Writings On The Wall (Street) Spell: Bear Market On The Horizon

There are numerous irrefutable signs in Wall Street that forecast an inevitable and imminent BEAR MARKET IN STOCKS.

There are numerous irrefutable signs in Wall Street that forecast an inevitable and imminent BEAR MARKET IN STOCKS.

Indeed, these same signs accurately forecasted the 2000-2002 and 2007-2009 Bear Market in stocks. And based upon the following devastating Technical Indicators, investors must expect a fugly Bear Market in stocks in the near future.

The Bear Market writings on the wall appear below.

DOW Index Divided By 30-Year US T-Bonds

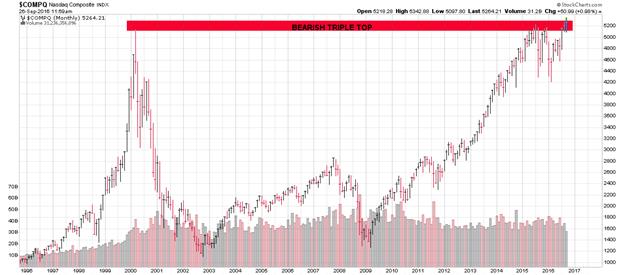

NASDAQ Bearish Triple Top

http://stockcharts.com/h-sc/ui?s=$COMPQ&p=M&yr=20&mn=11&dy=29&id=p29462074962&a=477598045&listNum=2

FTSE Index Quadruple Top

An interesting historical note: It was the UK’s FTSE that was a leading indicator to US stocks in the 1929 Crash…which ended in 1932 after the DOW Index had lost -89% of its October 1929 high.

http://stockcharts.com/h-sc/ui?s=%24FTSE&p=M&yr=18&mn=0&dy=0&id=p17641302373&a=477732944&listNum=2

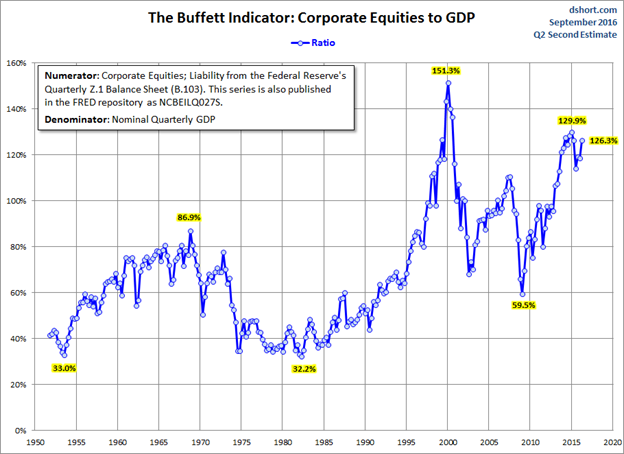

Buffett Valuation Indicator

Market Cap to GDP is a long-term valuation indicator that has become popular in recent years, thanks to Warren Buffett. Back in 2001 he remarked in a Fortune Magazine interview that "it is probably the best single measure of where valuations stand at any given moment." To be sure Buffett’s Valuation indicator is today suggesting US stocks are historically over-valued…just as it did in 2000 and 2007.

NYSE Margin Debt vs S&P500 Index

In 2000 and again in 2007 NYSE Margin Debt vs S&P500 Index peaked, which heralded the S&P500 peaks that marked the beginning of horrific Bear Markets. Well again early this year, this indicator has peaked…thus spot-lighting the probable entrance of Mr. Bear. Actually, this Bear Market Indicator is at an all-time record high! Effectively, ignorant US investors have “bitten off” more Margin Debt than they can “chew” (i.e. pay back without massive margin CALL SELLING).

(Source: http://www.advisorperspectives.com/dshort/updates/2016/08/31/nyse-margin-debt-and-the-market )

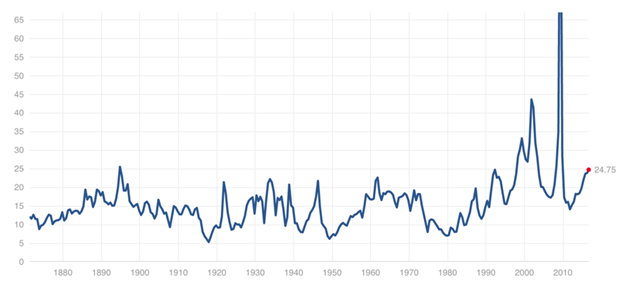

S&P500 Price Earnings Ratio

One of Wall Street’s widely accepted indicators measuring the evaluation level of US stocks has traditionally been the S&P500 Price Earnings Ratio. Clearly, today’s PER is one of the highest in the past 146 years (i.e. since 1870). Indeed and fact today’s PE ratio of nearly 25:1 is higher than it was in October 1929 (right before the Great Crash of Wall Street). Only naïve Pollyannas delude themselves into thinking US stocks are NOT SEVERELY OVER-VALUED.

DJIA Bullish Percent Index

One of the most accurate Technical Indicators which pin-pointed the beginning of the 2000-2003 and 2007-2008 Stock Market Crashes is DJIA Bullish Percent Index (when it crosses down below the DOW Stocks Index). And not too long ago this indicator of over-valuation is again heralding another Stock Market Crash. Needless to say, the Fed has artificially levitated stock values via Quantitative Easing. Nonetheless, the day of reckoning for this aging Bull is soon to come.

http://stockcharts.com/h-sc/ui?s=$BPINDU&p=M&yr=20&mn=10&dy=0&id=p00657974291&a=438802241&listNum=1

World Stock Index (ex USA)

This begs the question: What are global stock markets doing as the Wall Street Bubble reaches its bursting point? The chart below monitors all major world stock markets (excepting the US). Not only did this the World Stock Index accurately register the beginning of the last two Bear Market (2000 and 2007), but has been in a Bear Market since 2014.

What Is So-Called Smart-Money Saying And Doing?

George Soros: Multi-Billionaire Soros is still bearish on stocks and sold some of his gold. In his quarterly 13-F filing, Mr. Soros bought a lot more bearish PUTS on the stock market and sold some of his gold positions. Earlier this year, Mr. Soros publicly made the case that China is in trouble and it reminds him of the U.S. in 2007-early 2008- before the big 2008 financial crisis. To hedge against a market collapse, Mr. Soros, bought puts, which profit as the market declines, and bought gold, which is considered a risk-off investment. He took a bearish view, controlled his risk and will make money if the market falls (via stock PUTS).

Stanley Druckenmiller: Billionaire Druckenmiller argues the US Federal Reserve has artificially suppressed interest rates and refers to the current situation as the most excessive and drawn out monetary easing policy in the history of the United States. In his opinion, the Federal Reserve funds rate should be closer to 3% rather than the current 0.5%. Today’s rate reflects what has been the longest deviation from historical norms, and as a result, today’s market consumption and demand has been pulled forward by a generation. Three years ago Druckenmiller was negative about US and Chinese actions, yet he still felt asset prices could be driven higher. That’s not the case today. He figures stimulus measures have run their course and the bull market has finally exhausted itself. As a result, the market could decline a whopping 60% from current levels.

Carl Icahn: Multi-Billionaire Icahn predicts stock market crash in 2016–17 period. Carl Icahn, one of the world’s most astute investors, has turned into one of the most vocal bears on Wall Street. Over the past few months, one of the smartest investors in the world has warned “a day of reckoning” is coming. Carl Icahn’s prediction for the stock market crash of 2016 is all but inevitable unless the Fed continues to prop up the economy.

He’s not just spouting rhetoric and fear, hoping to pick up stocks on the cheap. Icahn Enterprises LP (NYSE:IEP) announced a net short position of 149%! On December 31, 2015, IEP stock had a net short position of just 25%. If actions speak louder than words, Icahn is warning of an imminent stock market crash in 2016–2017.

Bear Market Forecast For the DOW Stock Index

GREED AND COMPLACENCY rein in the stock market today…just as they did in 1929, 2000 and 2007 immediately before horrific bear markets began. It is imperative to remember the Dow Index fell -89% in the 1929-1932 Great Crash, -37% in the 2000-2002 bear market, while the stocks index plummeted -54% in the 2007-2008 debacle. Consequently, the powerful arguments advanced above suggest that instead of a mere bull-market correction, US stocks may well suffer a new secular bear market…as GREED AND COMPLACENCY morph into FEAR AND ANGST.

GREED AND COMPLACENCY rein in the stock market today…just as they did in 1929, 2000 and 2007 immediately before horrific bear markets began. It is imperative to remember the Dow Index fell -89% in the 1929-1932 Great Crash, -37% in the 2000-2002 bear market, while the stocks index plummeted -54% in the 2007-2008 debacle. Consequently, the powerful arguments advanced above suggest that instead of a mere bull-market correction, US stocks may well suffer a new secular bear market…as GREED AND COMPLACENCY morph into FEAR AND ANGST.

The average decline of the DOW Index in the two aforementioned Bear Markets was -45% with an average duration of 25 months. Therefore, if we assume the looming Bear Market might replicate an average drop in US stock values, the DOW Index could plummet to about 10500 sometime in 2017-2018 period. Indubitably, this bears watching (pun intended).

Related Research

Blue Skies and Market Blues (1929 & 2000)

********