back at levels of previous tops.

Gold Sector

$HUI is on a new long-term buy signal, ending the sell signal from early 2012.

Long-term signals can last for months and years and are more suitable for the long-term investors.

$HUI is on a short-term buy signal.

Short-term signals can last for days and weeks and are more suitable for traders.

Speculation remains near all time high.

Summary

Gold sector is on a new major buy signal.

Both COT data and the divergence in our cycle indicator suggest that we are at or near a major top.

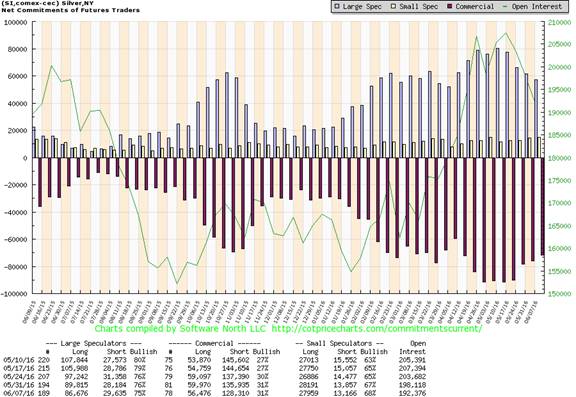

Silver Sector

Silver is now on a on a long-term buy signal ending the sell signal since Dec 2011.

Long-term signals can last for months and years and are more suitable for long-term investors.

SLV – short-term is on buy signal.

Short-term signals can last for days and weeks and are more suitable for traders.

Speculation continues to pullback.

Summary

Silver is on a long-term buy signal.

Short -erm is on buy signal.

COT data suggests lower prices overall.

Courtesy of www.simplyprofits.org

********