A Gold Backed Renminbi (Yuan) Looms On The Horizon

Renminbi Is Destined To Replace The US$ As The Global Reserve Currency…But When?!

(Chinese for Gold)

(Chinese for Gold)

PRESENTLY, there is precious little that really gives the Chinese Renminbi a significant competitive edge over the U.S. dollar. However, if Chinese authorities truly want the Renminbi to replace the U.S. dollar as the primary reserve currency of the planet, the People's Republic of China needs to do something that will make the rest of the world want to use it.

To be sure this is feasible by backing the Renminbi with gold. In fact, there are persistent rumors in recent months that China has been busily preparing for that objective.

"A number of factors suggest that the Chinese government wants to make Renminbi internationalization happen by 2015." But this begs the question: “Will it happen before the next Blue Moon?!”

A provocative article in this regard is the following: “China Gold Dragons” https://www.gold-eagle.com/article/china-gold-dragons

No one denies that today China is Total Foreign Reserves RICH…but GOLD POOR.

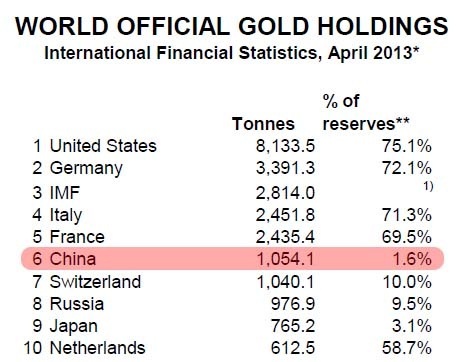

Nonetheless, In order to instill global monetary confidence in the Renminbi, China’s gold backing of its Total Foreign Reserves must equal that of the U.S. backing of 76%. The following table of gold backings of several major currencies clearly demonstrates how “Gold Poor the Renminbi” really is.

How much gold must China buy in order to equal the US gold backing of the U.S. dollar?

China has $3,300,000,000,000 (ie $3.3 Trillion) Total Foreign Reserves. Therefore, if China wishes to back the Renminbi with 75% gold, it needs a total of $2,475,000,000,000 in gold. And if it were possible to buy that much gold today at the current price of $1,230/oz, China would purchase 2,011,950,000 oz. This translates to about 62,000 tonnes of the shiny yellow (as there are approximately 32,500 troy oz per metric ton). But China probably has today perhaps 2,000 tonnes, therefore it needs to buy 60,000…to equal the U.S. gold backing of its Total Foreign Reserves.

Simple arithmetic says China could NOT conceivably buy 60,000 metric tons...equivalent to 23 years annual mine supply…as total yearly gold production is 2,600 tonnes worldwide ( NOTE: Today the world’s existing gold above ground is a tad more than 171,000 metric tons). Contemplate China’s monumental task to be able to honestly say its currency is backed by gold. In effect China must accumulate nearly 36% of all the (existing) gold in the world. Not very likely in the short-run…!!!! Consequently, The Peoples Bank of China must methodically and systematically buy gold at a pace faster than its continually increasing Total Foreign Reserves, which again grew by $166 Billion in the third quarter of this year…and now stands at $3.66 Trillion (more than triple of any other country).

Monetary pundits in China have made it clear that the Sino nation’s objective is to replace US$ as the Global Reserve Currency with the Renminbi. To achieve this daunting task will take much time and mountains of money to methodically accumulate that much gold. Consequently, it is inevitable that gold prices will soar for many years.

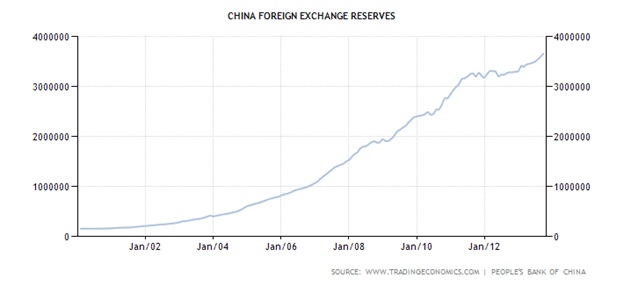

China’s Total Foreign Reserves CAGR is 23.1%

Undeniably, China has dominated world trade since 2000. The dominate factors allowing this feat is: their cost of production is the lowest in the world, and; China’s exports Trade Balance is the highest in the world…ie it exports many times more than it imports. This has allowed China to amass its Total Foreign Reserves beyond belief. Today’s the PBOC is awash in $3.66 Trillion. Moreover, during the past 14 years (ie since 2000) its Total Foreign Reserves boasts Compound Annual Growth Rate of 23.1%, which is four times greater than the U.S. CAGR for Total Foreign Reserves. No other country in the world can compare. Here is a chart showing China’s Total Foreign Reserves growth.

(Source: http://www.tradingeconomics.com/china/foreign-exchange-reserves )

Rest assured China will indeed implant the Renminbi as the world’s reserve currency…thus replacing the US greenback. The upshot of this slow methodical process will see gold prices inexorably increase exponentially during the next several years.

More by vronsky: https://www.gold-eagle.com/authors/vronsky