Gold Speculative Positions Up 3 Out Of Last 4 Weeks

Weekly CFTC Net Speculator Gold Report

GOLD Non-Commercial Positions:

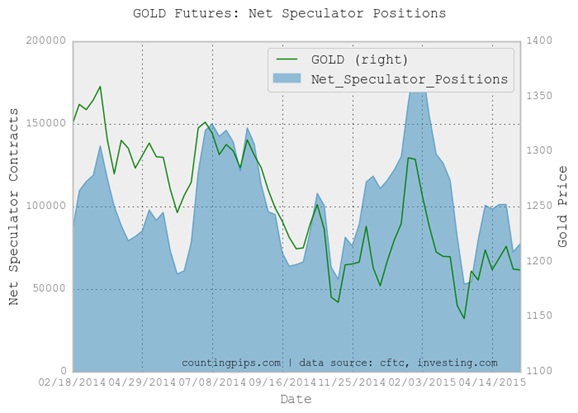

Gold speculator and large futures trader positions rebounded modestly last week following a sharp decline the previous week that brought gold speculator positions to the lowest level since March 24th, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Comex gold futures, traded by large speculators and hedge funds, totaled a net position of +77,440 contracts in the data reported through May 12th. This was a weekly change of an even +5,000 contracts from the previous week’s total of +72,440 net contracts that was registered on May 5th.

The results in the weekly net speculator positions (+5,000 net contracts) was due to a rise in the weekly bullish positions by 6,152 contracts that overcame the decline in the weekly bearish positions that fell by 1,152 contracts.

Over the weekly reporting time-frame, from Tuesday May 5th to Tuesday May 12th, the gold price edged slightly lower from approximately $1,193.20 to $1,192.40 per ounce, according to gold futures price data from investing.com.

Gold Commercial Positions:

In the commercial positions for gold on the week, the commercials (hedgers or traders engaged in buying and selling for business purposes) raised their overall bearish positions to a net total position of -77,502 contracts through May 12th. This is a weekly change of -3,340 contracts from the total net of -74,162 contracts on May 5th.

Gold Commercials Charts

Weeks of Large Trader Non-Commercial Gold Positions

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

********

Courtesy of http://countingpips.com/