Retire Happy With Dollar Cost Averaging

Last week I had the pleasure of attending and presenting at the Oxford Club’s 21st Annual Investment U Conference in St. Petersburg, Florida. The main topic was the current retirement crisis. Baby boomers are reaching retirement in worse financial shape than the previous generation—a phenomenon we haven’t seen in at least six decades.

So how can we reverse course and assure future generations are financially prepared to leave the workforce?

A common theme running through many of the Oxford presentations was to start investing early and to take advantage of compound interest.

This is so important. Albert Einstein once described compounding as “the eighth wonder of the world.”

If you’re reading this and have kids or grandkids, I urge you to help them on the path to participating in the market now. It doesn’t require as much capital as you might think—especially if you’re investing with dollar cost averaging.

What is does require, though, is discipline. Put a long-term plan in place and let compound interest work its magic.

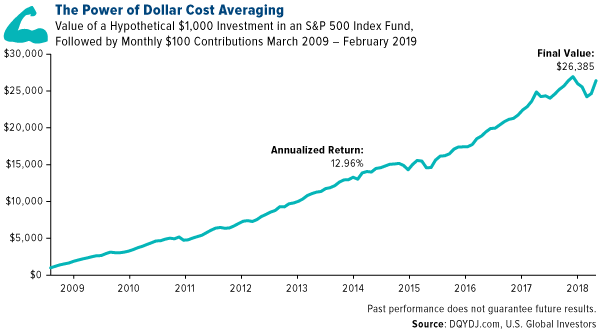

I’ve shared this chart with you before, but I think it’s worth sharing again. It shows a hypothetical initial investment of $1,000 in an S&P 500 Index fund in March 2009. Ten years later, after regular monthly contributions of only $100, the value of that initial investment grew at an annualized 12.96 percent to more than $26,385. Investors who had the discipline to stick with this plan and reinvest the dividends were rewarded handsomely.

Remember, the illustration above includes only the period during the 10-year bull market, and there’s no guarantee that the good times will continue.

But with dollar cost averaging, some of the guesswork involved in market timing is eliminated. Our own plan, which we call the ABC Investment Plan, automatically lets you purchase more shares when prices are low and fewer shares when they’re high.

The ABC Plan doesn’t assure a profit, of course, or fully protect against losses. No investment plan can guarantee those things.

Nevertheless, because it requires only a small initial investment, I think it’s a great way to get a young person started in today’s market. The Plan is also helpful for people who might be worried about their retirement goals but unsure how to build their wealth. It’s never too late to start participating.

The 10 Percent Golden Rule

I’d like to address a question I received over email last week from an investor. He asked for clarification on my 10 Percent Golden Rule. As you know, I often recommend a 10 percent weighting in gold, with 5 percent in physical gold and 5 percent in gold mining stocks.

“What does ‘weighting in gold’ actually mean?” he wrote. After explaining that he already owns a number of gold and silver coins, he asked how he knows if he has enough.

First of all, I think these are excellent questions.

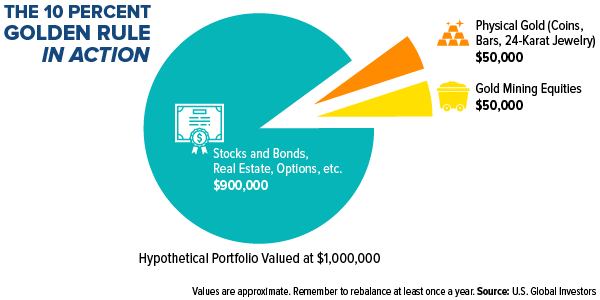

The best way to show what I mean is with a visual. Below is a hypothetical portfolio of stocks, bonds, real estate, options, hard assets and more. To keep things simple, let’s say the total portfolio value is $1 million.

Using the 10 Percent Gold Rule, your total gold allocation would be valued at approximately $100,000, with $50,000 in physical gold (coins, bars and 24-karat jewelry) and the remaining $50,000 in gold mining equities, including mutual funds and ETFs.

Of course, asset prices are always fluctuating, which is why I also remind investors to rebalance their portfolios at least once a year. If gold shoots up in price, it might make sense to take some profits. If it plunges in price, consider it a buying opportunity.

The Fear Trade Is Heating Up Gold Mining Stocks

As a reminder, there are a number of important reasons why the 10 percent rule might make sense.

For one, a certain amount of gold has been shown to improve a portfolio’s Sharpe ratio, or its risk-adjusted returns relative to its peers, based on standard deviation. The higher the ratio is over its peers, the better the risk-adjusted returns. One recent study found that an institutional portfolio with a 6 percent weighting in gold had a higher Sharpe ratio than one without any gold exposure. This means that volatility was reduced without hurting returns.

Yields are sliding all over the world right now on concerns that the global economy is slowing. Here in the U.S., the 10-year Treasury yield ended the week at 2.41 percent, after President Donald Trump’s nominee for the Federal Reserve Board, Stephen Moore, said he was in favor of cutting interest rates half a percentage point. Normally, monetary easing is a sign that policymakers are trying to stave off an economic slowdown.

With regard to our discussion here, gold has historically traded inversely to bond yields. When yields have fallen, the yellow metal has shined.

Gold mining stocks have behaved similarly. Take a look below. What the chart shows is the inverse relationship between gold mining stocks and the real 10-year Treasury yield—“real” meaning inflation-adjusted. As you can see, gold stocks soared in the summer of 2016 as yields deteriorated and finally dipped below zero.

Today, yields are similarly on a downward path, boosting gold stocks. From its 2019 low on January 22, the NYSE Arca Gold Miners Index is up more than 14 percent.

A program of regular investing doesn’t assure a profit or protect against loss in a declining market. You should evaluate your ability to continue in such a program in view of the possibility that you may have to redeem fund shares in periods of declining share prices as well as in periods of rising prices.

Sharpe ratio is a measure of risk-adjusted performance calculated by subtracting the risk-free rate from the rate of return for a portfolio and dividing the result by the standard deviation of the portfolio returns.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The index benchmark value was 500.0 at the close of trading on December 20, 2002.

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC. This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of