Stocks To Crash Worldwide In 2016

One of the most reliable truisms of stock markets worldwide is that History Is Prologue…and that Market Cycles are immutable…where only time and magnitude change. During the past 20 years Wall Street has enjoyed three Bull Markets…and the first two were followed by devastating Bear Markets. Specifically, US stocks fell -37% in the 2000-2002 bear market, while the DOW stocks index plummeted -54% in the 2007-2008 debacle.

One of the most reliable truisms of stock markets worldwide is that History Is Prologue…and that Market Cycles are immutable…where only time and magnitude change. During the past 20 years Wall Street has enjoyed three Bull Markets…and the first two were followed by devastating Bear Markets. Specifically, US stocks fell -37% in the 2000-2002 bear market, while the DOW stocks index plummeted -54% in the 2007-2008 debacle.

And it is imperative to take note the current US Bull Market is one of the longest secular uptrend periods in history of rising stock prices. Consequently, as history is testament an eventual and inevitable Bear Market will soon follow. What is probably unique this time is the fact that major stock markets worldwide appear to be moving in lethal concert with the US in developing Bear Market trends of declining stocks. Consequently, our forecast of evolving global Bear Markets will be demonstrated by the price charts of the 20 major stock indices in the world (the vertical white lines pinpoint where each bear market began per the Technical Indicators shown). These major markets are:

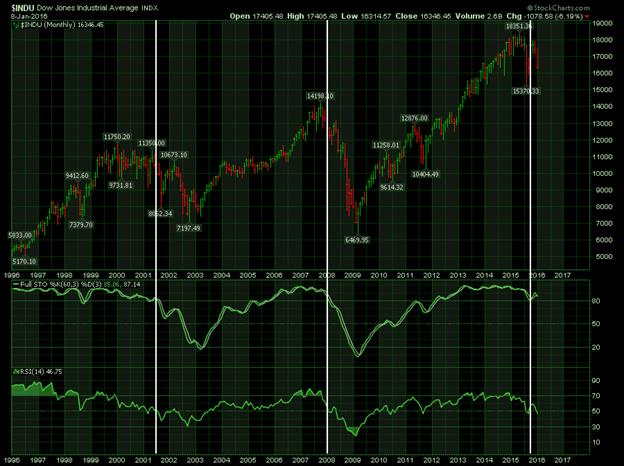

DOW Jones Industrial Index

http://stockcharts.com/h-sc/ui?s=$INDU&p=M&yr=20&mn=0&dy=0&id=p07293210459&a=437661841&listNum=2

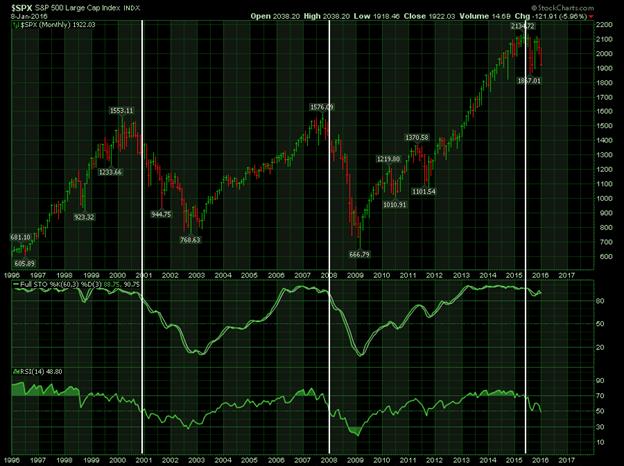

S&P500 Index

http://stockcharts.com/h-sc/ui?s=$SPX&p=M&yr=20&mn=0&dy=0&id=p59494386313&a=437662765&listNum=2

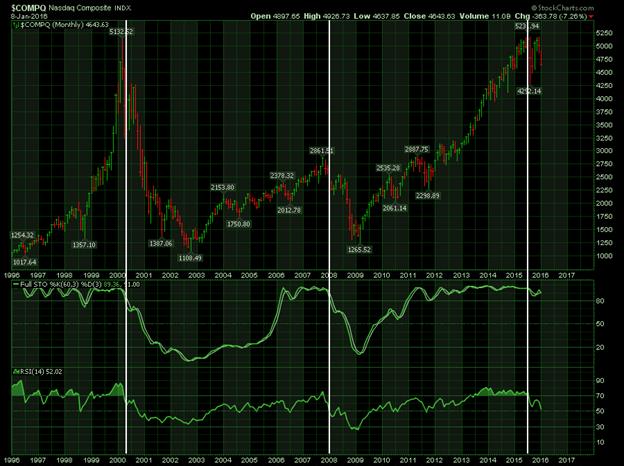

NASDAQ Index

http://stockcharts.com/h-sc/ui?s=$COMPQ&p=M&yr=20&mn=0&dy=0&id=p31581466264&a=437663085&listNum=2

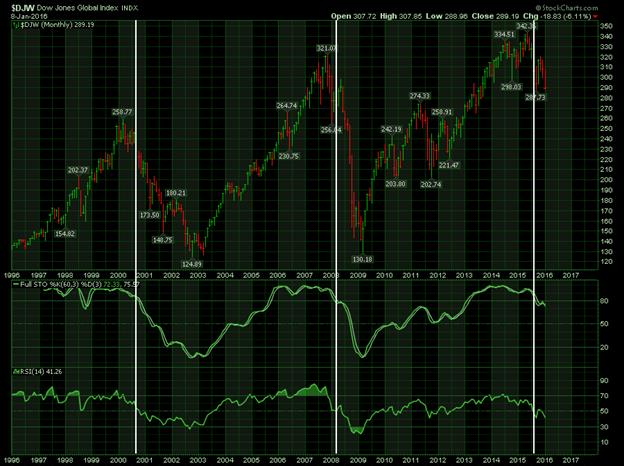

Dow Jones Global Index

http://stockcharts.com/h-sc/ui?s=$DJW&p=M&yr=20&mn=0&dy=0&id=p56767214246&a=437663163&listNum=2

FTSE All World Index

http://stockcharts.com/h-sc/ui?s=$FAW&p=M&yr=20&mn=0&dy=0&id=p85570354351&a=437663395&listNum=2

Global Dow Index

http://stockcharts.com/h-sc/ui?s=$GDOW&p=M&yr=20&mn=0&dy=0&id=p05892760235&a=437664311&listNum=2

MSCI World Index (excluding US)

http://stockcharts.com/h-sc/ui?s=$MSWORLD&p=M&yr=20&mn=0&dy=0&id=p75213725567&a=437664455&listNum=2

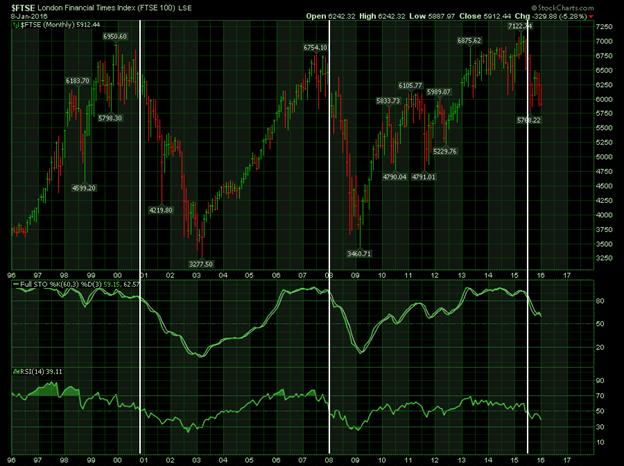

FTSE Index (UK)

http://stockcharts.com/h-sc/ui?s=$FTSE&p=M&yr=20&mn=0&dy=0&id=p75442567328&a=437664979&listNum=2

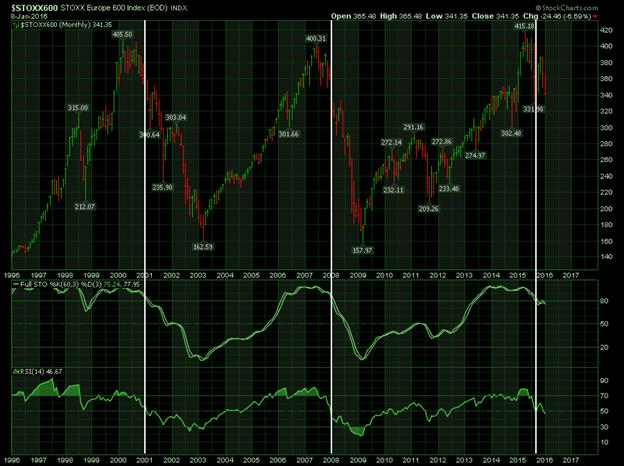

Europe 600 Index

http://stockcharts.com/h-sc/ui?s=$STOXX600&p=M&yr=20&mn=0&dy=0&id=p87842163579&a=437665119&listNum=2

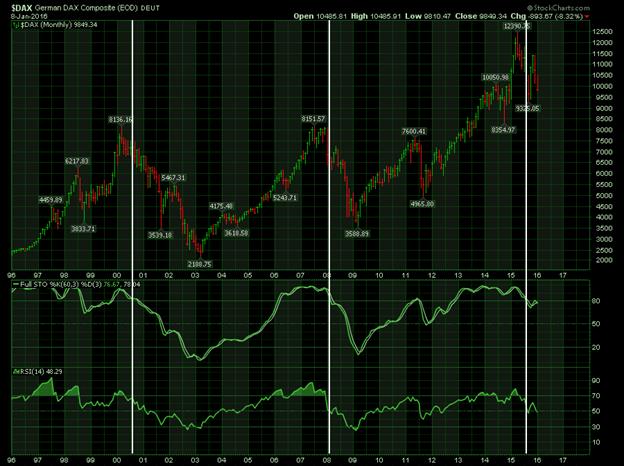

German DAX Index

http://stockcharts.com/h-sc/ui?s=$DAX&pM&yr=20&mn=0&dy=0&id=p84074945626&a=437665140&listNum=2

French CAC Index

http://stockcharts.com/h-sc/ui?s=$CAC&p=M&yr=20&mn=0&dy=0&id=p32097070009&a=437665157&listNum=2

Russian ETF

http://stockcharts.com/h-sc/ui?s=RSX&p=M&yr=20&mn=0&dy=0&id=p19200690016

Emerging Markets ETF

http://stockcharts.com/h-sc/ui?s=EEM&p=M&yr=20&mn=0&dy=0&id=p10966963803&a=437665323&listNum=1

Shanghai Stock Index

http://stockcharts.com/h-sc/ui?s=$SSEC&p=M&yr=20&mn=0&dy=0&id=p74043045462&a=437667174&listNum=1

Hong Kong Stock Index

http://stockcharts.com/h-sc/ui?s=$HSI&p=M&yr=20&mn=0&dy=0&id=p04521476464&a=437667202&listNum=1

FTSE China 25 Index

http://stockcharts.com/h-sc/ui?s=FXI&p=M&yr=20&mn=0&dy=0&id=p56183596439&a=437754578&listNum=1

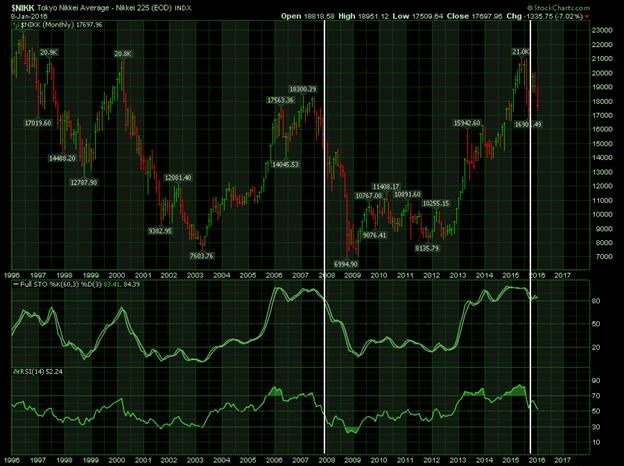

Japan Nikkei Index

http://stockcharts.com/h-sc/ui?s=$NIKK&p=M&yr=20&mn=0&dy=0&id=p66653594287&a=437668445&listNum=1

India Bombay Stock Index

http://stockcharts.com/h-sc/ui?s=$BSE&p=M&yr=20&mn=0&dy=0&id=p46843280508&a=437668461&listNum=1

Brazilian Stock Index

http://stockcharts.com/h-sc/ui?s=$BVSP&p=M&yr=20&mn=0&dy=0&id=p17190294609&a=437668479&listNum=1

Canadian S&P Stock Index

http://stockcharts.com/h-sc/ui?s=$TSX&p=M&yr=20&mn=0&dy=0&id=p81466913785&a=440350469&listNum=2

DOW Stock Index Historically And Horrifically Over-Valued Today

Here is a 100-Year Chart of DJIA. Much insight can be gleaned from it. Here are the most salient features of this DOW Century chart (below):

1921-1929 Bull Market

Compound Annual Grow Rate was 23.5%, peaking in late 1929.

Subsequent Bear Market crash saw DOW crashing -85% from its 1929 peak.

1949-1965 Bull Market

Compound Annual Grow Rate was 9.6%, peaking in late 1965.

Subsequent Bear Market crash saw DOW losing -73% from its 1965 peak.

1982-1999 Bull Market

Compound Annual Grow Rate was 13.1%, peaking in late 1999.

Subsequent Bear Market crash saw DOW losing -51% from its 1999 peak.

2009-2015 Bull Market

Compound Annual Grow Rate was 18.9%, peaking in mid-2015.

To be sure, the extent of the forth-coming Bear Market will be determined in 2016 and/or 2017. However, if the impending Bear Market declines the average of the first three, the DOW Index may well plummet -70% to about 5500. However, no one really knows how bad the on-coming Bear Market will be…as there are too many variables. Nonetheless, it ain’t gonna be a mere Teddy-Bear Market…bank on it.

Indeed, very volatile economic and geopolitical conditions prevail today throughout the world. Again history is testament that these conditions were never the mother of investor confidence. Consequently, extreme investor PRUDENCE is warranted in order to finally survive the on-coming horrific market volatility.

Indeed, very volatile economic and geopolitical conditions prevail today throughout the world. Again history is testament that these conditions were never the mother of investor confidence. Consequently, extreme investor PRUDENCE is warranted in order to finally survive the on-coming horrific market volatility.

And as I have said before…and bears repeating (pardon the pun):

Heretofore GREED AND COMPLACENCY will soon morph into FEAR AND ANGST…as market values relentlessly tumble.

Relevant Articles Suggesting Bear Markets On The Horizon

All The Stock Charts Spell: B-E-A-R M-A-R-K-E-T

Why China Will Bring Down The World Markets!

The Looming Global Bear Market In Stocks

The Least Surprising Stat Of The Week: Corporate Insiders Are Dumping Their Stock

A Major Long-Term Momentum Indicator Is Flashing, “SELL.”

Are Stocks 80% Overvalued? New Evidence Shocks Wall Street

The Fed Has Set the Stage For the Next Stock Market Crash

US Stock Bubble Bursts As The US Fed Begins To Shrink Its Balance Sheet

This Economic Collapse Will Trigger A Stock Market Crash

The Mother Of All Bubbles Will Burst In Late 2015

Investors' Sentiment Worsens…New Downtrend Or More Fluctuations?