Gold Speculators Pushed Net Bullish Positions Higher For 2nd Week

Gold positions show strongest weekly gain since January

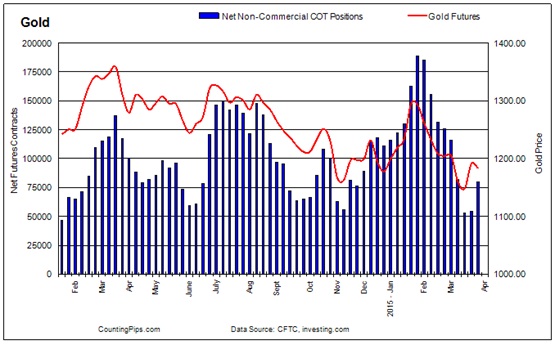

Gold speculators and large futures traders sharply boosted their gold bullish bets last week to the highest level in three weeks and notched a second straight weekly rise, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Comex gold futures, traded by large speculators and hedge funds, totaled a net position of +80,019 contracts in the data reported through March 31st. This was a weekly change of +25,738 contracts from the previous week’s total of +54,281 net contracts that was registered on March 24th.

The weekly gain in the net speculator positions, by +25,738 contracts, was due to an increase in the weekly bullish positions by 4,584 contracts combined with a decrease in the weekly bearish positions by 21,154 contracts.

Last week’s gain represents the largest weekly rise since January 27th when weekly net positions increased by +26,470 contracts.

Over the weekly reporting time-frame, from Tuesday March 24th to Tuesday March 31st, the gold price dipped from approximately $1,191.40 to $1,183.20 per ounce, according to gold futures price data from investing.com.

Large Trader Non-Commercial Gold Positions

COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data.