The Opportunity Found In Adding Gold Mining Stocks To Your Portfolio

Strengths

- The new Apple watch could revive the allure of gold for young consumers. Apple, which called gold “uniquely luxurious” in its advertising, has a history of swaying consumer tastes. U.S., U.K. and Italian demand for wearables made out of gold has been cut in half over the past decade, according to data from the World Gold Council, as shoppers favored white-colored metals such as silver and platinum. Apple’s status as the arbiter of cool means its new $10,000 gold watch and yellow iPhones and MacBooks may entice consumers to buy gold wearables and ornaments again.

- South Africa’s Deputy Mineral Resources Minister Godfrey Oliphant said lessons learned from a record platinum-industry strike last year will help prevent a similar stoppage during gold wage talks in 2015. Pay negotiations between labor unions and gold mining companies are set to begin next month.

- Atico Mining announced it has drilled solid extensions to its El Roble copper gold mine, which comprises a series of massive volcanogenic sulphide pods. The extensions could meaningfully boost mine life at its Colombian property. In addition, the company reported the results for three diamond drill core holes, which included 86.4 m of 5.04 percent copper and 3.71 g/t gold and 116 m of 3.05 percent copper and 2.38 g/t gold.

Weaknesses

- Gold traders are the most bearish in four months on the outlook for a continuation in the dollar’s rise. Bullion slid 4.9 percent in the past nine days and this week reached a three-month low. Further, ANZ Bank cut its second quarter 2015 outlook to $1,100/oz from $1,240/oz while UBS lowered its three-month forecast to $1,170/oz from $1,200/oz.

- Allied Nevada Gold Corp. filed for Chapter 11 bankruptcy on Tuesday after negotiating a reorganization plan that gives holders of $315.5 million in senior unsecured notes 75 percent of the new common stock when it emerges from bankruptcy. Noteholders providing bankruptcy financing are to convert $25 million of that debt into the rest of the new equity.

- The precious metals analysis consultancy Metals Focus revealed that the world’s top ten gold miners had moved into a combined negative cash flow position during the last quarter of 2014. This is after three consecutive quarters where they had recorded positive free cash flow. Perhaps most significant was a 9 percent quarter-over-quarter rise in capital spending, mostly sustaining capital expeditures. The consultancy notes that while in 2010-2013 sustaining capex accounted for less than 50 percent of total capex, in the fourth quarter of last year that figured had risen to around 70 percent. Another factor pointed out by Metals Focus is the high level of net debt within the grouping. Cumulatively it stood at $27.5 billion at the end of 2014 and will take several years to pay off based on earnings before interest and tax. If the gold price remains weak or falls further it could take even longer.

Opportunities

- Kirkland Lake Gold reported financial results above expectations on lower costs. Fiscal year 2015 production guidance was revised upwards to 153,000–157,000 ounces as operational improvements take hold.

- Lake Shore Gold announced results of its annual reserve update which included a 29 percent increase in total reserves to 773,300 ounces. The company said it has numerous opportunities to grow resources through drilling for extensions at the existing operations and for new discoveries. In 2014, exploration drilling to the southwest of Timmins West Mine resulted in an important new discovery within 500 meters of Thunder Creek. The 144 Gap Zone is a large zone covering 350 meters along strike and 350 meters down dip, which remains open for expansion. The company continues to generate net free cash flow, with cash and bullion having increased more than $10 million to approximately $72 million. The company also continues to reduce debt, with three payments remaining in their senior secured credit facility.

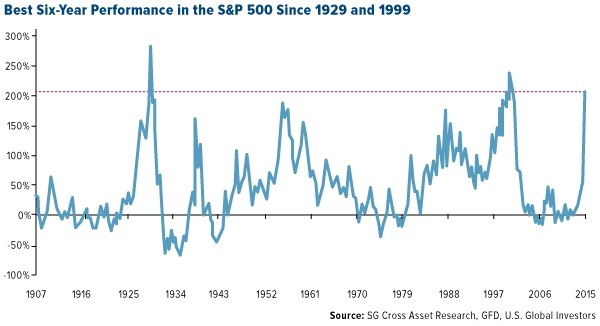

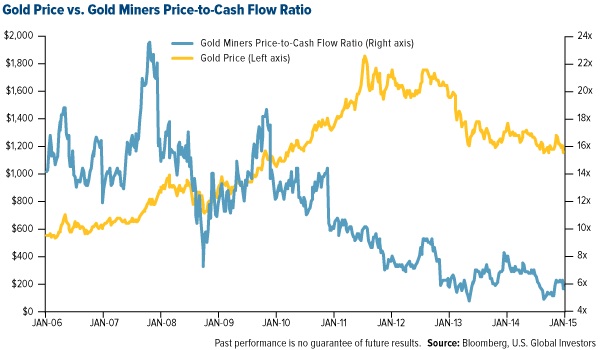

- The charts below show that the S&P500’s returns in the past six years have been the best since 1929 and 1999. In addition, earning momentum is U.S. stocks has reversed and is now in a strong downtrend. Contrasting record gains to record lows, the price to free cash flow multiple of gold miners currently stands at 5.7x, making them historically very cheap. Given the stark contrast, it would be prudent to consider adding gold mining stocks as a means of portfolio diversification.

Threats

- Venezuela’s central bank is in talks with Wall Street banks to create a gold swap that would allow it to monetize some $1.5 billion of the metal held as international reserves. Under the swap, the central bank would provide 1.4 million troy ounces in exchange for cash. After four years, it would have right of first refusal to buy the gold back. Venezuela would have to pay interest on the funds but the central bank would most likely be able to maintain gold as part of its foreign currency reserves. The country faces a cash crunch due to the combination of low oil prices and hefty debt payments, including the maturity of a 1 billion euro bond this month and coupon payments of nearly $700 million in April.

- All eyes are on India’s gold savings plan as it could negatively impact demand for physical gold in the country. With Indian households estimated to own about 20,000 tonnes of gold, even if 5 percent of it were to be unlocked by the new gold deposit scheme, it might reduce the country’s imports by 1,000 tonnes. For 2014, the country imported 769 tonnes of gold.

- According to commodities analysts, the plunge in the gold price following strong U.S. jobs data could be repeated over the coming months. There is speculation that jobs, which were never a big driver of gold, have now become a very big one.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of