Opportunities Across The Gold Mining Space

Strengths

-

Typical of FOMC meeting weeks, we tend to see the precious metals take a hit. The best performing precious metal for the week was palladium, off 0.43 percent on little market moving news. Ford announced that it will add more downtime to five North American automobile plants due to a decrease in demand as inventories rise on dealer lots.

-

The gold price could soon recover, says Jason Schenker, president and founder of Prestige Economics, the reason being that the Federal Reserve might raise rates less rapidly because of low U.S. inflation. “The fact that the Fed members lowered their forecast for their own future Fed funds rate indicates that the Fed may again kind of undershoot what they’re predicting they’re going to do for rates,” Schenker told Bloomberg. This could end up being neutral to bearish for the dollar, which would help support the gold price.

-

Gold has begun to climb back toward $1,300 an ounce on safe-haven demand now that tensions between Washington and Pyongyang are steeply escalating. Following new U.S. sanctions against North Korea, the rogue Asian country’s leader Kim Jong-un threatened to detonate a hydrogen bomb in the middle of the Pacific Ocean. With the back-and-forth rhetoric intensifying, investors’ interest in safe havens, gold included, has been renewed.

Weaknesses

-

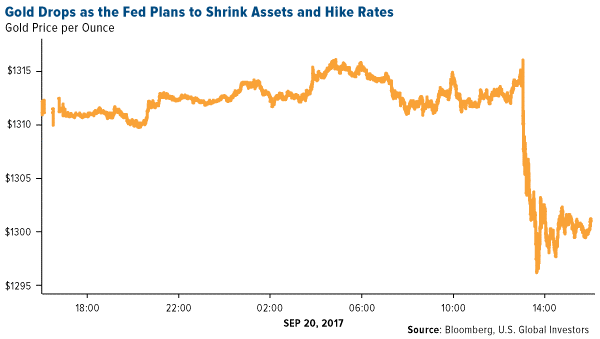

The worst performing precious metal for the week was platinum, off 3.77 percent. Platinum prices has been out of favor for the last couple of years, recently prompting Impala Platinum, the world’s second largest producer, to propose some job cuts in South Africa that could lead to supply disruptions if labor is not on the same page. Earlier this week, gold dropped below $1,300 an ounce as risks receded of another hurricane striking the mainland U.S. and as major stock market averages continued to hit record highs on a near-daily basis. In addition, a diplomatic resolution to the nuclear standoff with North Korea appeared likely, with Secretary of State Rex Tillerson saying the U.S. is seeking a peaceful conclusion.

-

The gold price responded negatively to Fed officials’ announcement that the central bank would begin unwinding its $4.5 trillion balance sheet as soon as October and also signaled additional rate hikes in 2018 following a December hike. Speaking with Bloomberg, RJO Futures’ Bob Haberkorn said that “the unwinding, coupled with the hawkish tone for December and the three hikes next year, could weigh on gold for the time being.”

-

The world’s 20 leading gold producers’ share of metal output is expected to fall to its lowest level in a decade in 2019, according to Bloomberg industry analyst Eily Ong. The mining group’s share of world output fell from 47 percent in 2010 to 39 percent in 2016, and could fall even further by 2019. “As gold producers’ focus shifts from volume to profitable ounces, their existing gold mines’ life expectancies have also continued to declined,” Ong writes.

Opportunities

-

Thursday and Friday of last week, Klondex Mines hosted a visit to its operations in Nevada to update the market on Hollister, Fire Creek, and Midas. We attended the site visits. Klondex is in a unique situation, having three, high-grade mines filling one centrally located mill at the Midas site. Overall, we would say investors and analysts came back with a favorable outlook. The share price outperformed the major gold equity ETF’s by over 550 basis points this week as several more positively toned analyst reports made the rounds. What we also think is noteworthy, was the quality of new people that have been attracted to Klondex, as operations have expanded, and the buy-in to the values of Klondex’s culture of safety at its operations. Prior to the trip, Klondex Mines completed the donation of the Rock Creek Lands to the Western Shoshone. For thousands of years, the Rock Creek Lands, about 20 miles northeast of Battle Mountain, Nevada, were used by the Western Shoshone. This was a goal of management and the board of Klondex to repair community relations with the Native Americans in the area which the previous owner of Hollister had ignored. Consequently, Klondex received drilling permits to now drill from the surface at Hollister to expand the exploration potential of the land package more cost effectively.

-

Wesdome Gold Mines announced management changes driven by the CEO, Duncan Middlemiss, with full support of the board. The current CFO, COO and VP of Corporate Development & Exploration were all replaced immediately, which completes a realignment of staffing started by the addition of Chairman Charles Page to the board a little over a year-and-a-half ago. We see Wesdome Mines, with its Kiena Deeps exploration target, becoming more catalyst rich heading into the fourth quarter.

-

With two of the bigger gold mining conferences for the year being held this week and next, there has been a swath of news releases distributed. Barsele reported a drill hole that intersected 19.75 meters grading 5.07 g/t gold, indicating continuity along a 100-meter gap between two lobes of the deposit. Jaguar Mining rose in excess of 25 percent on drill results that showed down plunge continuity of the principal ore body contained within the Banded Iron Formation. Both Golden Star and Red Pine Exploration reported double-digit grades from their respective orebodies that should lead to resource additions. In addition, Roxgold increased its production guidance for the year from 105,000-115,000ounces, up to 115,000-125,000 ounces.

Threats

-

According to U.S. Trade Representative Robert Lighthizer, President Donald Trump’s chief trade negotiator, China poses an “unprecedented” threat to world trade, highlighting the country’s massive subsidies to “create national champions” and “distort markets.” Because current global rules are too inadequate to address the problem, Lighthizer adds, the president should unilaterally impose tariffs on China and any other country that practices “unfair” trade policies. Doing so, it should be noted, could lead to a U.S. trade war with China, the second-largest economy in the world, causing dramatic price swings in commodities and other raw materials.

-

B&N Bank, a top-five closely held lender in Russia, has asked the country’s central bank for a bailout, reports Bloomberg, making it the second nationalization in less than a month. This highlights the complications accompanying the Bank of Russia’s efforts to clean up the financial sector after the dual economic shocks of a collapse in oil prices and international sanctions in 2014, the article continues. “The story of Otkritie, and now B&N, seriously raises questions about the actual state of private banks,” Dmitry Polevoy, chief economist for Russia at ING Groep NV in Moscow said.

-

With the debt-cap suspension expiring on December 8, Bloomberg reports that there is a growing sense among investors and analysts that the Treasury will have to “slow or hold off on the inevitable.” It is unknown how the Treasury will respond to the Federal Reserve’s tapering. “The mix of maturities it decides on has far-reaching implications for the world’s biggest bond market, with the potential to alter the shape of the yield curve for years to come,” the article reads.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of