Mr. Palladium Punches Back

It has been a few weeks since we focused on palladium... and the last three weeks have been eventful for our new friend. He's been punched lower, but has crawled up off the mat each time. And now he appears ready to make another batch of new all-time highs.

If you've been following along, then you'll recall that Mr. Palladium became our new friend back in the late summer of 2018. Here are links to our most recent articles:

• https://www.sprottmoney.com/Blog/watching-palladiu...

• https://www.sprottmoney.com/Blog/what-is-mr-pallad...

Recall that as the COMEX precious metals were having a terrible time last August, palladium began to rise from the ashes. And it has been a steady rally since, rising from $832 on August 16 to a recent ALL-TIME high of $1431 on January 17. That's a five month gain of 72%!! Additionally, it's not as if this has been some sort of crazy, speculative blow-off. Instead, it's just a steady, relentless rise. See below:

From a historical perspective, this rally has been even more significant and impressive as price has moved to new ALL-TIME highs, easily eclipsing the levels seen during the supply squeeze of 2001, which only ended after Yeltsin's Russia came to London's rescue.

Over the past few months, we've documented for you that this is almost assuredly a physical supply squeeze in London, where the primary market for physical palladium delivery exists. Two sure signs of a supply squeeze are extreme lease rates and price backwardation. Mr. Palladium has seen both, and the situation continues today with 1-month and 3-month lease rates near 20% and the COMEX futures board in full backwardation that at times has neared 10%.

But it's not all sunshine and lollipops. Over the past three weeks, there have been days where:

• some physical metal has appeared

• lease rates have fallen

• COMEX shorts have been written

• and price has fallen

However, as you can see below, each time a wave of selling has appeared, price has rebounded. And now it's back to within $50 of the all-time high that many claimed would be recalled as some sort of parabolic blow-off.

Maybe the next step will be a double top near $1400? Maybe Putin's Russia will ride to the rescue, as Yeltsin did seventeen years ago? Maybe The Banks will manage to shove price backward through paper contract manipulation in New York? Maybe. Maybe not.

If this situation begins to spiral out of control in terms of price and physical supply, the impact upon The Banks' Fractional Reserve and Digital Derivative Pricing Scheme could prove devastating. And this could be the break for which we've all been longing. Why? Because the LBMA/COMEX palladium market is structured identically to the LBMA/COMEX gold and silver markets. Price and supply/delivery are managed through a complex web of leases, forward contracts, promissory notes, and unallocated accounts.

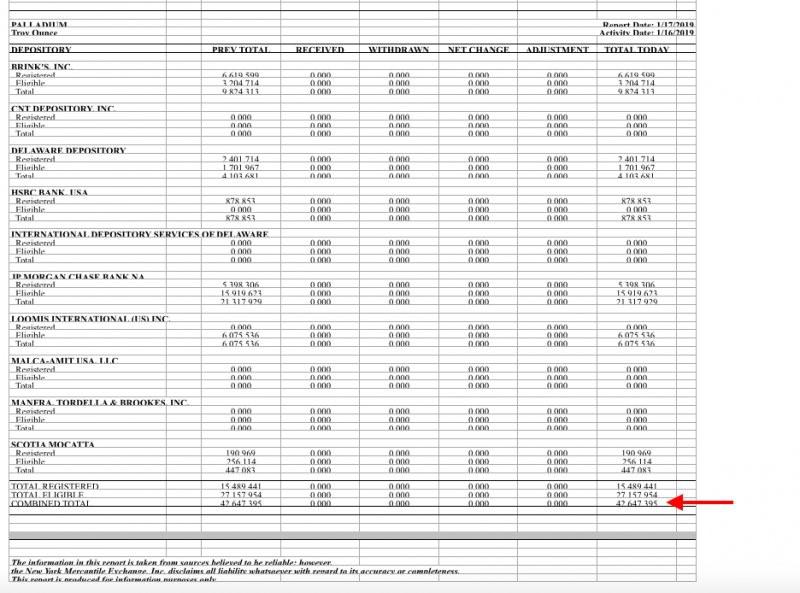

For example, the current amount of total open interest in COMEX palladium is 28,632 contracts. At an alleged 100 ounces per contract, those 28,632 contracts are the digital equivalent of 2,863,200 ounces of palladium. Well, the next question you should ask is " how much palladium does the COMEX have in its vaulting system"? The answer: about 42,000 ounces... in the ENTIRE vault... BOTH registered AND eligible.(Is this why the CME has already begun to tinker with the COMEX palladium "delivery" process? https://www.cmegroup.com/content/dam/cmegroup/notices/ser/2018/10/SER-8099.pdf)

This means there are sixty-eight digital/make-believe COMEX ounces for each physical ounce that is alleged to back them. If the LBMA truly runs dry of physical palladium in the weeks/months ahead, the next available stash of physical supply is in New York, and as you just learned, the leverage on COMEX of digital to physical is 68:1. Even at a supposed position limit of just fifty contracts or 5,000 ounces, it won't take long to drain the COMEX, too, and then what do we have? Complete pricing scheme collapse.

Should this happen, how long will it take for the global hot money sharks to smell blood in the water? Similar to the "bond vigilantes" of a few years back, after a failure in the LBMA/COMEX palladium market, could a run on the similarly-structured gold or silver markets be far behind?

And THIS is why Mr. Palladium matters. If he keeps crawling off the mat and moving to higher and higher highs, the pressure on the LBMA/COMEX system may become insurmountable. Thus, watch our new friend closely and hope that he keeps punching back in the days and weeks ahead.

*********