Billionaire Investor Sam Zell Buys Gold

Strengths

- The best performing precious metal for the week was silver, up 5.91%. Silver continues to do well due to the improving U.S. economy, which is strengthening the dollar. Reports showing a slowdown in manufacturing activity, along with disappointing jobs numbers, are also positive, as it implies that rates will remain low, which is good for silver. Palladium continues to do well and hit a 52-week high of $3,010.68 per troy ounce this week. Prices are up 23% year-to-date and are being driven by improved demand from catalytic converters.

- OceanaGold’s share price rose nearly 20% on the addition of Michael (Mick) McMullen and Paul Benson to the company’s Board of Directors. Both McMullen and Benson are highly respected in the mining industry and have relevant jurisdictional backgrounds that should help OceanaGold navigate its future.

- Franco-Nevada reported earnings surprise this week, $0.84 versus the $0.80 consensus. Revenues were 67% higher than forecasts, which is due to strong results from the Canadian Hemlo mine. Revenues from the mine were $21 million, higher than the $8 million consensus.

Weaknesses

- The worst performing precious metal for the week was palladium, down 0.60% after hitting an all-time high last week. The U.S. Mint’s sales of American Eagle gold coins totaled 38,500 ounces in April, a 63% decline year-over-year. This drop may be an inflection point, as January to April year-to-date sales rose 39% to 450,500 ounces.

- Centerra Gold share price traded down as much as 30% as the company updated the market on political developments in the Kyrgyz Republic, potentially impacting its ownership of the Kumtor mine. Political shocks like this are not uncommon regarding the ownership of Kumtor and can be painful short-term. The Kyrgyz government is the largest shareholder of Centerra, owning 26% of the company. Historically, these challenges can often turn into buying opportunities, although nothing is guaranteed.

- IAMGOLD, Argonaut Gold and Equinox all had earnings disappointments due to higher-than-expected costs along with a falling gold price during the quarter, which did not help. COVID-related issues have likely pushed operation efficiencies lower for many of the miners. Their operations are often in more remote regions of the world and it is known that vaccination rates are running much higher in developed regions.

Opportunities

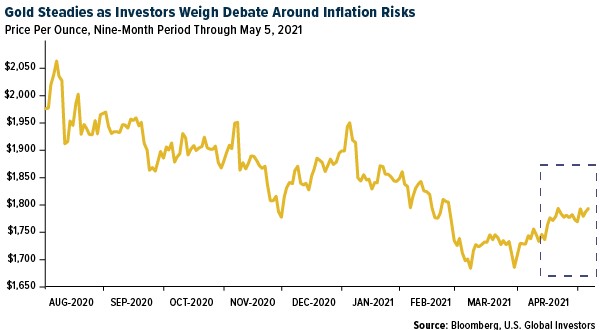

- Gold began to advance after last week’s decline as seen in the chart below. Treasury Secretary Janet Yellen said President Biden’s plan would not increase inflationary pressures because the boost to demand would be spread out over a decade. This would enable central banks to continue dovish monetary policies, which would allow gold to appreciate. Additionally, the recently announced disappointing jobs number may encourage the Fed to remain dovish. Billionaire investor Sam Zell is also now buying gold, despite decades of criticizing those who purchase it, reports ETF Trends. Zell says it is because these monetary policies may create inflation like the 1970s and gold could be a hedge.

- Gold Bull observed visible gold in drill chips from drill holes outside a known resource in Sandman, Nevada. Gold Bull’s core asset is the Sandman Project and assays from these drill holes are expected by mid-May. CEO Cherie Leeden said it is rare to see visible gold in drill chips.

- Roscan Gold announced high grade and consistent drill results for 42 additional holes at the Kabaya location. The increased depth and volume of these drill results indicates that there may be a significant increase in production. Estimates are that it may be up to 1.5 million ounces higher than before.

Threats

- B2Gold reported a feasibility study with materially weaker economics for its Gramalote project. Reserve grades were lower than expected, which could bring production down from 417,000 ounces to 347,000 ounces. B2Gold may also do a revised feasibility study, which could delay the project up to one year. There are likely more accretive uses for B2Gold’s capital, which currently has better visibility toward meaningful growth.

- Inflation is increasing mine costs. Higher construction material costs (steel, copper, and timber, for example) are being seen. A depreciating U.S. dollar is increasing Canadian dollar cost exposure as well, as the Canadian dollar appreciates.

- Investment trends in the gold industry are making it more difficult for gold companies to grow. Shareholders are demanding a high percentage of earnings and divestment proceeds. Miners must navigate tricky jurisdictions and geologies as well as gain the trust of politicians and populations at a time of rising environmental standards. Host nations are also demanding a bigger slice of any mining windfalls. Those management teams that best understand how to obtain their social license will likely prosper more.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of