U.S. Dollar Forecast

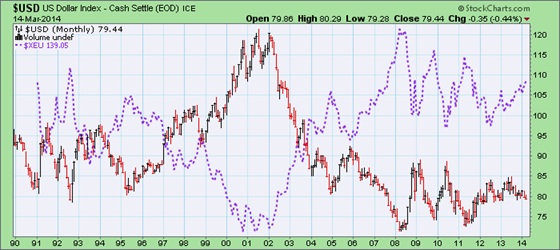

The US Dollar Index is on the verge of substantially rising in value during the next couple of years. There are a number of reasons for this prediction. Firstly, the US$ is grossly over-sold (ie under-valued). Since 2001 the greenback has lost more than one-third of its value, falling from 120 to 80.

To be sure a falling US dollar has imposed negative conditions on the nation’s economy and its population. Firstly, it has squeezed inflation down to its minimum expression. Inflation to an economy is the equivalent of blood pressure to a human. Slowly rising inflation acts as a fuel to promote economic growth AND JOBS CREATION. Conversely, slowly declining inflation is the fastest road to an economic depression AND HIGH UNEMPLOYMENT (ie the 1930s Great Depression when the US Unemployment Rate was 25%, exacerbated by a negative inflation rate of -5.3% average from late 1929-1933). In essence a moderately rising US dollar will boost inflation to feed a growing economy…which in turn will substantially reduce UNEMPLOYMENT…which is a cardinal objective of Fed Chair Janet Yellen.

OH!!! There are some economic ‘delusional quacks’ out there that falsely assert the present U.S. Unemployment Rate of 6.6% is considered near full-employment! OH YEAH…then how do they “rationalize” (a polite expression for BULL SHIT) that there are today nearly 50 Million Americans on Food-Stamps?! If 50,000,000 Americans need Food-Stamps, it means they are UNEMPLOYED OR UNDER-EMPLOYED. HELLO Fed Chair Janet Yellen…Can you hear me?!

Technical Analysis strongly suggests the US Dollar may soon reverse upward via a bullish Triple Bottom – see chart:

Moreover, notice how the COT positions of Commercial Hedgers and Large Traders has pinched down to near ZERO. The last time this happened was in February 2013, when the US dollar soared from 79 to 85 in the next five months.

Technical Analysis patterns dictate that one is obliged to conclude the US currency is under-valued at these low levels…and therefore is highly probable it will strengthen from these low values.

If T-Bonds fall…interest rates will rise…thus fuelling inflation higher

There are many advantages of High Interest Rates – And here are some of the reasons why we need higher interest rates. - See: http://www.thefiscaltimes.com/Columns/2012/06/29/7-Reasons-the-Fed-Should-Raise-Interest-Rates#sthash.6QppBm1H.dpuf

Global Uncertainty Strengthens Dollar (Source: By Andy Waldock - Inside Futures)

Five years ago the financial world was coming to an end. The stock market tanked and interest rates went negative due to the unsurpassed flight to safety in U.S. Treasuries. Most of this was due to greedy lending practices that claimed to be championing President Clinton's thesis that everyone in America should be able to own a home. Lax lending requirements that were intended to get lower income earners into their own homes travelled up market and allowed upper middle and upper tier earners to refinance their houses at artificially low rates to buy second homes and Harley's. Once again, misguided bureaucratic endeavors have been perverted by greed. The roaches in China are beginning to surface and the banking system stress tests in Europe are uncovering the depth of this five-year-old issue and once again, the primary beneficiary of these actions will be the U.S. Dollar.

There are three global issues currently taking place that should combine to provide some strength to the Dollar in the medium term. First, we have uncertainty in Ukraine's standoff with Russia over the Crimean peninsula. Putin has strategically played his hand into the largest land grab since the end of WWII. Ukraine is unable to defend itself and their calls to the West for help are falling on diplomatic ears rather than military strength. The European Union can't afford to engage Russia militarily or, economically literally, nor figuratively. They possess neither the combined funds, nor the political cohesiveness to put together a coalition support force.

Secondly, the European Union led by the European Central Bank is currently implementing stress tests on the largest European banks. Remember that these tests are in response to the economic meltdown of five years ago. These institutions, which include sovereign, public and privately held banks cannot withstand a negative rating by the European Banking Authority which is overseeing the stress test implementation. The ECB on the other hand, cannot afford to have the European Banking Authority suggest that capital requirements should be raised due to the extremely fragile Eurozone economic recovery. In essence, it comes down to a wink and a nod behind closed doors thus rendering the entire process toothless.

Finally, China has allowed the first corporate bond default in 17 years. The Chinese economy has been the hottest of the hot for several years, now. The main Chinese points are that the Chinese debt bubble may be bursting. This default is the first but certainly not the last. Maybe not even the last for this month. The second debt related Chinese issue is the copper they've taken as collateral for their lending. These first pricks of the bubble have sent copper futures to four year lows as fear overwhelms the market based on possible copper liquidation concerns as borrowers loans are being called. This exacerbates itself in a downward spiral of fear similar to our housing market in 08-09.

The Coming Crash of the Euro

FOREX genius George Soros alludes to the probability the Euro currency may collapse. The Billionaire speculator cautions over job losses but says Europe could still be pulled apart by deflation and slow growth: http://www.theguardian.com/politics/2014/mar/12/george-soros-british-eu-exit-foreign-exodus

Was Milton Friedman right?

Before the launch of the euro in 1999, the great, Nobel Laureate economist, Milton Friedman predicted that the Eurozone would not survive its first economic crisis.

He noted that in a world of floating exchange rates, if one country faces a shock, it could simply respond by letting the exchange rate change. But with the arrival of the euro, that option is no longer available.

Mr. Friedman also highlighted the case of Ireland. In 2001, he said the country should have been tightening its monetary policy but couldn't because it was tied into the new European currency. "The European Central Bank makes monetary policy for the whole of euroland."

In the absence of currency flexibility, analysts say competitiveness can only be regained through real economic adjustment such as labour reductions and downward wage adjustment.

Ergo, the Euro Union’s economic survival indeed depends upon a sharp devaluation of the euro currency.

And as all competent currency pundits well know, the Euro value runs inverse to the US Dollar Index. The chart below clearly demonstrates that during the past 24 years (since 1990), the Euro vs the US Dollar Index rise and fall inversely:

US DOLLAR FORECAST

Based upon all the above Fundamentals and Technical Analysis, it is highly probable the US Dollar Index will reverse upward during 2014. And with a slight boost from Fed Chair Yellen (a known staunch inflationist from way back), the greenback might reach 85 this year…and even 95 later.

********

A currently related analysis is “Forecast For U.S. Treasury Bonds”