Gold SWOT: The Gold Price Could Trend Higher Based On Historical Seasonality.

Strengths

- The best performing precious metal for the week was silver, up 1.84%, as hedge fund managers raise their new long position in the futures market. Bloomberg reported on Friday that the Securities and Exchange Commission said the recent wave of applications filed by asset managers to launch spot bitcoin exchange-traded funds (ETFs) are "inadequate." This includes those of Blackrock and Fidelity Investment, stating they were not sufficiently clear and comprehensive. Bitcoin has been a headwind to gold this year, so perhaps this news will cool down the recent enthusiasm.

- B2 provided an update that serves as an important de-risking step for the recently acquired Goose Project, providing increased confidence in the timeline, which remains on-track for the first quarter of 2025. B2 gave an updated capex estimate, with the remaining cost to completion now set at C$550M. In addition, B2 has committed to accelerating the underground mining schedule and is currently progressing geotechnical and engineering studies, which could increase average gold production to over 300,000 ounces per year.

- Endeavour Mining Plc is reported to have made a takeover approach to Kinross Gold in recent months that was rebuffed on differences over valuation, according to Bloomberg. Kinross was thought to be entertaining or drawing some bidders for its assets. Ideally, a third party may need to step in to split the deal cost and take what assets provide the most synergies with existing operations. However, there is no certainty the discussions will be reopened. This is another sign of a strengthening market for acquisitions.

Weaknesses

- The worst performing precious metal for the week was palladium, down 4.26%. Palladium fell to the lowest in more than four years on expectations that South African producers will ramp up supplies going into the earnings season. The metal, primarily used in catalytic converters, declined by as much as 6.6%. Sentiment toward it has worsened in recent weeks because the woes of South African national utility Eskom Holdings SOC Ltd. have not severely impacted output by the No. 2 producer. In the longer term, the metal faces structurally lower demand as automakers switch to cheaper platinum for gasoline cars and consumers increasingly opt for electric vehicles.

- Thirty years ago, in 1992, South Africa was by far the world's largest gold producing nation, accounting for 27% of total global production. It now accounts for 3% of the global total. South Africa's gold production is down 85% from 601 tons in 1992 to 93 tons in 2022. Meanwhile, growth in production from Russia, China and several newer producer nations has offset South Africa's decline.

- South Africa Platinum Group Metal ("PGM") equities are down 32% year-to-date, on average, partly reflecting negative sentiment related to Eskom operational impact, which perversely should restrict supply and investment and therefore support higher metal prices. SA PGMs are discounting metals prices to perpetuity below current spot prices.

Opportunities

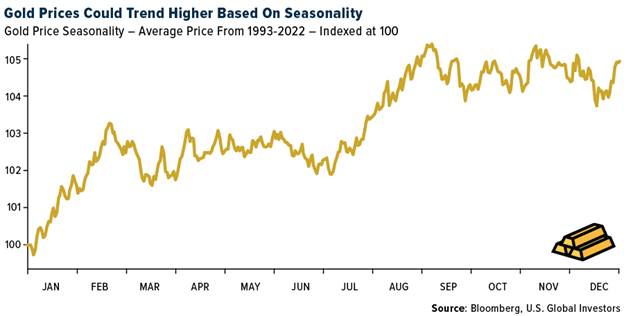

- The chart below shows the past 30 years of gold prices averaged by week and reindexed to 100. There is a distinct seasonal pattern that is depicted by the reoccurrence of gold prices tending to rise in the June – July time window. This seasonal lift in prices is largely attributed to the jewelry industry restocking for the upcoming fall and spring holidays. Now may be an opportune time to consider adding gold and/or gold stocks to your portfolio.

- Hot Chili Limited announced a $15 million binding investment agreement with Osisko Gold Royalties. The royalty includes a 1.0% Net Smelter Return (NSR) royalty on copper and a 3% NSR royalty on gold across Hot Chili's Costa Fuego Copper-Gold Project in Chile. Hot Chili's Costa Fuego project has received positive results from the recently released Preliminary Economic Assessment (PEA) and is set to commence a 30,000-m drilling program following the closing of this agreement with Osisko to further upgrade resources as well as fund the advancement of the Costa Fuego PFS and general project development.

- Newcrest Mining Ltd. may have enough gold and copper deposits at its Red Chris project in Canada to open an entirely new section and extend mining in the area for decades, Chief Executive Officer Sherry Duhe said. Australia's biggest gold producer, which is set to be acquired by U.S. giant Newmont Corp., plans to decide later this year on whether to add underground block cave mining to its open pit operations at Red Chris.

Threats

- Gold prices have typically also broadly tracked with gold ETF holdings – a rising gold price usually comes alongside gold ETF inflows and vice versa. Yet since the start of November, gold rallied as much as 25% while gold ETF holdings stayed stubbornly flat.

- Even if it is trading around a record high of $2,000 these days, gold is likely to remain so for the foreseeable future. According to a new study from the National Bureau of Economic Research, gold prices have followed some standard principles since at least 1990. To put it simply, gold prices decline when real interest rates rise. That is because gold itself has zero direct yield, so at higher interest rates the opportunity cost of holding gold goes up.

- According to Morgan Stanley's historical analysis on gold, which has focused on real yields versus real gold price, has been shifting. Running this analysis had an R2 of 92% in 2018-2021, which fell to 63% in 2022 and is now just 30% year-to-date. The group expects gold somewhere below $1,300 per ounce and not the $1,930 per ounce it's at today. Its price forecasts have upside to gold into year-end but have pushed out the timing of peak prices and brought targets down modestly, now calling for gold to reach $2,100 per ounce by the first quarter of 2024.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of