Gold Price Prediction: Is The Final Low Already Behind Us?

Gold moved substantially higher in the past few months, rallying from $1,045 to well above $1,250. Gold stocks and silver stocks rallied as well and many investors and traders claim that the decline in gold that started in 2011 is now over. The answer to the question whether this is the case or not has critical implications for the precious metals investors as the above impacts one’s decision to either invest in the precious metals market, or wait to do so at much lower prices. What’s the most likely outcome?

Gold moved substantially higher in the past few months, rallying from $1,045 to well above $1,250. Gold stocks and silver stocks rallied as well and many investors and traders claim that the decline in gold that started in 2011 is now over. The answer to the question whether this is the case or not has critical implications for the precious metals investors as the above impacts one’s decision to either invest in the precious metals market, or wait to do so at much lower prices. What’s the most likely outcome?

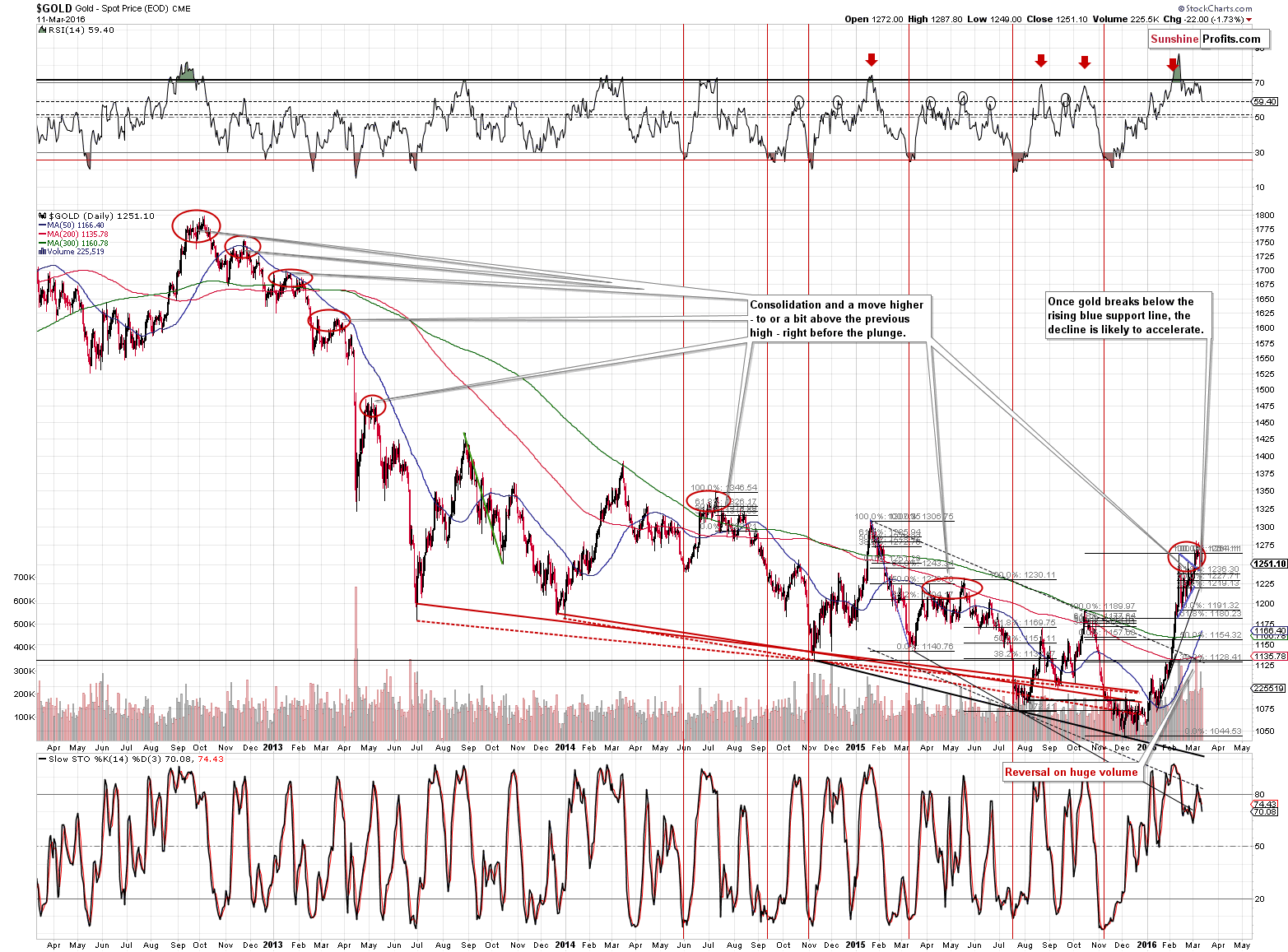

In short, we think that it’s more likely that we will see new lows before the bull market in the precious metals sector truly resumes. Let’s take a look why we think this is the case, starting with gold (charts courtesy of http://stockcharts.com):

In the previous alerts we wrote the following:

Given the current economic problems of the Eurozone, ECB had little choice other than to stimulate the economy further (given the current mainstream way of thinking about economic policies). At the same time if they didn’t want the euro to plunge, so they simply said something that is not really binding, but they made it appear as such. What’s next? The market will likely realize that today’s rally in the euro based on the “it’s over” comments is overdone and then the move will be at least corrected (likely cancelled, but not necessarily right away).

By writing “not binding” we meant the idea that process of lowering rates is done – it is not binding, because the Powers That Be can say that the situation has changed based on some economic indicator. Consequently, they would be “forced to take adequate action” and continue to lower rates regardless of their previous comments. Consequently, the comments that the rates will not be decreased further are not binding and actually have little implications, if any.

We didn’t have to wait for much longer for the above to prove true. With a decline of $22 on Friday, gold trading resulted in a practically complete cancellation of Thursday’s rally. Did the situation become much clearer because of that? No, because the volume that we saw on Friday was not very significant, and we would like to see pronounced volume at a major top.

In Friday’s alert, we wrote the following:

We have already written about the possibility that gold could even move to $1,328 or so (thus correcting 38.2% of the decline that started in 2011) before declining once again and nothing has changed in that regard. The thing that we would like to focus on is the volume. On a daily basis, yesterday’s volume is a bullish thing, but if we consider the bigger picture, the implications are bearish for the medium term.

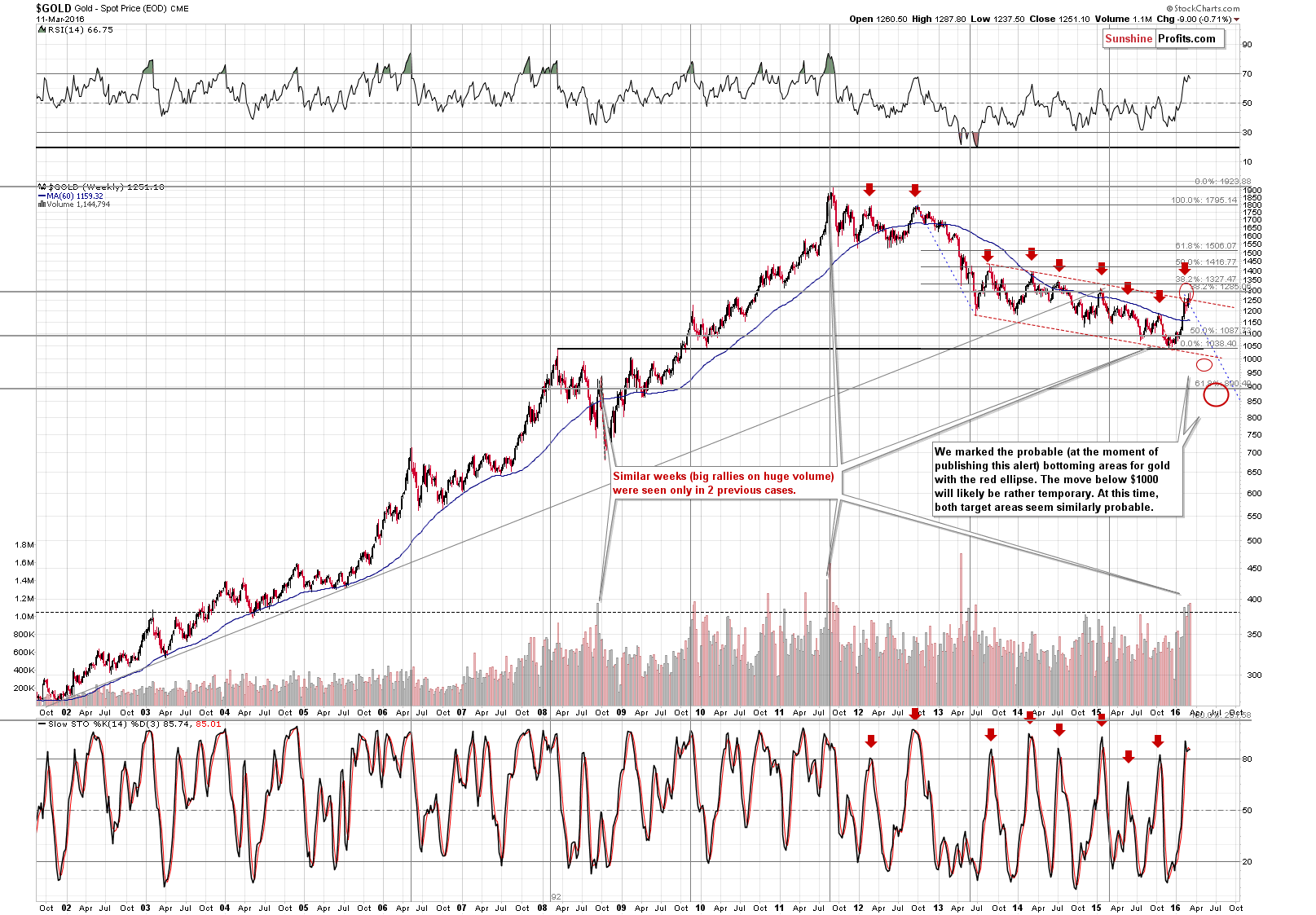

The only 2 times that we saw as big a volume as we’re seeing now was right before the 2011 top and right before the mid-2008 top. In both cases, sharp and huge declines followed in the following weeks. In the latter case, gold declined to new lows and in the former case, gold formed an all-time nominal high. While the implications are not for the very short term, they are important and bearish.

The implications continue to be bearish. The sell signal from the Stochastic indicator was very insignificantly invalidated and we expect to see another one relatively soon, especially that analogous signals were not invalidated in other markets/ratios. Gold has not broken visibly above the declining trend channel (marked with red dashed lines) and it’s likely that we will see another reversal shortly or within the next several days or weeks.

Gold moved to the lower of our target levels for this rally – slightly above $1,286, which is the 38.2% Fibonacci retracement level based on the entire bull market. This increases the chance that the top is already in.

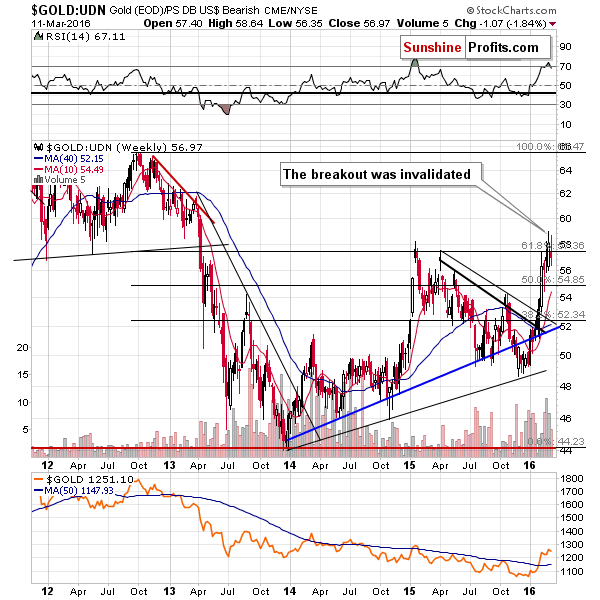

From the non-USD perspective, gold actually (despite bullish comments from the ECB) declined last week after invalidating the breakout above the 2015 high. That’s a quite bearish piece of news as it shows that gold is not responding to positive signals – or at least that the reaction was not sustainable. Gold in non-USD terms should have soared last week – but it didn’t, which is a bearish sign for the medium term.

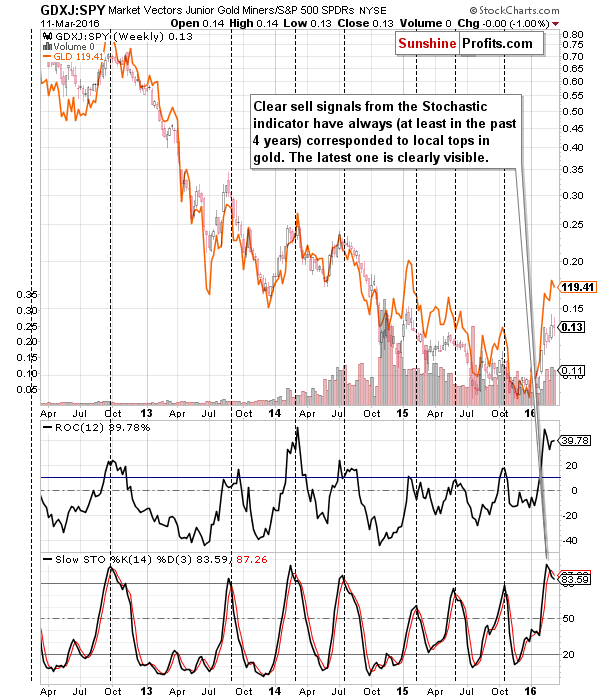

As we wrote earlier, the sell signal from the Stochastic indicator was not invalidated in all cases – comparing the performance of gold to the one of the general stock market, we see that the sell signal remains in place. The implications are bearish.

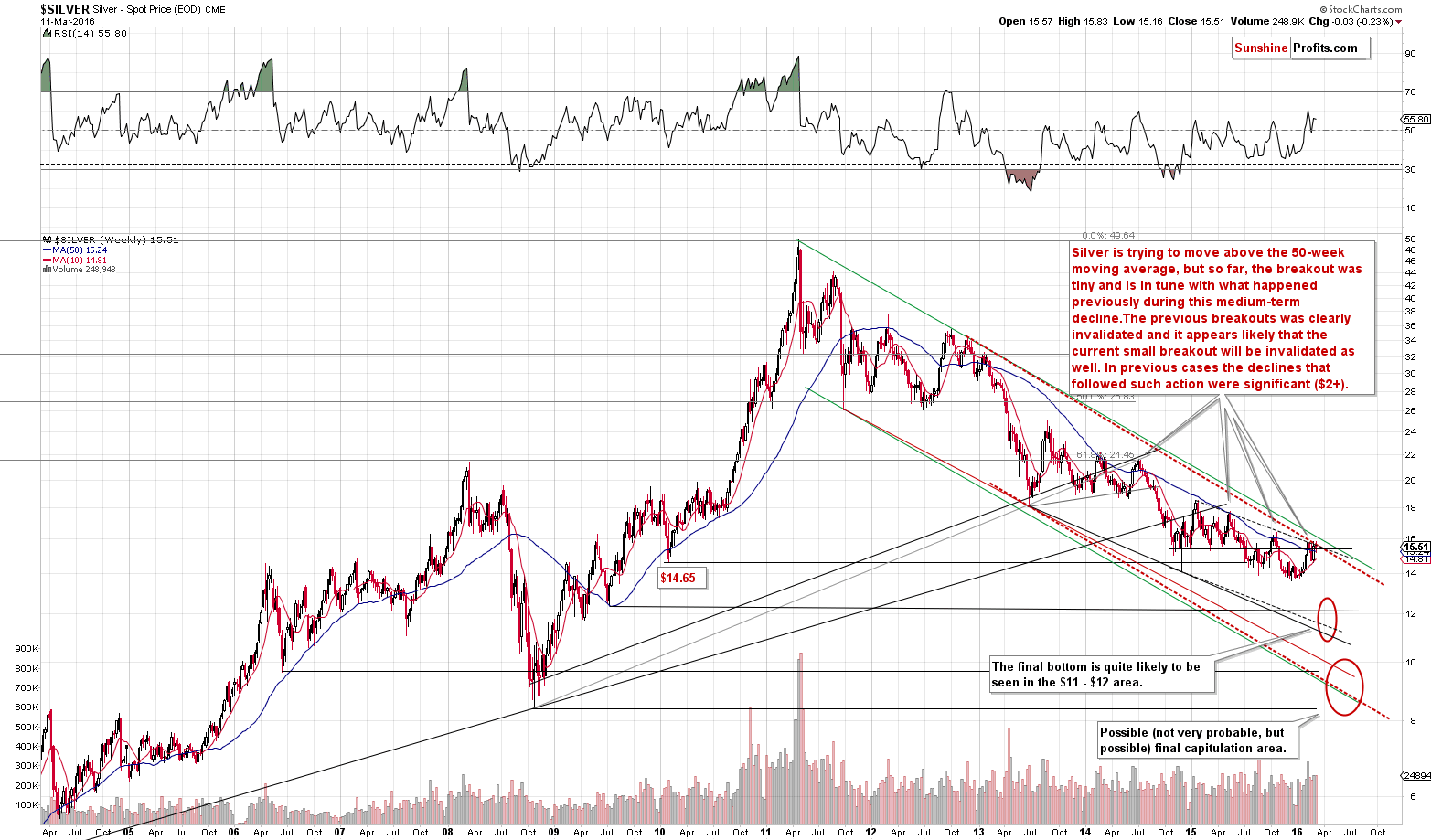

The situation in silver didn’t change much as it declined only several cents on Friday. The short-term picture for silver is not the most important one, though – the long-term one is.

The long-term silver chart continues to favor lower prices in the following weeks, although it doesn’t have very short-term implications. The long-term trend line was not successfully broken and therefore the trend simply remains down. The rally that we saw in gold in the past few months is definitely not confirmed by the action in silver.

Moving back to the short term – the cyclical turning point for silver is just around the corner, and since the previous move was to the upside, we can expect an important reversal just any day now.

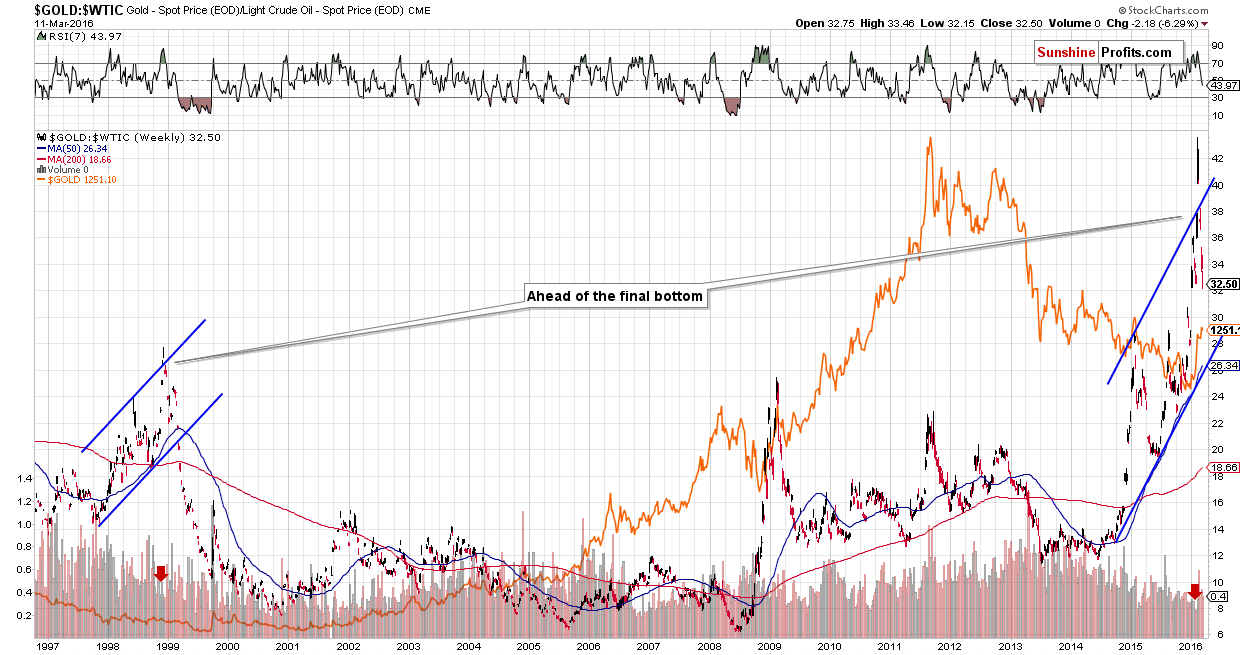

Before moving to mining stocks, let’s take a look at the gold to oil ratio. A few weeks ago we commented on this chart by saying that the rally was unsustainable and that the ratio (and gold as well) was very likely to reverse and move lower. The move lower has been clearly seen in the case of the ratio, but we have yet to see the big slide in gold. Back in 1999 we had to wait several more month, but gold has indeed moved to new – and final – lows. The implications are bearish for the medium term.

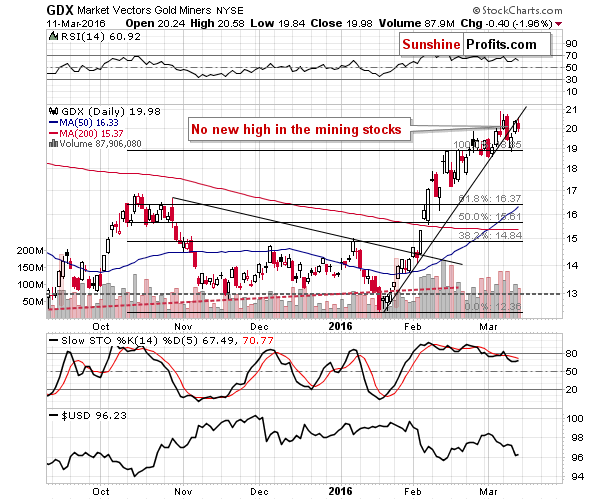

The most important thing visible on the above chart for the HUI Index (proxy for gold stocks) is the clear sell signal from the Stochastic indicator. This signal is something that confirmed tops multiple times in the previous years and the efficiency of these signals has been remarkable. The implications are of medium-term nature, though.

On a short-term basis, we see that that mining stocks are clearly below the rising support line once again, however, the move lower took place on volume that was not huge, and the decline was smaller than the one seen in gold (compared to the previous day’s gain), so the short-term outlook didn’t deteriorate substantially based on Friday’s action.

The medium-term outlook is clearly bearish based on the juniors to general stock market ratio. The sell signal from the Stochastic indicator is clearly visible in this case and the value of the Rate of Change indicator confirms the sell signal. Still, the implications are of medium-term nature, so we could still see a move higher in the very short term.

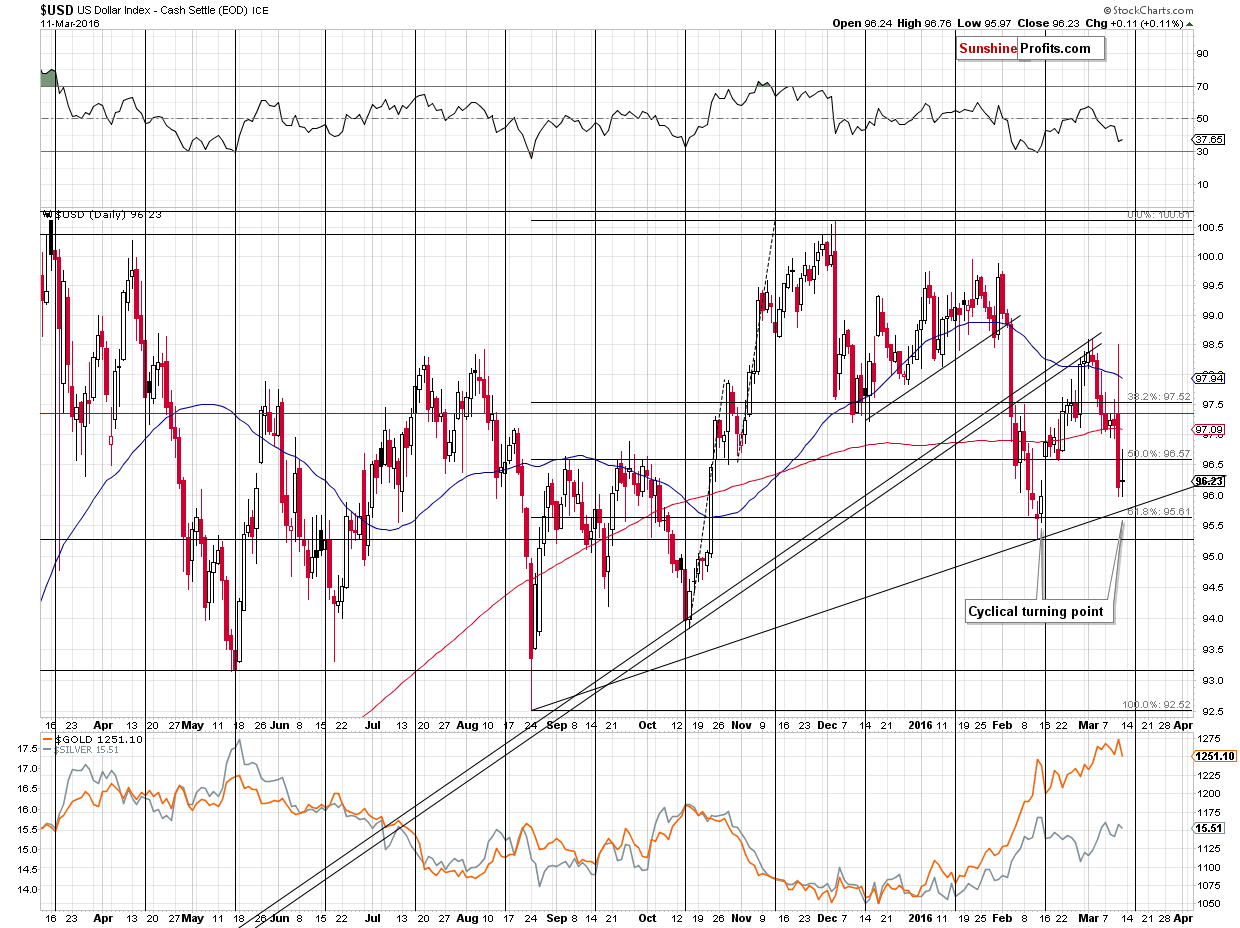

Finally, let’s take a look at the USD Index. The US dollar moved sharply lower last week and based on the above technical picture, we could see some additional small move to the downside (to the rising support line and the Fibonacci retracement at about 95.6 - 95.8) that would very likely – based on the cyclical turning point – be followed by a reversal and a rally.

There are naturally direct implications of the above for forex traders, but there are also consequences that are important for precious metals investors. The likely impact on the precious metals market is rather unclear (but more likely bullish) for the short term and bearish for the medium term.

Summing up, the outlook for the precious metals sector remains rather unclear for the short term, but bearish for the medium term. Gold moved to one of the target levels, which means that the top could already be behind us, but on the other hand there are some factors that suggest that the rally will continue for a few more days and will be followed by a reversal at that time (based on the situation in the USD Index for instance).

The most important reason for which we are expecting lower prices (even lower than seen in 2015) in gold is that we have seen too little confirmations that the final bottom is already in.

This year started with important price swings, but the most important appears to be still ahead - paying extra attention to this market for the next few months should prove well worth it.

Please note that the above is based on the data that was available when this essay was published and we might change our views on the market in the following weeks. In order to stay updated on our thoughts regarding the precious metals market and our free articles we suggest that you sign up to our gold mailing list – it’s free and if you don’t like it, you can unsubscribe anytime.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Silver & Gold Investment

Contact Przemyslaw Radomski, CFA

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,