Gold Stocks: Up, Up And Away!

A year ago, I predicted that any US stock market sell-off would be accompanied by a dramatic surge in the price of GDX and GDXJ.

That’s exactly what happened; the stock market tanked and key gold stocks soared.

This year, I’m predicting that any major US stock market crash will again be accompanied by the soaring price of the gold producers…

But I’m also predicting that most CDNX-listed junior explorers are set to soar too!

America’s top money printing cheerleader (President Trump) brags that his government essentially has the Chinese government cowering in a corner. He claims they are ready to throw in the white towel in the trade war. Reality check:

It’s obvious that major money managers are becoming very concerned about these tariff taxes.

This is the horrifying US stock market chart.

On the one hand, private enterprise must be respected. Great companies exist and prosper in the socialist nations of Europe and in China. They will continue to prosper.

The drive of entrepreneurs must never be underestimated, even in the harshest conditions.

On the other hand, when governments unveil growth-negative policies like tariff taxes and money printing, stock markets can experience dramatic declines. These declines are usually temporary, but they are very painful.

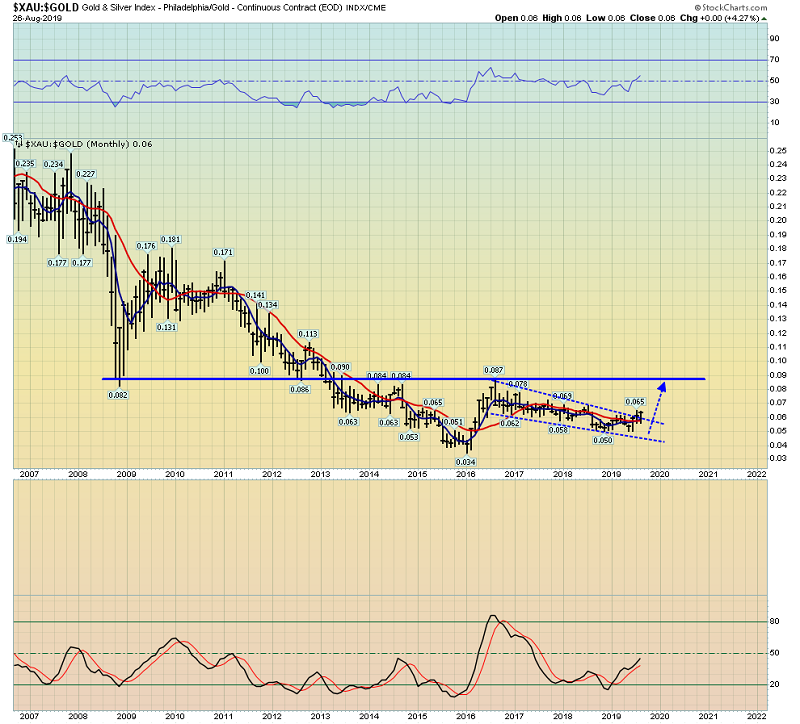

This is the important gold stocks versus gold chart.

I call it the “Just buy” chart, because there really isn’t much else to do here except buy, buy, and buy!

That’s especially true for core position enthusiasts. Gold stocks are incredibly cheap compared to gold bullion.

Also, I believe investors can make the most money in the market buying when their analysis has gone awry. The “Golden Beeline” chart.

Many gold analysts have tried to “top call” gold since the rally from about $1167 began. This has been a mistake and I believe it will continue to be a mistake in the months ahead.

A gargantuan bull continuation pattern is forming on the weekly gold chart. It’s an inverse H&S pattern with a potential neckline in the $2000 area.

This is not a time to sell gold or top call it. It’s a time to buy, sit back, and watch those positions fly! Here’s why:

Institutional money managers are adding gold to their portfolios. These are not highly leveraged hedge funds gambling on the COMEX.

They are unleveraged institutions. They are serious players who understand the destructive nature of the Trump tariff taxes. These taxes are being implemented as the business cycle peaks and with relentless ramp-up of US government spending and debt.

This horrifying scenario has superstar managers like Ray Dalio predicting serious inflation and potential rioting in the streets.

Please click here now: Top money managers are concerned that stagflation is emerging as the Fed is forced to print money and cut rates to offset the taxes. They are not buying gold, silver, and the miners for a “quick flip”. This is long-term allocation.

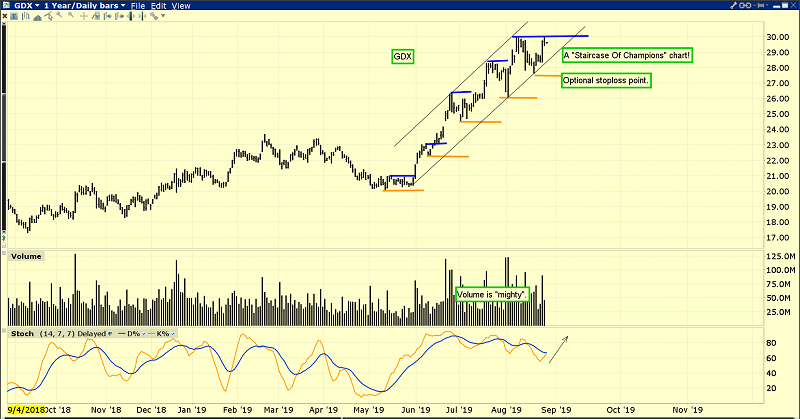

This is the fabulous GDX chart.

Profit-lock enthusiasts can buy a breakout over $30 and place a stoploss at $27.50. A move above $30 opens the door for a violent surge to $37-$39.

From there, core positions can be added on a pullback to about $30. Nervous investors can buy put options to manage their emotions, but everyone else should be in “Buy & Fly!” mode alongside the institutional money managers. Today’s Superman is a man of gold and looking at GDX today, I believe he would say… Up, up, and away!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Golden Junior Rockets!” report. I highlight junior miners trading under $2/share that are beginning to soar, with key buy and sell prices for each stock.

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: