Gold Price Correction Forecast

Since late December 2015, the gold price has initiated a new bull market. Nonetheless, all bull markets inevitably and eventually experience corrections…especially after having surged more than 28% in less than 8 months, which is the greatest gold price increase in memory for this short period. Hence, it is reasonable to believe (the shiny yellow is aching for a correction. Testament to this is the Gold Miners Bullish Percent Index ($BPGDM), which recently bounced off the 100% ceiling. Objective precious metal analysts well know that the $BPGDM has NEVER reached this level of unbridled bullishness in history…not even in late 2011 when gold futures forged its all-time high of $1,920. Indeed, a price correction is in order and warranted. However, the burning question is: How much should the gold price fall to alleviate the overtly excessive bullishness?

http://stockcharts.com/h-sc/ui?s=%24BPGDM&p=D&yr=9&mn=0&dy=0&id=p02314169454&listNum=1&a=472429027

As the recent 2016 gold price surge is very similar in intensity and magnitude to the late-2011 gold price increase, it is reasonable to assume the initial price correction might well be commensurate. In this event, the following numbers may be applicable. In late 2011 gold reached an intraday high of $1,920. Subsequently, it corrected -16% to about $1,610 during the next four weeks. Projecting a similar correction translates to a possible gold price of about $1,155 before yearend.

However, there are sundry factors which might play a material role in driving the gold price (in either direction) during the next four months. Namely: The price trend of the US Dollar; The teetering stability of the Euro Union and its tumbling euro; November US Presidential Election and Gold’s Price Seasonality.

We will address several Technical and Fundamental factors, which in our opinion will play the most important material roles in forging the gold price here to yearend…and perhaps even well into 2017.

Price Trend Of The US Dollar Index

In my recent What Drives The US Dollar? analysis, a well substantiated argument is made that the US currency is obviously in a bull market trend. Therefore, if indeed the greenback continues to strengthen in the months ahead, most likely the price of gold will decline accordingly.

The Teetering Stability Of The Euro Union And Its Tumbling Euro Currency

The article, Financial Armageddon Looms On The Horizon As The EURO UNION IMPLOSION Nears clearly paints a dire picture of the disastrous state of affairs of the ill-conceived Euro Union and its ill-fated euro currency.

Dollar Higher As Fed’s Fischer Leaves Door Open For 2 Rate Hikes In 2016

The dollar pivoted higher last Friday after Federal Reserve Vice Chairman Stanley Fischer said the central bank could possibly raise interest rates twice before the end of 2016, depending on the strength of economic data released in the coming months. (Fischer’s comments, made in an interview with CNBC:

http://www.marketwatch.com/story/dollar-edges-down-as-all-eyes-on-jackson-hole-speech-2016-08-26 )

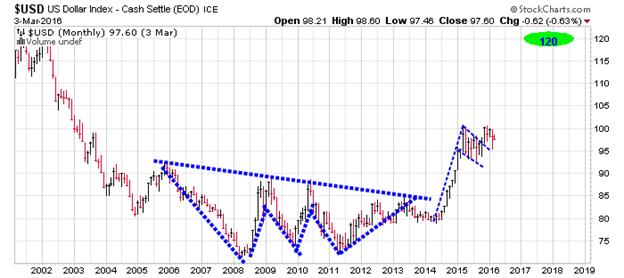

US Dollar Index Makes A 30-Year Upside Breakout

Global monetary conditions have strengthen the US Dollar, whereby it recently achieved an incredible 30-Year Upside Breakout…indubitably, NO MEAN FEAT! Moreover, the chart shows triggered bullish Inverted Head&Shoulders and Flag patterns with a projected price objective of 120.

3-Month US Treasury Yield vs US Dollar Index

This chart demonstrates that the 3-Month US Treasury Yield has trended parallel with the US Dollar Index during the past 7 years. Moreover, both are NOW trending upward. It is imperative to recall that some members of the Fed are now suggesting interest rate increases are now on the horizon…and could easily materialize before year end. Consequently, the US Dollar Index will rise accordingly…which may well depress the price of gold.

http://stockcharts.com/h-sc/ui?s=%24IRX&p=M&yr=7&mn=3&dy=0&id=p92787707667&a=456068073&listNum=1

The Euro Currency Runs Inverse To The US Dollar Index

Due to the dire plight of the Euro Union, its currency appears hell bent for leather to substantially decline per a bearish flag (which has not yet triggered). In this event the euro may well fall to about 70…thus strengthening the US Dollar Index.

http://stockcharts.com/h-sc/ui?s=%24XEU&p=M&yr=20&mn=0&dy=0&id=p57675734279&a=464369174&listNum=1

To ascertain the feasibility of the gold price correction declining to about $1,155 before yearend, one needs also to read the following Related Research articles, which are very well documented.

What a US interest rate rise really means for the dollar

How the Fed Fund Rate Hikes Affect the US Dollar

Why the US dollar may be set to strengthen

Germany talks WAR...which surely will increase interest rates - The War and Interest Rates:

Related US Dollar Research

US Greenback To Reign Supreme Through 2017

US Greenback To Rise Like The Proverbial Phoenix

Gold Forecast: The Next Great Buying Opportunity

The US Dollar Index And Helicopter Money

Bankrupt Banks Brutally Bleeding…Worldwide

Slaughter Of The PIIGS Looms On The Horizon

Will The US Dollar Remain The Reserve Currency Of The World?

Financial Armageddon Looms On The Horizon As The EURO UNION IMPLOSION Nears

********