Gold & Silver Update

The snow in my backyard stopped melting as Arctic air once again dominates Minnesota. So my tribulations with melting snow seeping into my basement have been postponed. Don't worry, before April 15th I'll be swabbing decks again. There is a lot of snow this year in the Upper Midwest, and it's all going to drain down the Mississippi. Expect record floods this spring. I'm also getting up to speed with charting my data with MS Office 2010. I hate new software, but as gold made new all-time highs this week, I might as well share my thoughts on the gold and silver markets with my readers.

Things are getting exciting in the gold and silver markets, with silver playing first fiddle! What's happening behind the scenes that's driving the precious metals upward? "US monetary and fiscal policy." That, plus the "policy makers" unraveling price manipulation in the financial markets is destroying the US dollar's reputation as an international unit of account. The simple fact that 99% of Americans can't seem to comprehend, is that the rest of the world doesn't want areserve currency that a little bearded weasel from Princeton University is quantitatively easing into infinity. And don't fool yourself that prices and yields in the US Treasury Bond market are being driven by market forces. If it weren't for the Federal Reserve and foreign central banks buying US Treasury bonds, all bonds priced in US dollars would drop dramatically, and interest rate would soar.

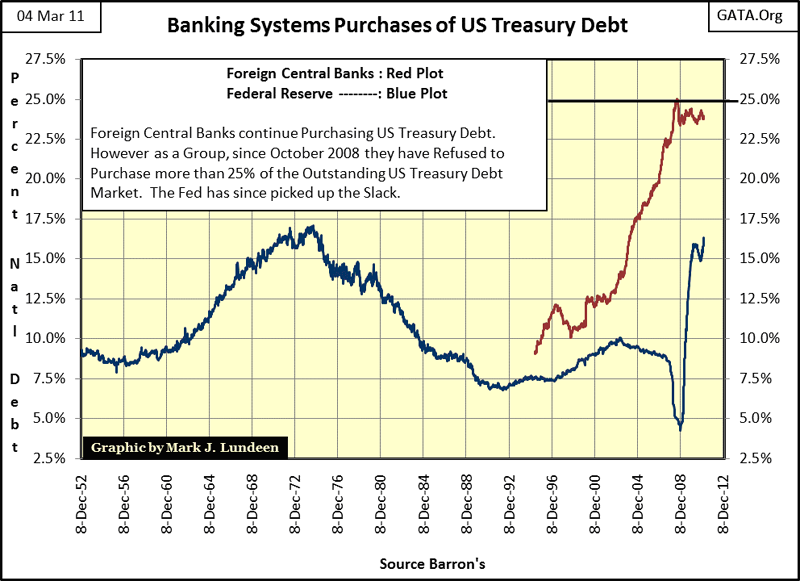

Here is a chart showing the percentage of the US National Debt owned by foreign central banks and the US Federal Reserve.

The money used to finance these "official sector" purchases of US Treasury debt is pure monetary inflation. This chart is reason enough for people the world over to move into gold and silver. For your information, that steep 2008 dip in the Fed's holdings of US Treasury debt was the result of the Fed's first Wall Street bailout from Congress's "Affordable Housing Program." The Fed was exchanging its US T-Bonds for Wall Street's toxic "mortgage products." Unfortunately Wall Street had more toxic mortgages than the Fed had T-Bonds. No doubt, one of the "new tools" Congress granted the Fed and the US Treasury in October 2008 was the ability to directly "monetize" mortgage backed securities, at face value, with no questions asked.

We should note how after the credit crisis of October 2008, foreign central banks, as a group, refused to take on more than 25% of the US national debt. This "official sector" buyers strike has forcing the Fed to pick up the slack. But, had the Fed been managed by responsible people, they would have refused to fund Congress's slush-fund in the US Treasury with monetary inflation, and they would have allowed interest rates to rise substantially higher than they are now, leaving the stock and bond markets free to find their fair market values in 2008-09. If left alone the Dow Jones would have fallen far below its BEV -60% line and interest rates would have soared to levels not seen since the 1980s.

Believing this necessary may sound harsh on my part. But when governments use the financial markets as electioneering props, and inflate paper asset values far from where economic reality would have them, there are consequences that may be postponed, but unavoidable nonetheless.

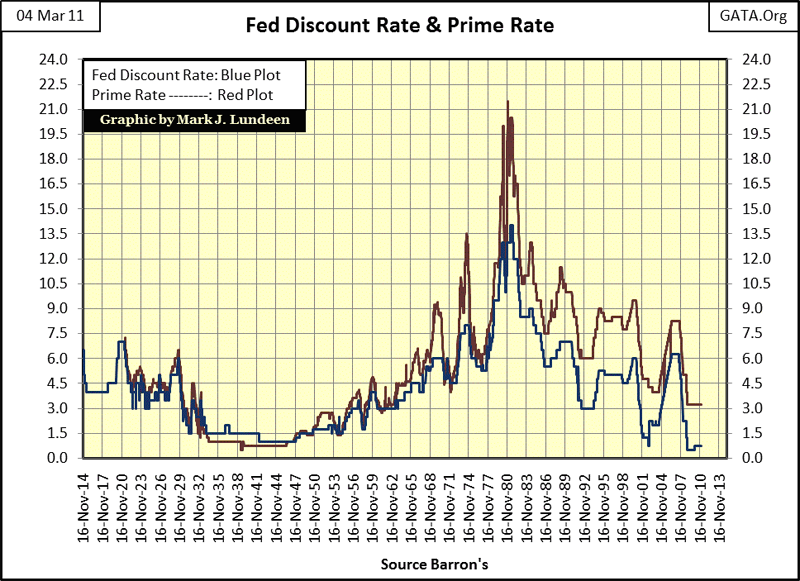

But responsible people are kept far away from the levers of power at the Federal Reserve. So, whatever problems were present in the financial markets two years ago are still here today, but magnified by the Fed's continual debasement of the US dollar. If you think gold and silver prices are high now, you won't have long to wait to see the error in this logic. And for your information, historically gold, silver and precious-metal mining stocks LOVE RISING INTEREST RATES.

Rising interest rates are proof positive that money is fleeing financial assets, and flowing into commodities, like gold and silver. But that will * NOT * be the way it will be reported. Get ready for the financial media, and government officials first to complain of "speculators" driving up the price of food, energy and metals, and then taking some form of action to "punish" the evil doers.

Let's take a look at gold and silver as they continue their bull markets. Gold finally made a new all-time intraday high of $1440, which is to be expected. In a secular bull, periodic new highs must be regularly reached. This week marked the fifth straight week of higher closes for gold, and the sixth straight week of higher closes for silver.

Here is the Bear's Eye View for gold. I can't help myself but have a little fun at the expense of the gold bears, who in January were all crying the sky was falling on the gold market. My Bear's Eye View tells the story: the January 2011 decline was one of the smallest corrections in the price of gold since its bull market started in 2001. It was just a normal 7.5% bull market correction, BUT YOU WOULD NEVER HAVE KNOWN THAT BY WATCHING CNBC. Yes I watch CNBC all the time, but with the volume turned down until Rick Santelli is on the tube.

But still, there is no doubt that after rising up from $255 in 2001 to over $1400 ten years later, gold isn't cheap anymore. But remember, gold is priced in US dollars, a corrupt unit of measurement if there ever was one. Here is a chart plotting the real price of gold, deflated by the increase in US Currency in Circulation. When we price gold in 1975 dollars (left scale),in the past 10 years it has only increased to $110 from $45, while paper dollars and base metal coins in circulation (right scale)have increased ten-fold in the past 36 years. In other words, for every one paper dollar in circulation in 1975, the US Government has increased its dollars in circulation to ten in 2011. I expect the price of gold still has a long way to go before it fully adjusts to the monetary inflation of the past few decades.

Also, remember that during the last bull market in gold, much of the world lived in communist totalitarian states, like China and Russia. Decades ago, billions of people were prevented by law to purchase precious metals. This is no longer so. In 2011, ALL the global currencies are on the road to being worthless, diluted by inflation, AND NOW there are billions of additional people who will be bidding up the price of gold and silver, people who were forbidden from doing so 40 years ago, now funded by the savings and prosperity we gave them by running massive trade deficits and off-shoring manufacturing jobs.

$1400 Gold? CHEAP!!

Let's move on to silver. Silver is the place to be, and currently is still affordable to the average person. Like I said, if you were thinking of buying silver in January, but didn't like the price a few months back, you're really going to hate the price in July!

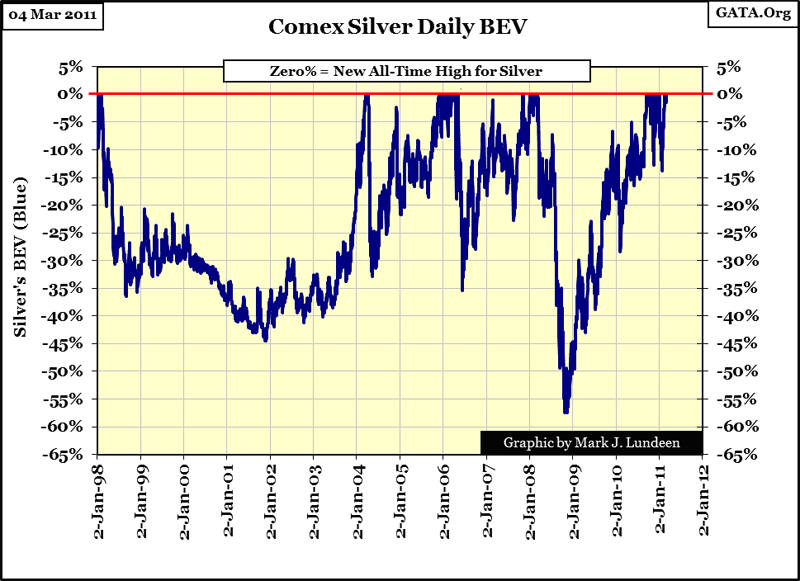

Let's take a look at the silver with the Bear's Eye View chart. Seeing silver come off its -58% lows of 2008, and rebound 280% in a little more than 2 years is amazing! In the past 365 days, silver is up 107.5%, gold is up 26.4%, while the US dollar index is down 5.1% Only cotton and coffee among the commodities have exceeded the returns in silver, and these are not good stores of value, difficult to take deliver, make a mess of your house when they arrive, and much more volatile and subject to the influence of weather.

The silver market currently offers a unique opportunity to retail investors. Even at current prices, the potential gains for investors who simply purchase silver eagles or pre 1964 US silver coins might be greater than were seen in the 1990s high-tech bull market. At this point in time, silver could be the most underpriced commodity in history. The Silver to Gold Ratio (SGR) is key to understanding why such gains are possible.

The Silver to Gold Ratio approached the important 40:1 ratio this week. At 40.44, it's at levels not seen since 1984. Only two years ago it was more than 80. To see this ratio break decisively below 40 is no small thing, and should create additional upward pressure on both the price of gold and silver. But don't be surprised if it were to backtrack once or twice above the 40 line before it makes its big move down. Remember, economics isn't hard science and Mark J. Lundeen can't see into the future. But gold and silver are in a 10 year bull market that is nowhere near the top. You can thank your local central bank for that!

In a world where Princeton Professors are allowed to create trillions of dollars from thin air, there is nothing to stop the price of gold from rising above $10,000, or even $100,000 as the US dollar, and all the other global paper currencies goes into cardio collapse. If the SGR should decline to its 10 line, silver would see prices that are simply not believable today. Will this happen? In March 2011, it's too early to say where the price of anything will be in 2016-20. But what I CAN say is that if the "policy makers" continue their "market stabilization policies" with ever larger "injections of liquidity" whenever the markets twitches; sometime in the next few years you'll be wishing you HAD purchased some silver at $35 an ounce in 2011.