Gold Price Forecast – An Observable USDX Breakout, Is It All Crystal-Bullish Now?

The year that we’re in is one of the most challenging ones to date for the global stock market, and many other markets. Gold is no exception. And yet, there are quite a few techniques that allow one to stay up-to-date with markets and to determine outlooks for them. In case of gold, the thing that is often particularly useful, is the correlation between USDX and gold, which tends to be strongly negative. That’s been the case recently, which allows us to make predictions for gold thanks to analyzing the USD Index.

In most cases, the relationship between gold and USD is an inverse one, meaning that if the U.S. dollar’s value moves down, gold tends to move higher, becoming more affordable in other currencies in the process. Whatever is bearish for the USDX is bullish for the gold stock, and vice versa.

Now, throughout the current formidable year that the world is in, fundamentally, it seems that everything went well from gold, apart from the signals pointing out to excessive situations. To clarify, when some of the bullish factors temporarily ease, and investors are worried about the economy’s rehabilitative ability, gold is likely to correct significantly, before continuing with its upward trend.

Speaking of indications pointing to the situation being excessive, let’s take a look at the USD Index.

Remember when in early 2018, we wrote that the USD Index was bottoming due to a very powerful combination of support levels? Back then, practically nobody wanted to read that as everyone “knew” that the USD Index is going to fall below 80. Consequently, it has come to our attention that people were against us in some blog comments because we’ve disclosed our opinion - that the USD Index was bottoming, and gold was topping. People were very unhappy with us writing that day after day, even though the USD Index refused to soar, and gold was not declining.

Well, we’re in a similar situation again right now.

As we know, the USD Index is at a powerful combination of support levels. One of them is the rising, long-term, black support line based on the 2011 and 2014 bottoms. The other major, long-term factor is the proximity to the 92 level – that’s when gold topped in 2004, 2005, and where it – approximately – bottomed in 2015 and 2016.

Currently, the USDX has just moved to these profound support levels, and it’s very oversold on a short-term basis. Keep in mind that this all happened in mid-year when the USDX formed major bottoms on many occasions. This makes a short-term rally here highly possible.

While it’s not that obvious at first sight (click on the chart to enlarge it), the USD Index moved briefly below the long-term, black support line, and then it invalidated this breakdown before the end of the week. This is a very bullish indication for the next few weeks.

Based on the most recent price moves, we can conclude that the USDX is once again below the above-mentioned strong rising support line, but we doubt that this breakdown would hold. Therefore, we expect to see an invalidation thereof that is followed by a rally.

Now, before moving to the short-term chart, please note that the significant USD Index bottoms that formed in the middle of the previous years often took form of broad bottoms. Consequently, the current back and forth trading is not that surprising. This includes 2008, 2011, and 2018 bottoms as well.

Shortly after invalidating its breakdown below the late-July lows, the USD Index broke above its declining short-term resistance line. It then consolidated and paused below the declining medium-term resistance line.

The above happened shortly after Fed announced a more dovish approach, which theoretically should have made the USD Index decline. This resilience was bullish, and it’s something that suggests that the USD Index is about to break above the declining resistance line rather sooner than later.

Everything would have all been nice and bullish, that is if the USD Index didn’t invalidate its breakout last week. As it turns out, it did, pushing us to even (temporarily) decrease the size of our short position in the precious metals market. But still, we wrote that the invalidation should not be trusted based on the situation regarding the two biggest USDX components. To quote our Friday’s analysis:

The USDX was quite visibly above the declining resistance line, but it failed to hold these gains. Back in July, failure to rally above is resistance meant another big downturn, which translated into higher gold prices.

Does the same fate await the USD Index – and gold – in the near term?

Not necessarily.

The USD Index is a weighted average of several currency exchange rates. The biggest weight (over 50%) is attributed to the exchange rate with the euro, and the second biggest weight is attributed to the exchange rate with the yen. So, let’s see how the situation looks like in both currencies.

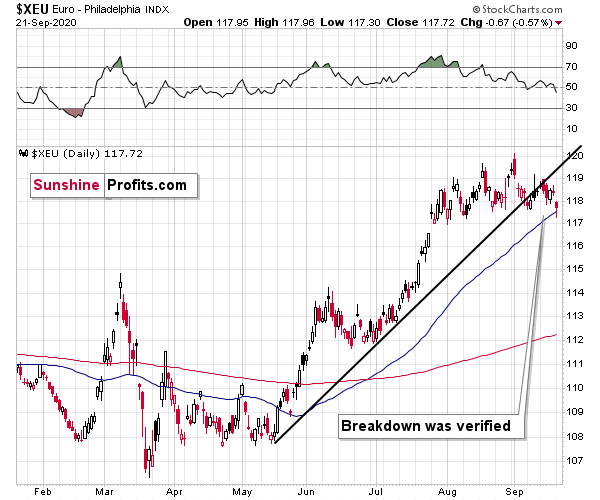

The euro is after a breakdown and a verification thereof. This is a very bearish situation. That’s bullish for the USD Index and – because of that – bearish for gold, at least in the short run.

What about the Japanese yen?

The situation is not that different as far as implications are concerned, but the direct reason for it, is.

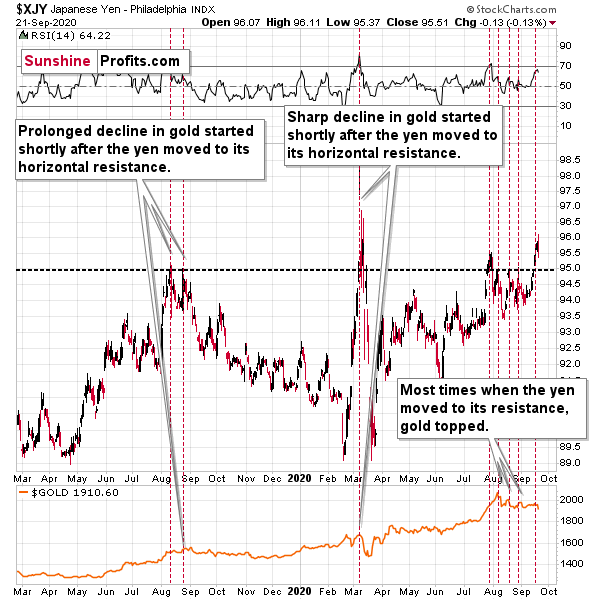

As you can see on the above Japanese yen index chart, in the past 1.5 years, whenever it tried to rally above the 95 level, it topped shortly and reversed its course.

In mid-2019, this resulted in a prolonged decline in gold, and in early 2020, this resulted in a sharp and deep decline.

In the last few weeks, we saw this signal (the yen index trying to break above 95) 4 times: once it was a bit before the final top in gold, and in all the remaining (3) cases, these were local tops in gold.

The implications of the current situation in the yen are bearish for gold, and they are bullish for the USD Index, as the Japanese currency is likely to once again invalidated the breakout. The history tends to rhyme, after all.

Given the trading tips that the individual currency exchange rates give us, should we really expect the invalidation of the USD Index’s breakout to lead to lower values? Not really. The individual currency exchange rates are more “basic” and their individual outlooks outweigh the index chart that is essentially based on them.

This means that the validity of the bearish implications of USDX’s invalidation is suspicious, to say the least.

And indeed, the USD Index rallied. The move was not significant in terms of nominal price changes, but it was profoundly relative to the important resistance that it broke. At the moment of writing, the USDX is after a visible breakout.

Of course, just as it was previously, the situation won’t become crystal-bullish, unless we see a confirmation of the breakout in the form of either a significant move above the resistance (it’s not significant so far), or three consecutive daily closes above it. Today would be the first such close (unless the breakout is invalidated on an intraday basis that is).

All things consider, we can conclude that based on today’s pre-market movement in the USDX, the situation in it is more bullish and more bearish for the PMs than it was last week. This means that the outlook for the precious metals market is very bearish for the next several weeks.

Summary

The days of USDX trading below its declining resistance line appear to be over, and that won't leave the precious metals sector unmoved. After gold broke below its medium-term rising support line, and it verified this breakdown.

The following days are not likely to be pleasant times for anyone who refuses to jump on the bullish bandwagon just because prices moved higher in the previous months. But what’s profitable is rarely the thing that feels good initially. As silver often moves in close relation to the yellow metal, forecasting gold’s rally without a bigger decline first is thus likely to be misleading. The times when gold is lastingly trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Naturally, the above is up-to-date at the moment of publishing and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis, we invite you to sign up to our gold newsletter. You’ll receive our articles for free and if you don’t like them, you can unsubscribe in just a few seconds. Sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,