Gold And Silver Price Seasonality…June Worst Month?

It is universally known that there are many, many sundry factors that can affect the price of gold and silver. To name just a few: Political Environment, Value of the US Dollar and the Euro, Commitment of Traders, Possible Manipulation by the Fed, US Fed Policies Regarding the Level of Interest Rates, International Belligerent Turmoil, the Relative Value of the Stock Markets…and last but NOT LEAST THE SEASONALITY of Precious Metal Prices.

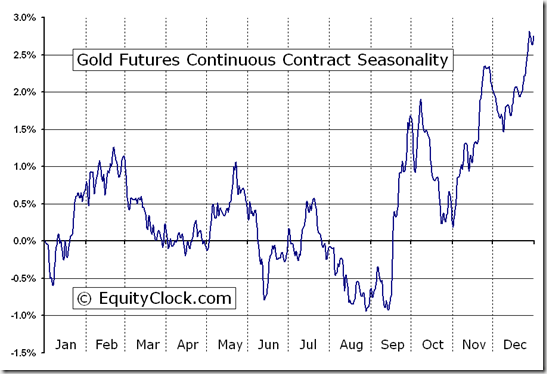

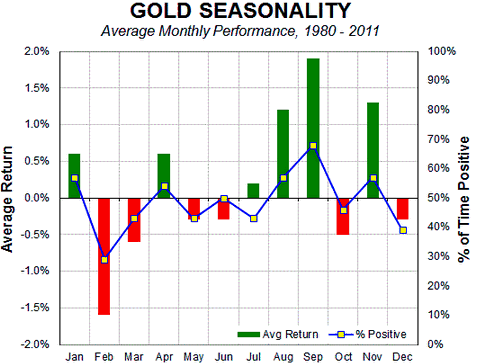

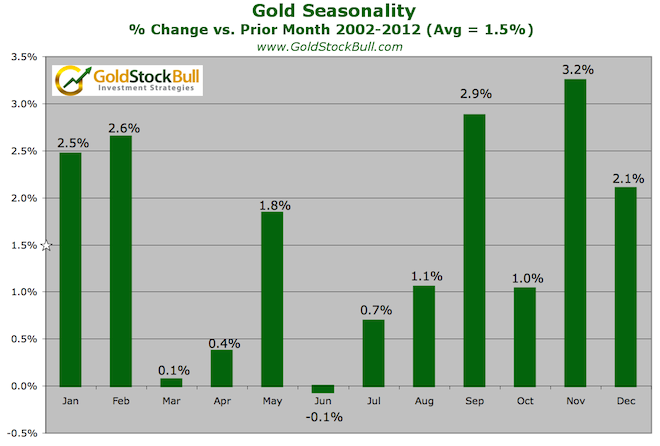

This analysis will only focus on THE SEASONALITY of Precious Metal Prices as there enumerable encyclopedic reviews of all the other factors affecting gold and silver prices. Specifically, what has been the average monthly price variance of the price of gold or silver for the 12 months over a period. In an effort to seek objectivity, we have selected Seasonality Charts from several pundit sources.

Gold Seasonality

There are sundry determinations for Gold’s Seasonality…and here are a few views.

(Source: TradePro Academy)

Although one can make several conclusions regarding each monthly performance for the price of gold, the one which stands out from a timely point of view is JUNE…which we are entering as I speak. CLEARLY, the month of June has on average been a down month for the price of gold. However, Caveat Emptor (let the buyer beware), because IT IS NOT GUARANTEED that the gold price will necessary decline in June 2017 (due to all the other above mentioned factors that can affect the price of the shiny yellow). NONETHELESS, whereas history does not assure a repeat performance of the past, it indeed demonstrates lines of probability that the gold price may decline this June.

Silver Seasonality

Like the June gold price, silver likewise demonstrates a pronounced weakness in the month of June.

Indubitably, the price of silver shows an average material price weakness in the month of June. But like gold, there are many factors which can alter the June Seasonality. Consequently, it is best to be extra cautious this June regarding the price of gold and silver.

A sage old saying is: Whereas history does NOT repeat itself…it definitely rhymes.