Something’s Got to Give

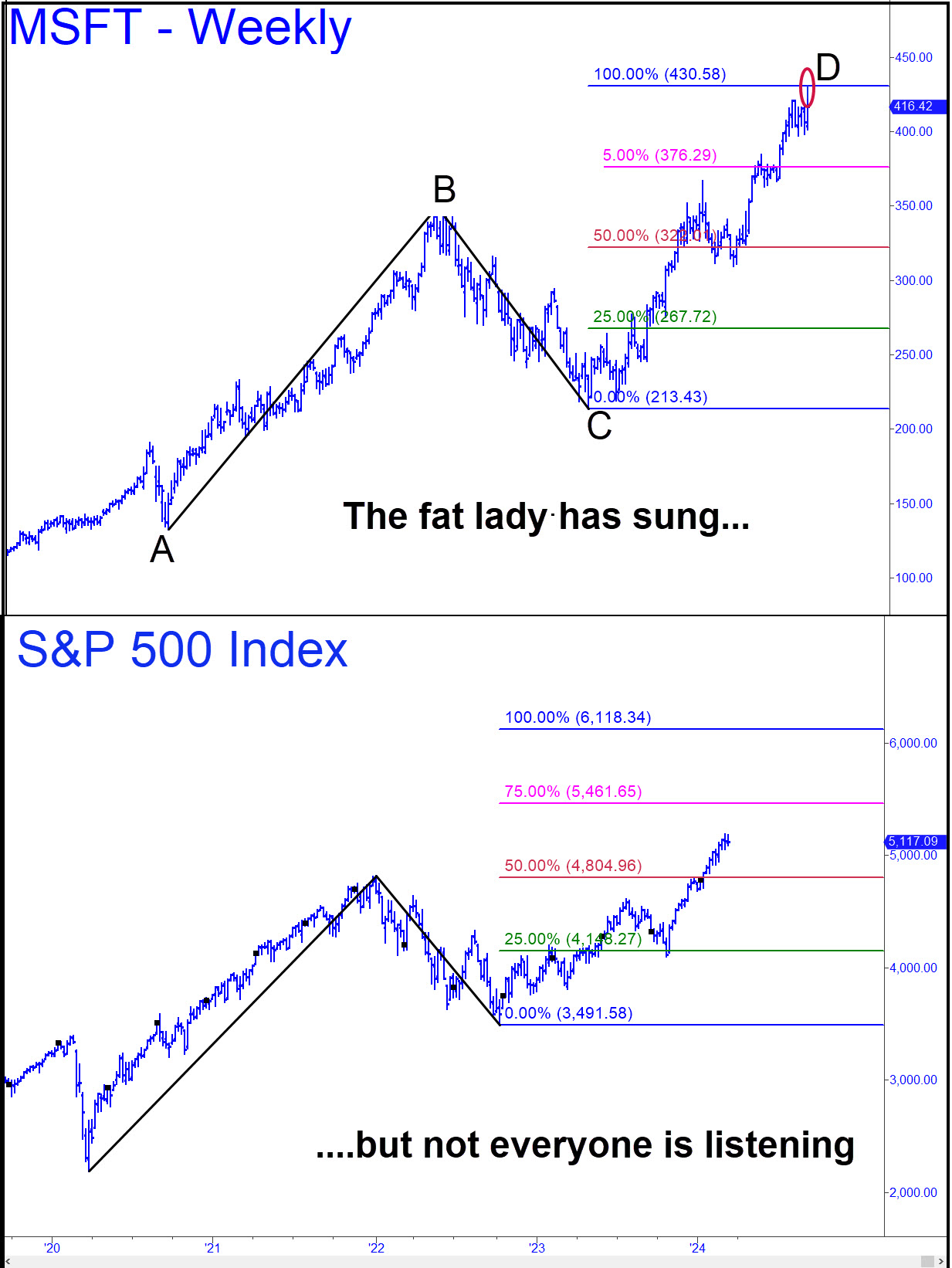

For nearly a year, I’ve promoted the idea that the post-covid bull rampage would end when Microsoft shares hit $430. They effectively achieved that benchmark on Friday with a pre-dawn print at 428.95 that gave way to a $16 plunge. If this was not THE top, it certainly felt like A top, and a potentially important one. However, before we draw any conclusions, let’s see if the selloff gets legs, since we don’t want to underestimate the power of a market that has been in the grip of mass psychosis since October. If there were any doubt about this, consider how stocks have rallied into the Fed’s decision to stay tight even after investors had deluded themselves into expecting aggressive easing in 2024.

Originally I’d picked Apple as our infallible bellwether, because it is the most valuable company in the world, and because its shares are so heavily owned by institutions. But so are Microsoft’s, with a key difference: Although iPhone sales are poised to implode in the severe economic downturn that’s coming, Microsoft is unlikely to feel much pain even in the hardest of times. That’s because revenues from Microsoft 365 will continue to flow from more than 60 million subscribers, regardless of the economy’s condition. The company’s earnings are nearly bomb-proof, and that it is why it is arguably the best stock in the world to own, as well as the most important stock to follow. When it is rising strongly, the broad averages cannot fall; if it falls, it will take the broad averages with it.

What If?

However, the technical picture is not complete without considering the very bullish chart of the S&P 500. It says that before the 15-year-old bull market ends, the S&Ps are likely to hit 6118.34, a 20% gain from current levels. How do we reconcile this with signs that MSFT may have peaked? A plausible answer is that both are topping but will resume their respective uptrends after significant corrections. A hard fall seems likely for Microsoft, if not necessarily for the S&Ps, because the software giant’s ABCD uptrend is so clear and compelling. It’s tempting to say there’s no way MSFT will simply blow past $430 without a struggle that features a punitive selloff and then a running start to new all-time highs. If so, the bull-market target would rise to 456.88, a Hidden Pivot derived from extending the pattern’s C-D leg to its maximum theoretical length. That would avoid having to use the bigger pattern’s puny December 2018 low at 93.96 as the starting point for the biggest bull market of them all. We’ll revisit this conundrum if and when MSFT gets second wind following a correction from these levels.

********