Maund On Gold

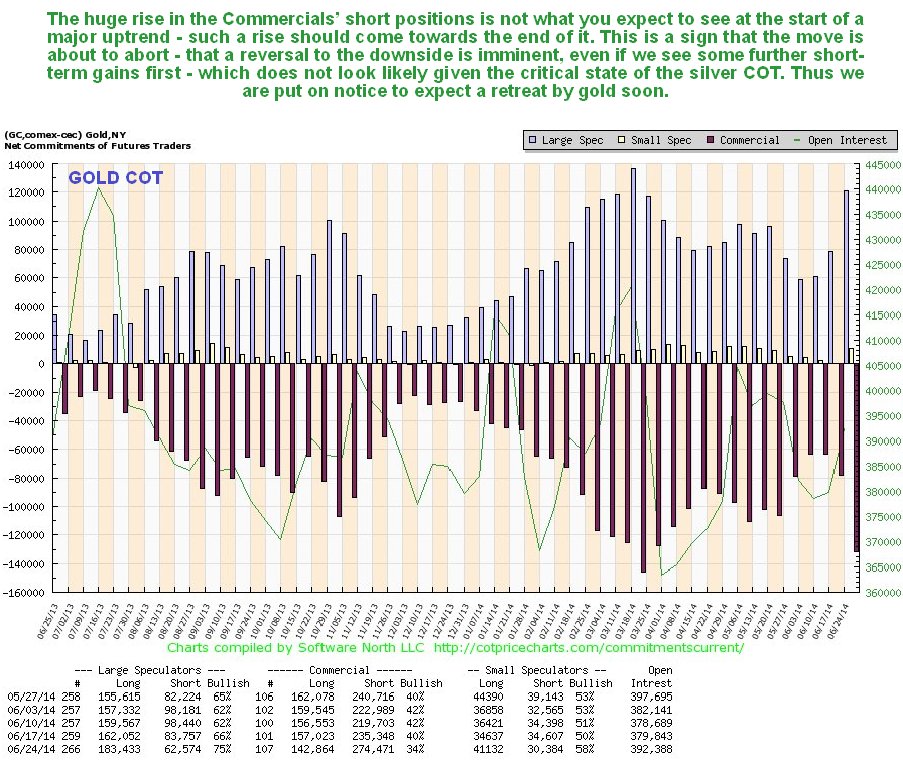

The latest COTs are indicating another false start for the Precious Metals sector. There was a very big jump in Commercial short positions in gold last week, but an astounding jump in Commercial short positions in silver, that is believed to be unprecedented. With both already at a high level as a result, it looks like we are in for a rerun of what happened after mid-March.

Gold is now at a crossroads, with the downtrend in force from late 2012 intersecting with the long-term uptrend in force from the start of the bullmarket back in 2001. Before considering the implications of the latest COTs, let’s look at the intersection of these trends on the charts to see why this is such an important juncture.

First of all, on its 5-year chart, we can see why gold is at an important juncture here, because it has arrived at resistance at the downtrend line in force from late 2012. This is why the explosion in Commercial shorts here is a very unwelcome development for bulls. Nevertheless the situation that has now developed may only require a relatively modest retracement that does not involve a breach of last year’s lows, as happened after the high Commercial short position in gold that had built up in mid-March.

On gold’s long-term 15-year chart we can see that the long-term uptrend remains unbroken and also how it is currently intersecting the downtrend in force from late 2012. Our earlier conclusion that a major uptrend should develop from here, or soon, was based in part on the strongly bullish behavior of beaten down junior and mid-cap mining stocks, and this may yet prove to be the case, although the latest COTs are pointing to another retracement first.

The reason why the sudden explosion in the Commercial’s short positions in gold and silver is such a negative development for the sector is simply because this is not what you expect to see at the start of an uptrend. Normally, an uptrend starts with widespread bearishness and skepticism on the part of the majority, which gradually eases as prices continue to march higher, but what has happened here is evidence that there is a large bullish crowd who have been waiting in the wings to pounce at the first sign of a major uptrend starting. The Commercials take the other side of the trade and the reason that their short positions have exploded is because the Large and Small Specs have suddenly bust out of the closet again and jumped in with both feet. These people need to be smashed before a sustainable major uptrend can get underway, and the latest data unfortunately shows that they are going to be.

Looking at the latest COT chart for gold we see that the data was reasonably positive just 2 weeks ago, then came a substantial rise before the massive jump last week that has already taken Commercial shorts close to their March peak. This is clearly is not what you want to see when a potential uptrend is still in its infancy at a time when gold has arrived at important trendline resistance – the conclusion is that gold is going to react back here, or soon, and hard.

On the long-term COT chart we can see that despite the sharp jump last week, readings are not that extreme historically, which is why the expected reaction may restore COT readings to a reasonable level before last year’s lows are reached.

Chart courtesy of www.sentimentrader.com

On gold’s 6-month chart we can see the sharp jump on good volume over a week ago. Normally we would expect to see the consolidation that we have seen over the past week lead to another upleg, but we should keep in mind that gold is now at resistance at the trendline shown on its 30-month chart, as already discussed, so it is at risk of dropping back again, perhaps after a false break higher.

Public Opinion on gold is in middling ground at this point…

Chart courtesy of www.sentimentrader.com

Rydex traders are negative on gold, which in itself is positive…

Chart courtesy of www.sentimentrader.com

There is a widespread assumption in the markets now that the stockmarket can’t drop, because the banks and the Fed are colluding and have got it all worked out so that the banks can continue to speculate in the stockmarket against the background of perpetually low interest rates. There is only one problem with this, and that is that companies have to make money. Despite the endless money pumping the forces of deflation are already circling and closing in on the US economy – you only have to consider the awful negative 1st quarter GDP figures to realize that – and it could well get worse in the 2nd quarter. A dropping GDP means worsening corporate results, and once players get cold feet because of this a really nasty self-feeding plunge could ensue, zero interest rates or not. The US is facing persistent and worsening stagflation involving a contracting economy and rising prices, with the economy severely weakened by wasting $6 trillion on the Iraq misadventure, which only benefitted the “defense” industry and a clique of criminals. If we see a broad based plunge in the markets, that is the circumstance in which gold could crash its support at last year’s lows and drop hard, but here we should note that generally, deflation is good for gold, as it was in the early 30’s, so after an initial drop, a la 2008, it should then stabilize and turn higher. This is only a threat at this stage but it is a threat worth staying aware of, particularly in view of the latest COTs.

On the site we look at ways to protect from loss in the event of the sector turning lower soon as expected, and also ways to capitalize on such a drop.