Record Number Of Fund Managers Believe Gold Is Undervalued

Strengths

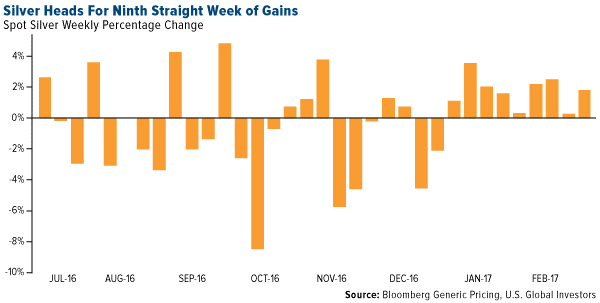

- The best performing precious metal for the week was platinum, with a gain of 2.32 percent and closely followed by silver and then gold. Gold traders and analysts surveyed by Bloomberg continue their bullish stance on the yellow metal for the ninth straight week, as prices climb to November highs. Silver is also on a roll, reports Bloomberg. As you can see in the chart below, silver is up for the ninth straight week, which is the longest run of gains since May 2006. A 9.6 percent decline in supply over a 36-month rate of decline in supply for the metal is the steepest production decline since the World Bureau of Metal Statistics began tracking production in 1995.

- According to a spokeswoman for the Finance Ministry, Ecuador has repaid a $400 million loan to Goldman Sachs due on February 20 of January 2017, reports Bloomberg. The $400 million loan included interest calculated at a three-month LIBOR rate, plus 4 percent. Thus, there is no threat that the gold collateral for the loan would be monetized.

- Russia increased its gold reserves by 37 metric tons in January, reports Sputnik News, which is equivalent to more than a million troy ounces. Last month’s purchase comes after a pause in December when Russia did not buy any gold.

Weaknesses

- The worst performing precious metal for the week was palladium, down 0.81 percent. Toyota announced mid-week that they have developed a new smaller catalytic converter that uses 20 percent less platinum group metals, but is just as effective as current technology. Toyota plans to introduce the new module into its production lineup later this year.

- Following the Fed’s rate hike outlook earlier this week, the dollar strengthened sending gold to its lowest in nearly a week, reports Bloomberg. Philadelphia Fed President Patrick Harker said that a March rate hike is not off the table. “There seems to be growing consensus among FOMC members that there is an increasing urgency to normalize rates; hence the narrative that every meeting is a ‘live’ meeting,” said Jonathan Chan, an analyst at Phillip Futures in Singapore.

- Primero Mining reported that its December 31 gold reserves fell 24 percent and its silver reserves dropped 20 percent year-over-year, reports Bloomberg. The company says the decrease is primarily attributable to mining depletion and modified modeling parameters.

Opportunities

- Gold continued near a three-month high this week as the dollar weakened, reports Bloomberg. The price movement followed U.S. Treasury Secretary Steven Mnuchin’s remarks that he expects low borrowing costs to persist. In an interview with CNBC, Mnuchin said that issuing ultra-long Treasury bonds is something we “should seriously look at,” with interest rates likely to stay low for a long period.

- After selling all of his gold on November 8 following the election, Stanley Druckenmiller has returned to the yellow metal. While his decision may have been a smart one, Trevor Gerszt writes, it was only smart in the short-term. “Contrary to his prediction, the U.S. Dollar Index began to see significant declines beginning in late December, through January,” Gerszt says. It’s important to remember that gold is not a “get rich quick” investment. Hedge fund manager David Einhorn is also a proponent of gold right now, reports Bloomberg. “Our long-term outlook remains bullish,” for the metal, Einhorn said. “The new Trump administration comes with a high degree of uncertainty, and its policy initiatives appear to be focused on stimulating growth and, with it, inflation.”

- According to the latest fund manager survey by Bank of America Merrill Lynch, gold was viewed as the best hedge against protectionism, reports FTAdviser. In addition, a record amount of fund managers have said gold is undervalued, backing its safe-haven qualities in the event of a rise in anti-trade policies. Similarly, in a recent report from Morgan Stanley, the bank reviews why it is bullish on China, highlighting the Asian nation’s transition from a middle-income nation to a prosperous, high-income nation (sometime between 2024 and 2027). This will likely lead to an increase in gold consumption with more disposable income.

Threats

- Philippines lawmakers will be deliberating on the fate of Environmental Secretary Gina Lopez’s fate as DENR secretary tomorrow. Currently, Lopez’s confirmation is facing opposition because of her decision to cancel 75 agreements for mining projects near watersheds, saying that no new contracts will be issued in sensitive areas. The Philippines president is back and forth on the matter – originally backing Lopez, but more recently deciding to observe due process, and then again using language supportive of her stance.

- The World Bank continues its outlook on gold, writes Kitco News, and it’s not a positive one. John Baffes, the lead author of the bank’s quarterly Commodity Markets Outlook report, reiterated his call that gold could fall 8 percent this year. The forecast, which came out in the bank’s January report, remains grim roughly one month later.

- Although a bright outlook for gold in the first quarter has become as predictable as spring, explains Gadfly, over the past four years the rally has only held throughout the entire year one time, in 2016. Perhaps this means that gold’s strong performance may be nearing its end. Gold prices has always shown a pronounced seasonality, driven largely by the period from early November to mid-February, but of course there was no Trump Whitehouse in the prior four-year study Gadfly examined.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of