What Recent Moves In The US Dollar Mean For Gold

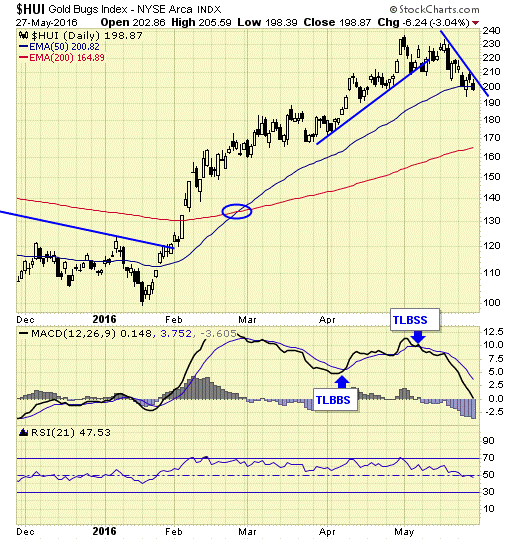

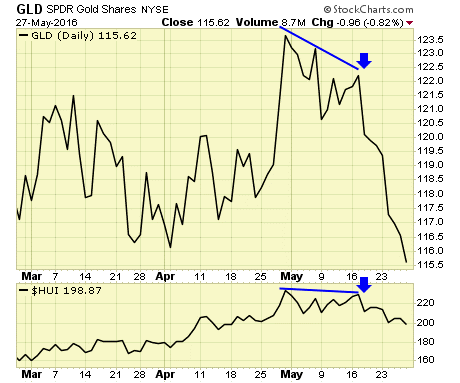

A correction is in progress in the gold sector.

Gold stocks remain on short term sell signal, and if we are in a bull market, prices should find support at the 200ema, which may be an excellent entry.

The divergence as noted in the last report has resulted in lower prices in both gold and gold stocks.

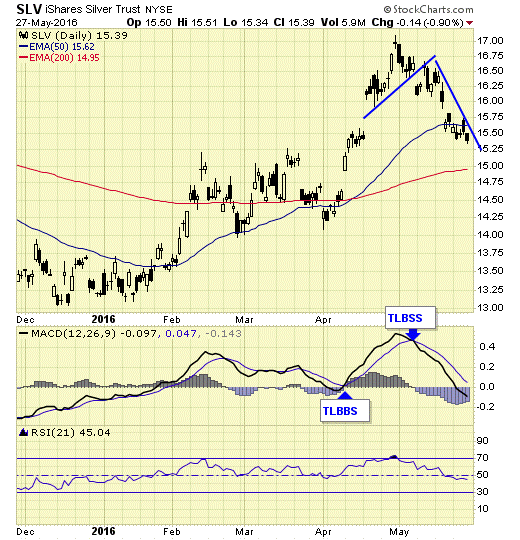

SLV – we took profits on our short position and will wait for a new set up.

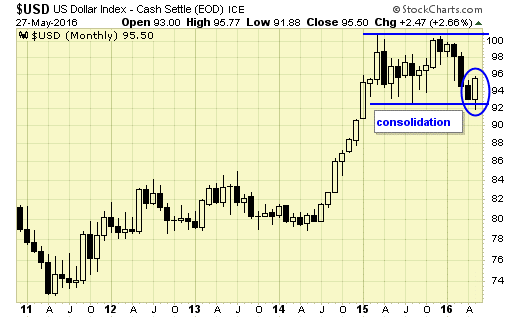

With one session left in the month, the US Dollar (USD) bounced off the lower trading range of this over a year-long consolidation with an outside reversal monthly candlestick, which suggests that the correction is complete and more strength ahead in coming months. A rising dollar is not friendly to the metals.

Summary

A correction is in progress in the gold sector, while the cycle has just turned down recently. Expect lower prices overall until the cycle bottoms and COT data becomes favorable.