Black Gold Forecast

One of the pillars of any major world economy is its Energy Section. Therefore, how much a country consumes is a sign of its growth and relative economic strength vis-à-vis other nations. The following table shows the 12 biggest energy consuming nations in 2006. Annual energy consumption by the USA, China and the Russian Federation tower over all other countries. However, on a per capita basis, energy consumption in the USA far surpasses that of China or the Russian Federation. Nonetheless, China’s yearly rate of change in per capita basis far surpasses that of the USA…which means the Sino nation will be the #1 Energy Consumer in the not too distant future.

One of the pillars of any major world economy is its Energy Section. Therefore, how much a country consumes is a sign of its growth and relative economic strength vis-à-vis other nations. The following table shows the 12 biggest energy consuming nations in 2006. Annual energy consumption by the USA, China and the Russian Federation tower over all other countries. However, on a per capita basis, energy consumption in the USA far surpasses that of China or the Russian Federation. Nonetheless, China’s yearly rate of change in per capita basis far surpasses that of the USA…which means the Sino nation will be the #1 Energy Consumer in the not too distant future.

Primary Energy Consumption - per region in 2007 - all key forms of primary energy (nuclear, coal, natural gas and oil):

Oil Consuming Countries

Due to its heretofore importance of oil to an economy, many pundits have termed it “BLACK GOLD.”

Here is a list of countries by oil (I.E. Black Gold) consumption based on the CIA World Factbook

Price Of Crude Oil For The Past 150 Years

Needless to say the price of oil has been very volatile since 1861. Indeed Black Gold’s market value is a function of the inflation rate (as attests the graph below). Notice that from 1861-1864 the Real Price of oil (measured in 2011 US dollars) soared from $13/bbl to $115/bbl. However, today’s nominal oil price equates to the 1864 Real Price.

One of the Primary Price Factors that cause the price of oil to rise is INFLATION

The near vertical jump in the Crude Oil price during the 1970s was due to the US Inflation Rate, which nearly tripled the rate of the previous decade (See two charts below).

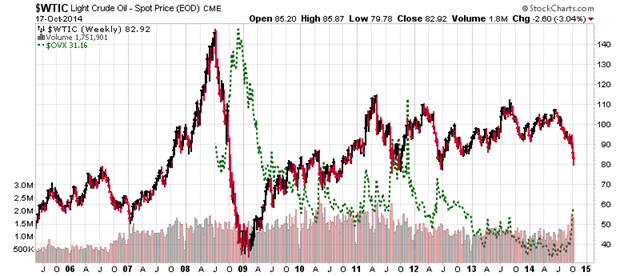

Interestingly, the price of Black Gold (i.e. Crude Oil) has soared about 150% during President Obama’s Administration. However, troubling economic waters globally have recently caused Black Gold value to tumble. Indeed and fact the following two charts are forecasting substantially lower prices for Crude Oil.

Crude Oil Technicals Are Very Bearish

Falling equities worldwide imply a global recession is brewing on the horizon. Consequently, the demand for energy (i.e. Crude Oil) will be severely curtailed. It the logically follows institutional investors are dumping Crude Oil Futures....and going SHORT same.

In fact Crude Oil might retest the long-term uptrend line at about $50ish/BBL.

Moreover, Technical Analysis Even Suggests a possible drop to $35/bbl:

Other Factors that affect the price of crude oil:

http://www.eia.gov/finance/markets/reports_presentations/eia_what_drives_crude_oil_prices.pdf

What 3 Factors Do Traders Use To Determine Oil Prices?

http://useconomy.about.com/od/commoditiesmarketfaq/f/oil_prices.htm

Ten Factors that Affect the Price of Oil

Gasoline is a derivative of BLACK GOLD, which begs the question: How has the price of Gasoline performed during President Obama’s Administration? >> January 2009.

Dollar Price Trend of Gasoline:

Percent Price Increase of Gasoline:

Fall in Crude Oil Price during the 2007-2008 US Recession: During the last recession the price of Crude Oil plummeted -75% -- and it could happen again.

Crude Oil Price vs Dow Index from 2001 shows that the price of Crude Oil moves parallel to the stock market.

Future Black Gold Forecast

The recent jump in Oil’s Volatility portends lower values for Crude Oil here to yearend. How far crude oil will fall will depend on what’s going on in the US economy and especially in the Euro Union (which is in shambles…and getting worse by the week). Many experts opine that the only monetary event that will shore up the price of Black Gold is if the value of the US$ Index begins to decline…which is a distinct possibility in light of numerous geo-political conditions…like: ISIS over-running Syria and Iraq; Ebola literally going viral in the USA; and Obama’s popularity continues to plummet to all-time record lows for an incumbent President. ALAS, I fear the price of Black Gold is destined to retest historic lows.

To be sure there is one other important factor which may well curtail the future consumption for Crude Oil. And that is the accelerating demand Solar Energy. Rapidly developing Solar Energy Technology promises a brilliant future. And whereas Crude Oil is an ever diminishing resource, Solar Energy is limitless…indeed inexhaustible as it derives its infinite source from the sun.

To be sure there is one other important factor which may well curtail the future consumption for Crude Oil. And that is the accelerating demand Solar Energy. Rapidly developing Solar Energy Technology promises a brilliant future. And whereas Crude Oil is an ever diminishing resource, Solar Energy is limitless…indeed inexhaustible as it derives its infinite source from the sun.