What Drives The US Dollar?

To adequately answer the title question of this article would indubitably demand the voluminous attention of 10 PhD dissertations. The reason being that there are an uncountable number of factors that fuel and guide the greenback’s path. Here are merely a few of these mind-boggling complex factors:

Three Factors Affecting Dollar Value

The methodology to determine the direction of the US$ can be divided into three groups as follows:

- Supply and Demand Factors

- Sentiment and Market Psychology

- Technical Factors

(Source: http://www.investopedia.com/articles/forex/09/factors-drive-american-dollar.asp )

Five Economic Reports That Affect The US Dollar

“Currency traders are always seeking information that will provide insight into whether the value of the dollar is set to rise or fall. Just as there are a variety of indicators that stock traders use to track the health of the companies in which they invest, there are a variety of economic reports that provide insight into the future direction of the value of the dollar.”

These 5 Reports Are:

- Trade Balance

- Non-Farm Payroll

- Gross Domestic Product (GDP)

- Retail Sales

- Industrial Production

(Source: http://www.investopedia.com/articles/forex/11/five-reports-that-move-usd.asp )

Insurmountable Complexity Of The Above 3 Factors And 5 Reports

Any ardent student of economics well knows that it is virtually impossible to obtain an objective and precise determination of the aforementioned factors and reports. The reason being that there are literally 100s of inputs which mold these factors and reports. Moreover, unquantifiable political influence can (and does) distort the results of these factors and reports. Consequently, this analyst will not waste time trying to ‘guess’ the true meaning of these complex information sources. Rather, I will devote my study to analyzing the quantifiable inverse relationship between the US$ and the euro currency of the EU. My analysis will also examine what may affect the future value of the euro, based upon recent history and reasonably well based assumption as to what may soon occur to the Euro Union (EU).

US$ vs The Euro

What is the US Dollar Index (US$)

The US Dollar Index (US$) is a measure of the value of the US dollar relative to the value of a basket of six currencies of the majority of the US's most significant trading partners.

Components of the US$

The index started in 1973 with a base of 100, and values since then are relative to this base.

How Has the US$ Performed vis-à-vis the 6 Currencies During the Past 5 Years?

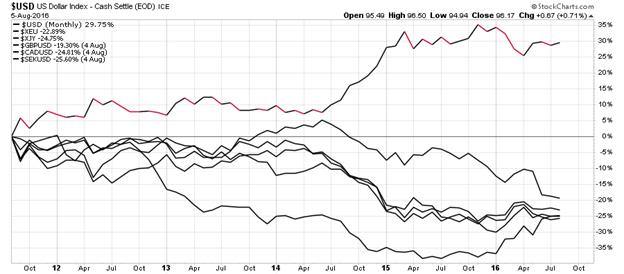

Since mid-2011 the US$ has relentlessly risen (albeit slowly but methodically) vs the individual country currencies. Effectively, the US$ rose nearly +30% since 2011, while the average of its components declined -23%.

http://stockcharts.com/h-sc/ui?s=%24USD&p=M&yr=5&mn=0&dy=0&id=p23393322087&a=469680535&listNum=1

The following chart clearly demonstrates the inverse trend relationship between the US$ and the ill-fated euro since 1997. Moreover, Technical Analysis suggests the US$ is headed higher as the doomed euro slumps with a possible downside price target to the low made in 2001. In this event the US$ will have risen to its 2001 high of 120.

http://stockcharts.com/h-sc/ui?s=%24USD&p=M&yr=20&mn=0&dy=0&id=p56151114575&a=470823105&listNum=1

Euro Fundamentals Support Technical Analysis

It is obvious to all well-read students of the markets that the EU has become an unmitigated economic and financial disaster. Many of the individual nations comprising the EU are well-nigh insolvent…and close to reneging on their national debt. Characterizing their insolvency, they are being called PIIGS by global economists. Specifically, PIIGS stands for Portugal, Italy, Ireland, Greece and Spain. And if their failing banks were NOT enough to crater their economies, these wretchedly poor countries are being over-run with indigent immigrants – living off the dole of these poor countries. As all well know, the UK recently abandoned the EU (i.e. BREXIT), which may easily lead to other members fleeing the EU. The end result is eventual and inevitable: COLLAPSE OF EU…which will probably translate to the euro currency becoming next to worthless. The upshot of this probable outcome will motivate…NO STAMPEDE millions of Europeans to the US Dollar, exploding greenback demand and its value upward.

Other Factors Increasing the Value of the US$

There are four more factors which can drive the value of the US$ upward. They are:

- China Devaluation of the Renminbi

- Trump Policies

- Open Interest

- Interest Rates

The Peoples Bank of China has been guiding its Renminbi currency lower against the US dollar in order to aid Chinese exporters and prop up weakening economic growth in the Sino nation. The end result is to strengthen the value of the US greenback.

A Trump Presidency Could Cause The Dollar To Rise Again

http://www.marketwatch.com/story/president-trump-could-make-the-dollar-rise-again-2016-05-05

Bullish Open Interest Speculation

The following chart from 1992 shows that Open Interest is at a pivotal point, which may well catapult the US$ to its 2001 high of 122. Of course, this assumes that the obvious Bull Flag finally triggers – and subsequently moves the US dollar upward.

Interest Rates

The interest rates in a country tell you how much return you can get for money invested there. When interest rates in the US are high compared with rates in other countries, international investors convert money to dollars so they can invest in the USA…and the dollar rises. Undeniably, US interest rates have been creeping upward since last October. This is especially true with the 3-Month US Treasury Yield. In October 2015, this short-term interest rate was groveling at about 0.0%. And today it is at 2.5%. Needless to say that yield has soared during the past 10 months. Moreover, there are no indications on the horizon that the rise in US interest rates will not continue rising for the foreseeable future. Hence, international money will flow to the US…thus strengthening the US$ even more.

Related Research

US Greenback To Reign Supreme Through 2017

US Greenback To Rise Like The Proverbial Phoenix

Financial Armageddon Looms On The Horizon As The EURO UNION IMPLOSION Nears

Bankrupt Banks Brutally Bleeding…Worldwide

Slaughter Of The PIIGS Looms On The Horizon

Will The US Dollar Remain The Reserve Currency Of The World?