The Upside Potential In Junior Gold Stocks

Our research continues to argue that the current record rebound in gold stocks will continue. Every time we’ve predicted a correction, the weakness in the sector has been only a fraction of what we expected in both price and time. New bull markets that follow epic bear markets typically show exceptional strength in their first year. This bull has been no different. Thus, we expect the strong performance to continue. Today, we share a few reasons why the junior sector is poised to outperform in nominal and real terms.

Juniors typically outperform once the new bull is established and metals prices are trending higher. The large cap miners perform best at the very beginning of the new bull. Later on, their performance in relative terms (against metals and juniors) weakens. Naturally, once the trend is established and sentiment improves, investors take on more risk. That benefits the junior sector. Moreover, that point time is when larger companies have the financial strength and optimism to acquire the smaller or junior companies. That is another positive for juniors.

The current rebound in juniors as compared to the past still has plenty of upside potential. Take a look at the bull analog chart below. My junior gold index currently contains 18 companies and has a median market capitalization of about $350 Million. It has been reconstructed several times dating back to 2000. While the index has already gained 200% in the past six months, if it follows the previous two bull cycles it could potentially double in the next seven months and then double again after that!

Junior Gold Stocks Bull Analog

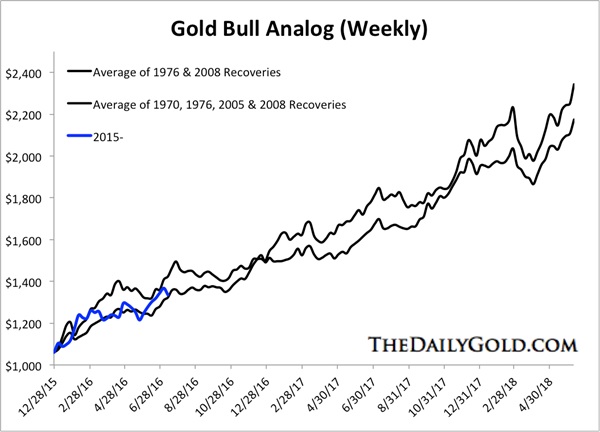

The junior sector should see an increased benefit if $1300-$1400 Gold becomes a floor and Gold continues to rise. The weekly Gold bull analog below shows that Gold’s recovery has been following the weaker of the two analogs. If that continues, Gold could retest its all-time high by the end of next year!

Gold Bull Analog

Be advised that no one can predict the future -- and these are projections based on a limited history. That being said, we believe the fundamentals for the junior sector have never been better. Moreover, there is a strong precedent for the sector to go gangbusters in the years ahead. We did not even mention the full blown mania of the late 1970s…and the mini-mania that occurred from 1993 to 1996. In short, we believe the precious metals sector continues to offer upside potential. However, the junior space both in real and nominal terms offers the best risk/reward potential.

********