Gold Price In March: Legitimacy & Transparency

Gold buy-side HSR: $1033, $887.

Gold sell-side HSR: $1320, $1340.

HUI buy-side HSR: 155. Sell-side HSR: 250, 360.

Dow buy-side: 14200. Sell: None.

Silver: buy-side: $15.20. Sell-side: $18.17, $22

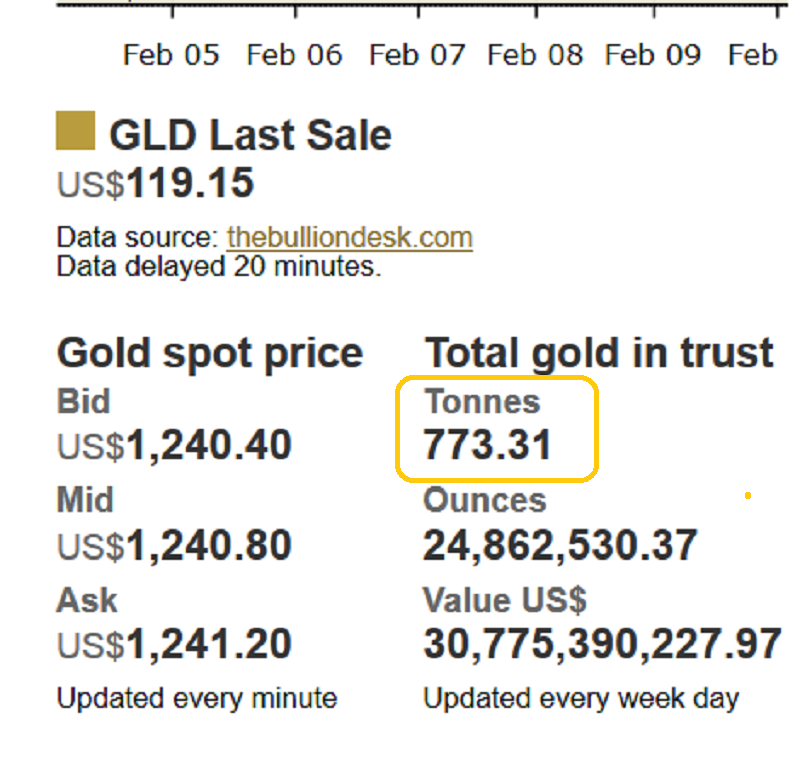

GLD Tonnage: 773

COMEX Gold Option Expiry Day: March 26

Next FOMC Meet: Mar 17 - 18

All gold community eyes should be on the month of March, for three key reasons.

First, London is the world’s largest gold trading centre. The LBMA sets the price with a “fix” that is created by bank traders, using telephones.

There are two problems with the traditional London price fixing mechanism. First, there is a lack of transparency. Second, the bank bids and asks don’t necessarily reflect mine and scrap supply, or investment and jewellery demand.

In March, a new electronic LBMA price-discovery process is set to be unveiled, and it should bring great transparency to the market.

Also, three Chinese banks are becoming members of the LBMA, and will play an important role in ensuring that the price of gold reflects mine and scrap supply versus the demand of investors and

jewellers.

“Lacking transparency means that gold prices can be rigged to benefit banks at the expense of producers, traders, investors, jewelry producers and other market participants.” – China Daily News, February 10, 2015.

Clearly, Chinese mainstream media is very aware of the recent gold price rigging scandals that have involved Western banks. “If Chinese banks can take part in the price fixing, it will increase the robustness of the data and better represent the gold market. At the moment, gold prices in China are set through trading on the Shanghai Gold Exchange.” – China Daily News, February 10, 2015.

I can’t promise the Western gold community that the March changes to the LMBA fixing mechanism will bring them a “gold price parabola”, but I am predicting the new system will attract more value-oriented funds to gold. Large money managers like transparency and stability, and the new LBMA system should make them feel very comfortable.

A lot of gold analysts question whether the Fed should raise interest rates in 2015. They argue that the economy is not as strong as it appears.

In contrast, I argue that the Fed is more focused on inflation than GDP growth. The enormous number of minimum wage jobs that have been created since the 2009 Dow lows make the economy extremely vulnerable to a wage inflation shock.

I think that shock could happen as early as March of this year. I’ve drawn an inverse head & shoulders bottom onto this Zero Hedge chart of American wages.

Wages have been in a trough since 2009, and most of the US jobs growth has involved minimum wage jobs. Corporate profits have surged since the 1970s, while wages have stagnated. I think an upside breakout in American wage inflation could occur very quickly, and very violently. I believe the fear of wage inflation is the main reason the Fed is focused on rate hikes in 2015.

The third important March event involves the February 28 Indian federal budget. There is tremendous pressure on finance minister Arun Jaitley to cut the import duties, to reduce the role of the mafia in the world’s largest and most inelastic gold market. I think there’s a 70% chance that Jaitley announces a cut.

That won’t necessarily produce an immediate price spike in gold (although it’s possible). More importantly, a duties cut will reduce the role of the mafia, and allow the devastated Indian jewellery sector to rehire workers, and begin the healing process. Like the LBMA fix news, a duty cut would add transparency and stability to the Indian market, enticing value-oriented Western money managers to invest in mining stocks.

I think most gold analysts are vastly underestimating the importance of the titanic changes taking place in the world gold market. In the big picture, 2015 is likely to go down in history as the year that transparent and legitimate price discovery returned to gold.

A gold market that is electronic, fair, transparent, and stable, is one that attracts vastly more capital to it than one that is murky and operated by shadowy bank figures, making private telephone calls to determine the price.

That’s a look at the GLD-NYSE fund holdings. They are unchanged from Thursday of last week, despite the sell-off in the gold price that occurred after the release of the US jobs report on Friday.

Most bank economists predicted that key old ETF holdings could decline in 2015. Instead, they have been rising, even on price declines! The type of investor that is buying gold ETFs in 2015 appears to be much more solid than the wildly leveraged hedge funds that bought during the “QE to Infinity Cowboys” era. That’s more good news for Western investors, and for the entire world gold community.

This daily gold chart shows the lead line of my 14,7,7 Stochastics oscillator is now at about 25. The 15 – 25 area is where $50 - $150 gold price rallies tend to begin. Gold may be almost ready to launch another “attack” on the $1305 sell-side HSR (horizontal support and resistance) zone!

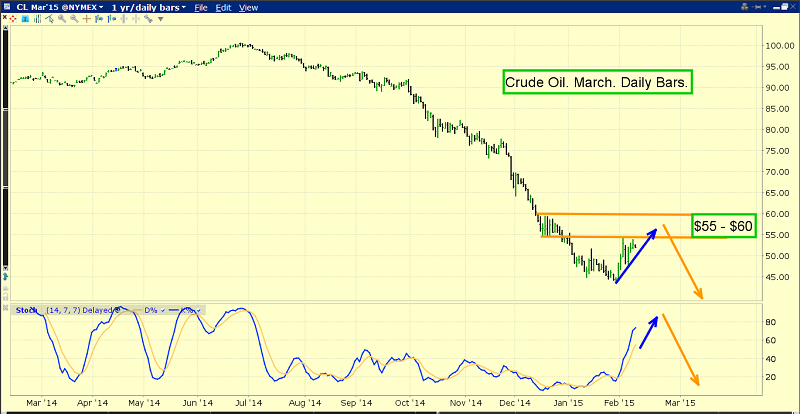

That’s the daily oil chart. Unlike gold, the 14,7,7 Stochastics series oscillator looks terrible. It’s already almost overbought, and oil is struggling at the $55 sell-side HSR zone. I expect oil to collapse to new lows soon, reducing fuel costs for quality gold mining companies, just as the “age of transparency and legitimacy” comes to gold.

This GDXJ daily chart looks solid. Many technicians have noted the inverse head and shoulders bottom pattern in play. It’s important to remember that charts don’t make fundamentals. Fundamentals make charts. The coming events in March should help bring even more volume into gold stocks than has occurred since November.

My suggestion to all gold stock investors is to focus their eyes on the March timeframe, rather than on the head and shoulders pattern. The pattern could morph into another pattern, but the legitimacy and transparency coming to gold in March can’t be changed.

I have a lot of dividend-oriented holdings, and I use the regular and hefty payouts I get, to add to my gold and gold stock positions on all significant price weakness.

That’s the monthly chart for silver. It’s very interesting that silver is attempting to stage a major upside breakout, with the month of March less than three weeks away. I expect the breakout to occur, as the new age of legitimacy and transparency for precious metals begins! Thank-you for your time.

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Yellowcakes Versus Gold & Silver!” report. In recent weeks, uranium has been rallying nicely. I highlight my buy and sell points for three junior uranium stocks, three junior gold stocks, and three silver stocks, and discuss which sector could be the big winner in 2015!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: